The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 12th May 2019

In my previous piece last week, I forecasted that the best trades would be short EUR/USD, and long USD/SEK and the S&P 500 Index above last week’s high prices if they are broken. While the EUR/USD currency pair rose by 0.28%, the USD/SEK currency pair closed below its high by 0.02%. The S&P 500 Index did not break its previous week’s high price, so the week’s trades produced a very small averaged loss of 0.10%.

Last week’s Forex market saw the strongest rise in the relative value of the Japanese Yen, and the strongest fall in the relative value of the British Pound.

Last week’s market moved into “risk off” mode as the U.S. administration made public tariff threats against China after accusing Chinese negotiators of reneging upon earlier commitments.

The Forex market has been livelier, with commodity currencies weak while safe-haven assets such as the Japanese Yen strengthened.

This week has a lighter news agenda with no central bank input due for any major currency. The week in the Forex market will probably be dominated by news about the progress of the trade dispute between the U.S.A. and China.

Fundamental Analysis & Market Sentiment

Fundamental analysis has turned more bearish on the U.S. Dollar following the Federal Reserve’s more dovish approach to monetary policy and growth and weaker than expected inflation data. However, the economy is still growing relatively strongly although the stock market has been hit by the trade war with China.

Market sentiment is quite strongly risk-off and this seems likely to continue as the week opens, with the Japanese Yen likely to continue to be the major beneficiary.

Technical Analysis

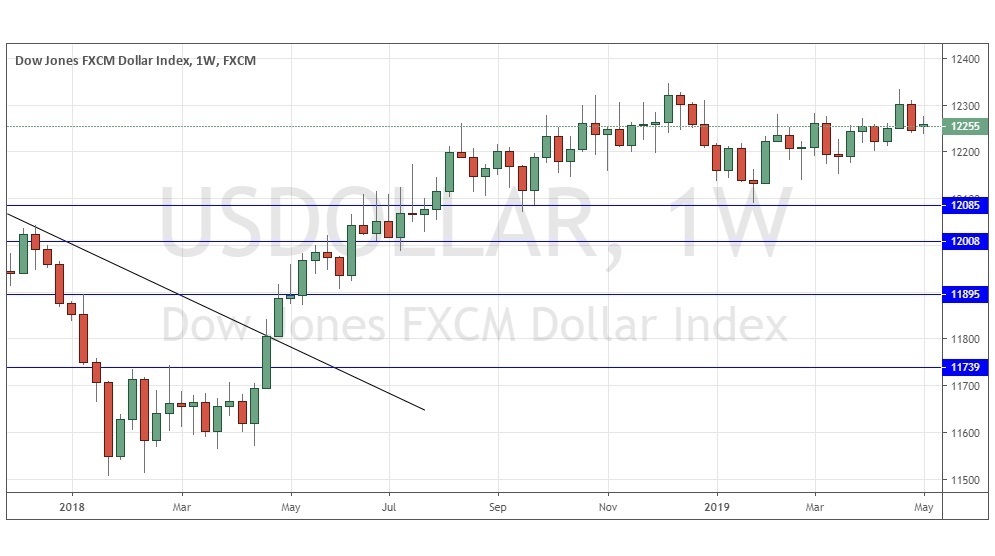

U.S. Dollar Index

The weekly price chart below shows that last week the USD Index printed a small doji candlestick within a multi-month area of consolidation. However, the price is still very slightly up over 3 months and 6 months, indicating a bullish trend. Overall, next week’s direction looks extremely uncertain.

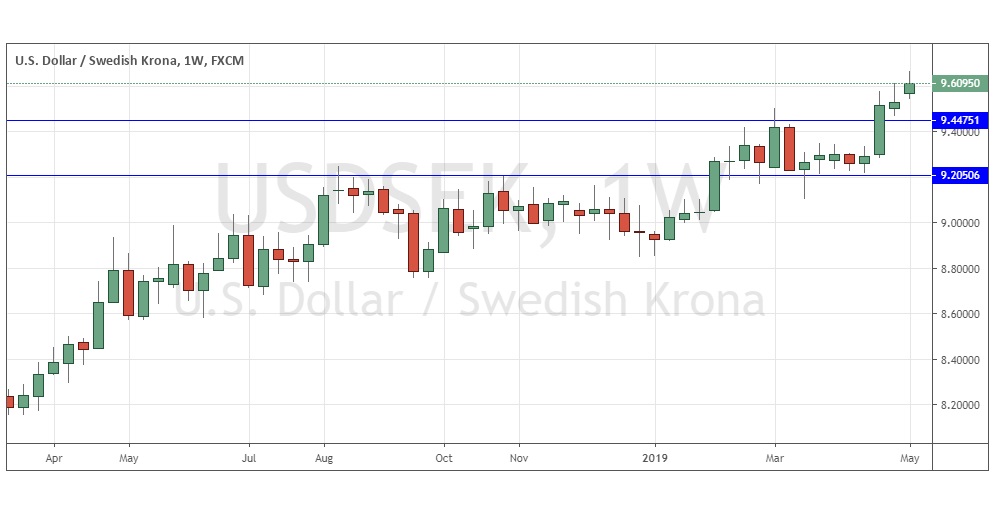

USD/SEK

The weekly chart below shows last week produced a relatively large near-pin candlestick at an all-time high price. This is the highest weekly close this pair has ever made, which is a bullish sign, but the shorter-term price action is bearish which indicates entry is not safe right away. The price is in a clear long-term upwards trend, above its levels from both three months ago and six months ago and rising steadily. If the all-time high gets broken again and the price holds up strongly, it should then be a long trade worth being interested in.

S&P 500 Index

The weekly chart below shows last week produced a large bearish candlestick with a large lower wick. The price is in a long-term upwards trend, above its levels from both three months ago and six months ago – but we have seen some very large and volatile dips since January 2018. Typically, sharp weekly falls within a bull market are followed by strong recoveries over the following week in this stock index. The price looks likely to rise further over the coming week, so I’d be looking to be long above last week’s high price. I take the extra caution of waiting for a break of the high because the fall is caused mostly by the escalation of the trade dispute between the U.S.A. and China.

Conclusion

This week I forecast the best trades will be long USD/SEK and the S&P 500 Index above last week’s respective high prices if they are broken.