Yesterday’s signals were not triggered, as there was no bearish price action at either of the resistance levels which were reached yesterday.

Today’s BTC/USD Signals

Risk 0.75% per trade.

Trades must be entered prior to 5pm Tokyo time Wednesday.

Long Trades

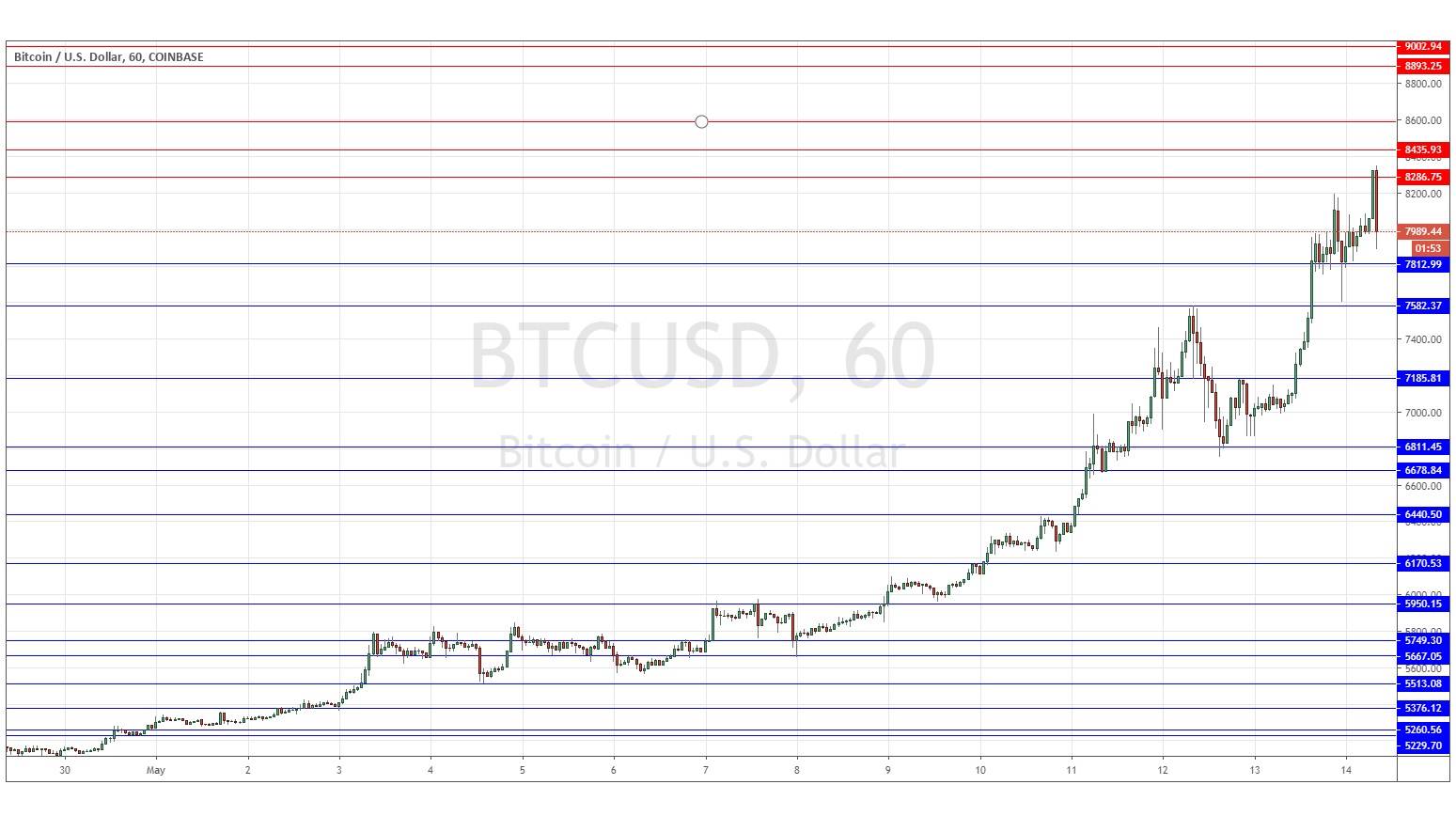

- Long entry at a bullish price action reversal on the H1 time frame following the next touch of $7,813, $7,582, $7,186 or $6,811.

- Put the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Remove 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

Short Trades

- Short entry after a bearish price action reversal on the H1 time frame following the next touch of $8,287, $8,436, $8,593 or $8,893.

- Put the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Remove 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote yesterday that the picture had simply become strongly bullish since last Wednesday, with the price making a 30%+ rise in value to its peak Sunday. It was true that there was new lower resistance formed over the past few hours by bearish price action, but we had a strong rise coupled with a clear long-term bullish trend in a speculative asset.

There was no reason not to be bullish, and I was ready to take a bullish bias if we get a firm bullish bounce at any of the blue support levels shown in the price chart below.

We never did quite get a pullback to any of those support levels, but my generally strongly bullish approach paid off. The picture still looks very bullish with the price advancing very strongly over recent days and weeks from long-term lows in a very speculative asset. Nobody knows how far it can go, but there is every reason to expect it will go higher still over the short-term.

I would be bullish above $8,350.

There is nothing important due today concerning the USD.