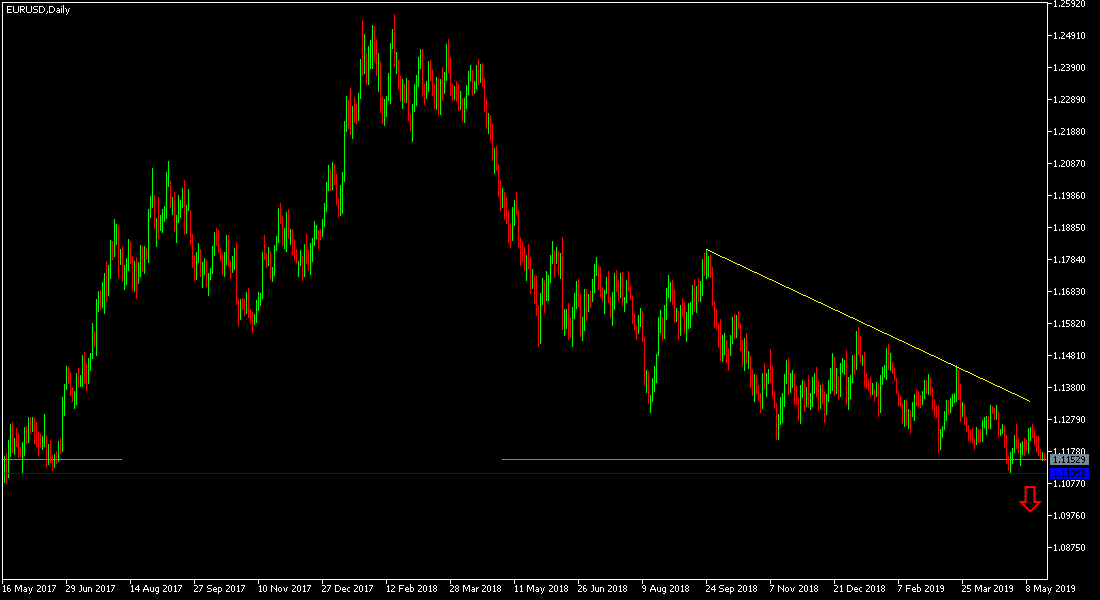

The bearish momentum continues to dominate the performance of the EUR/USD as the single European currency continues to lose confidence amid the slowing of the Eurozone economy led by Germany as global trade wars continue. This situation supported the EUR/USD which slid to the 1.1147 level at the time of writing, and the near-22-month low support around 1.1110 which was tested at the end of last month. The euro was not affected by the announcement of CPI figures in the Eurozone, which, as expected, remained unchanged, but the core consumer price index was announced higher, however the rate is still far from the ECB's 2.0% target. The pair is still under bearish pressure below 1.1200 psychological support.

For the economic data, the revival of German economic growth and economic growth stability in the Eurozone was offset by the weakness of the ZEW economic growth index for Germany and the Eurozone, as opposed to the expectations of improvement, which increased pressure on the Euro, that has been under pressure due to confidence crisis since the start of the Eurozone economy slowdown led by Germany, in response to continuing global trade wars.

The US dollar gains increased as investors became more attractive to it as a safe heaven after Trump's latest threat to impose more tariffs on Chinese products worth 200 billion. China has responded by imposing tariffs on $60 billion of US imports. The stability of the pair around and below the support level 1.1200 supports the continuation of the bearish trend for the pair. The Euro did not benefit from the high inflation in the Eurozone, as factors of rise are still temporary. The dollar gained stronger momentum with positive US job numbers, adding jobs more than expectations and a drop in unemployment to a 49-year low.

The Federal Reserve Board kept the interest rate unchanged as expected, pointing out that it is unlikely to raise or lower interest rates in the coming months amid signs of renewed economic health while at the same time inflation is still unusually low.

As we mentioned earlier, we now emphasize that the divergence of the economic situation and the monetary policy between the US and the Eurozone will remain a strong influence on any chances for the pair to correct above.

Technically: We had expected and recommended in the previous analysis for a long time to sell the pair from every ascending level. The EUR/USD is now bearish, and the nearest support for the pair are currently at 1.1165, 1.1050 and 1.0975, respectively. On the upside side, the German-led Eurozone's negative economy weakened the correction opportunity further. The pair's current resistance levels are 1.1220, 1.1300 and 1.1380, respectively.

On the economic data front, the economic calendar today will focus on consumer confidence in the Eurozone and the Existing home sales from the US.