Last Wednesday’s signals were not triggered, as there was no bullish price action when $5,950 was reached that day.

Today’s BTC/USD Signals

Risk 0.75% per trade.

Trades may be taken before 5pm Tokyo time Tuesday.

Long Trades

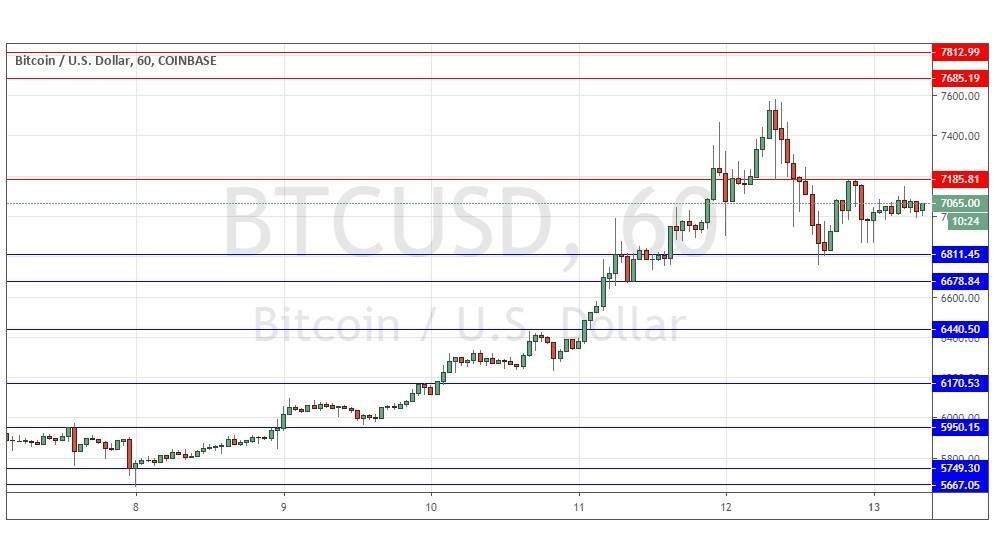

Go long at a bullish price action reversal on the H1 time frame following the next touch of $6,811, $6,679, $6,441 or $6,171.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is $50 in profit by price.

Take off 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to ride.

Short Trades

Go short after a bearish price action reversal on the H1 time frame following the next touch of $7,186 or $7,685.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is $50 in profit by price.

Take off 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote last Wednesday that a move down to the second support level at $5,667 looked quite possible, but I would be ready to take a bullish bias if there were a strong bounce there. I would also consider taking a short trade if there were another test and convincing rejection of $5,950. The support level mentioned was never reached and there was no bearish price action at $5,950.

The picture has simply become strongly bullish since last Wednesday, with the price making a 30%+ rise in value to its peak yesterday. It is true that there is new lower resistance formed over the past few hours by bearish price action, but we now have a strong rise coupled with a clear long-term bullish trend in a speculative asset.

There is no reason not to be bullish, and I would take a bullish bias if we get a firm bullish bounce at any of the blue support levels shown in the price chart below. There is nothing important due today concerning the USD.

There is nothing important due today concerning the USD.