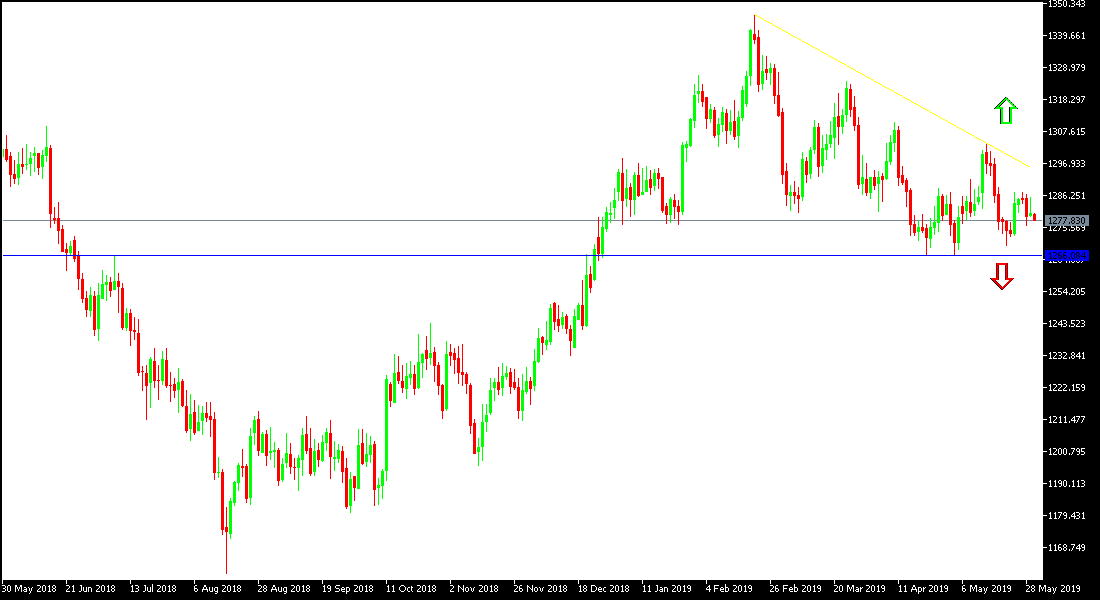

Gold prices tried to rally during yesterday's trading, but the gains did not exceed the $1286 level an ounce, after falling the previous session to the $1276 support level, where it is almost stable around at the time of writing. The price of the yellow metal is trying to correct upward as trade tensions continue between the world's two largest economies, but in contrast, the gains of the US dollar as a safe haven amid these tensions, limit the chances of the yellow metal to make stronger gains. The psychological high of $1300 remains the key to a bullish correction. To achieve gains, the yellow metal is dependent on strong Indian demand, global stock declines due to fears of a long-term US-China trade war and weak economic data from the United States, the European Union and the world.

At the same time, global stock indexes fell amid fears of continued global economic slowdown in response to growing trade disputes between the world's two largest economies, concerns over Italy's large budget deficit and political chaos in Europe, which has boosted investors' appetite for safe assets.

Trade concerns deepened after the People's Daily claimed Beijing was ready to use its hegemony in the course of its trade fight with Washington. Where the United States imports about 80% of its rare earth elements, used in a range of electronic components, from China.

In another development, Huawei Technologies Co Ltd filed a motion for summary judgment in the lawsuit against the US government. "The US government has not provided any evidence to prove that Huawei is a security threat," said Sung Leopeng, the company's chief legal officer. There is no weapon or smoke. Earlier this week, US President Donald Trump told a news conference with Japanese Prime Minister Shinzo Abe that he was "not ready to make a deal with China," where he struck a blow to hopes of a permanent deal.

The most important support levels for gold today are: 1275, 1266 and 1254, respectively.

The most important resistance levels for gold today are: 1288, 1300 and 1312 respectively.