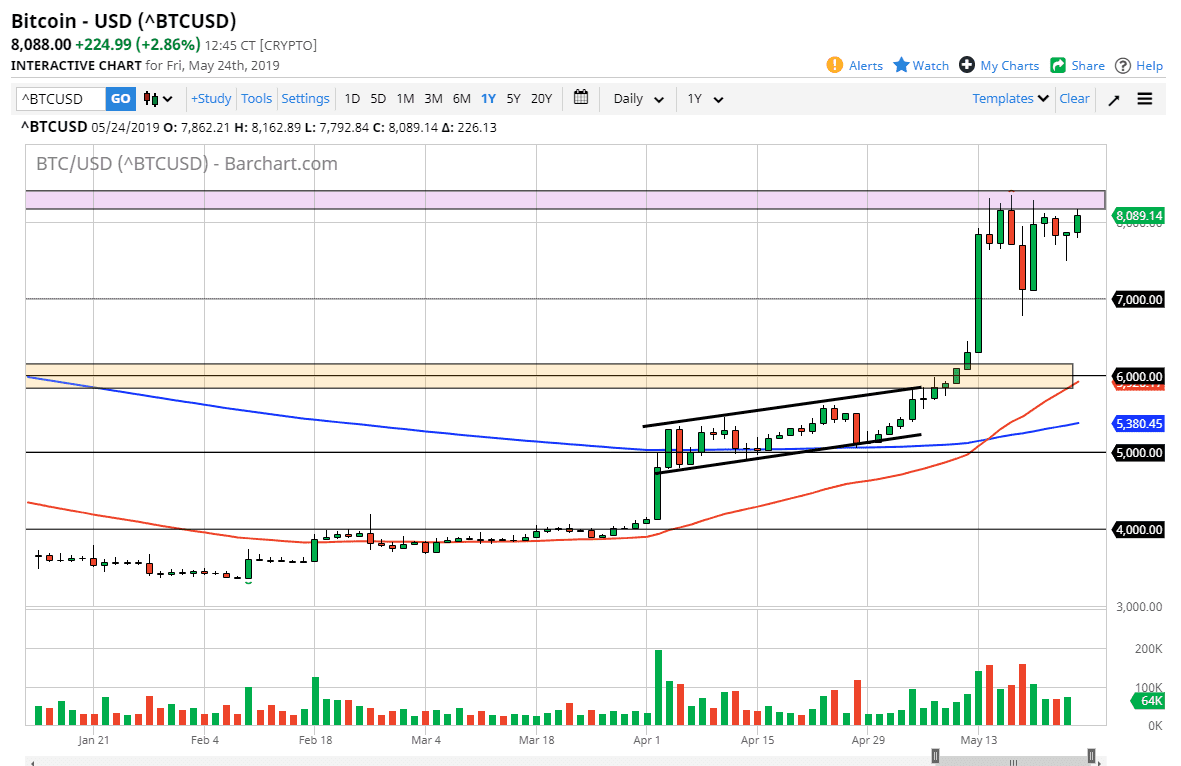

The bitcoin market rallied a bit during the trading session on Friday, reaching towards the same resistance areas that we had seen previously. Because of this, it looks like the market is trying to make a statement but we will obviously have a lot of work ahead of us. Looking at the pink box on the chart, you can see that there has been resistance extending to the $8250 level. If we can break above there, then the market could go much higher, perhaps reaching towards the $10,000 level as it is a large, round, psychologically significant figure, and it is of course an area that we had seen a lot of action at previously.

We have pulled back to the $7000 level but bounced significantly from there. I think that there is a significant amount of support at this level, so it’s not until we break down below there that I would be concerned. Even then though, the $6000 level underneath is even more supportive, so I’m not particularly worried until we break down below that level. We are in a major uptrend, so it’s very obvious that the dips should offer plenty of value the people will be willing to take advantage of.

I think in the near term we are more than likely going to see more of a grind sideways as we try to pick up more volume and more buyers to finally bring in the inertia to break out. Money is flowing out of China, which of course can send a lot of money into bitcoin, and then beyond that we are seeing people fleeing from some of the more common markets, perhaps trying to put money into bitcoin to store some of the value of their currency.