Last Friday, CPI figures were released in the Eurozone. As expected, consumer prices remained unchanged, but the rise in the core consumer price index was announced, however, the rate is still far from the ECB's 2.0% target. Therefore, the EUR / USD maintained its bearish momentum and was not positively affected by that result. The pair is still under bearish pressure below 1.1200 psychological support and its next target may be the lowest support level for 22 months at 1.1110, which the pair had tested at the end of last month. For the economic data, the revival of German economic growth and its stability in the Eurozone was offset by the weakness of the ZEW economic growth index for Germany and the Eurozone, as opposed to the expectations of improvement, which increased pressure on the Euro, which has suffered a crisis of confidence since the start of the slowdown of the Eurozone economy led by Germany in response to Continuing global trade wars.

The US dollar increased gains as investors became more attracted to it as a safe haven currency after Trump's latest threat to impose more tariffs on Chinese products worth 200 billion. China has responded by imposing tariffs on $ 60 billion of US imports. The stability of the pair around and below the support level 1.1200 supports the continuation of the bearish trend. The Euro did not benefit from the high inflation in the Eurozone, as factors for this rise are still temporary. The dollar gained stronger momentum with positive US job numbers, adding jobs more than expected and a drop in unemployment to a 49-year low.

The Federal Reserve Board kept the interest rate unchanged as expected, pointing out that it is unlikely to raise or lower interest rates in the coming months amid signs of renewed economic health while at the same time inflation is still unusually low.

As we mentioned earlier, we now emphasize that the divergence of the economic situation and the monetary policy between the US and the Eurozone will remain a strong influence on any chances for the pair to upward correction.

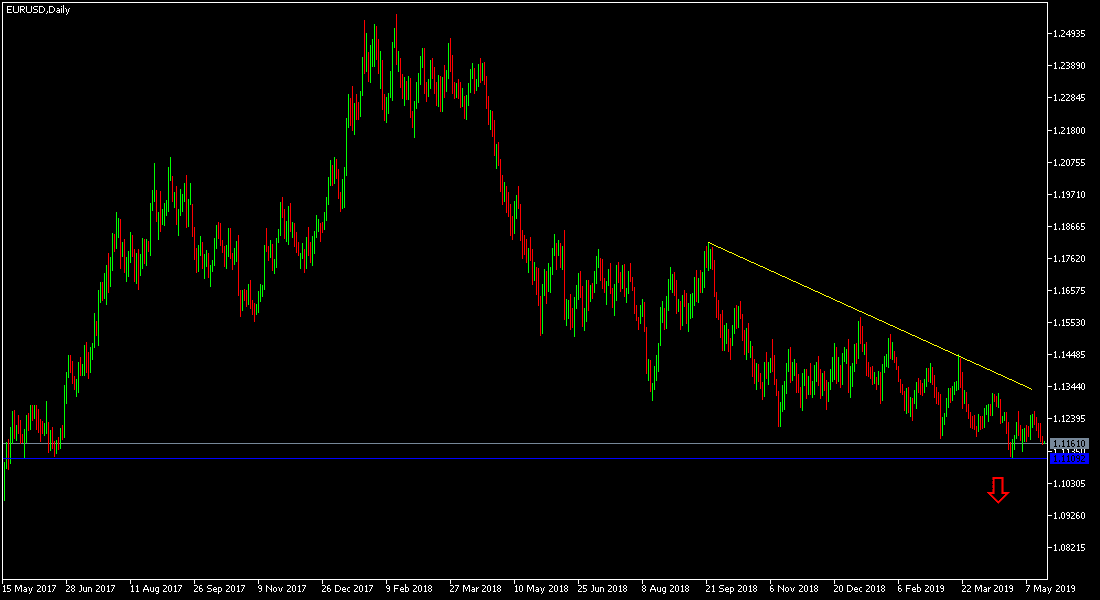

Technically: We had expected and recommended in the previous analysis for a long time to sell the pair from every ascending level. The EUR / USD is now bearish and currently the nearest support for the pair are at 1.1165, 1.1050 and 1.0975, respectively. On the upside side, the German-led Eurozone's negative economy weakened the correction opportunity further. The nearest resistance levels are 1.127, 1.1340 and 1.1420 respectively.

On The Economic Data Front: The economic calendar today will focus on German producer prices and the current account in the Eurozone. There are no significant US data until later when the Federal Reserve Governor, Powell, makes his comments.