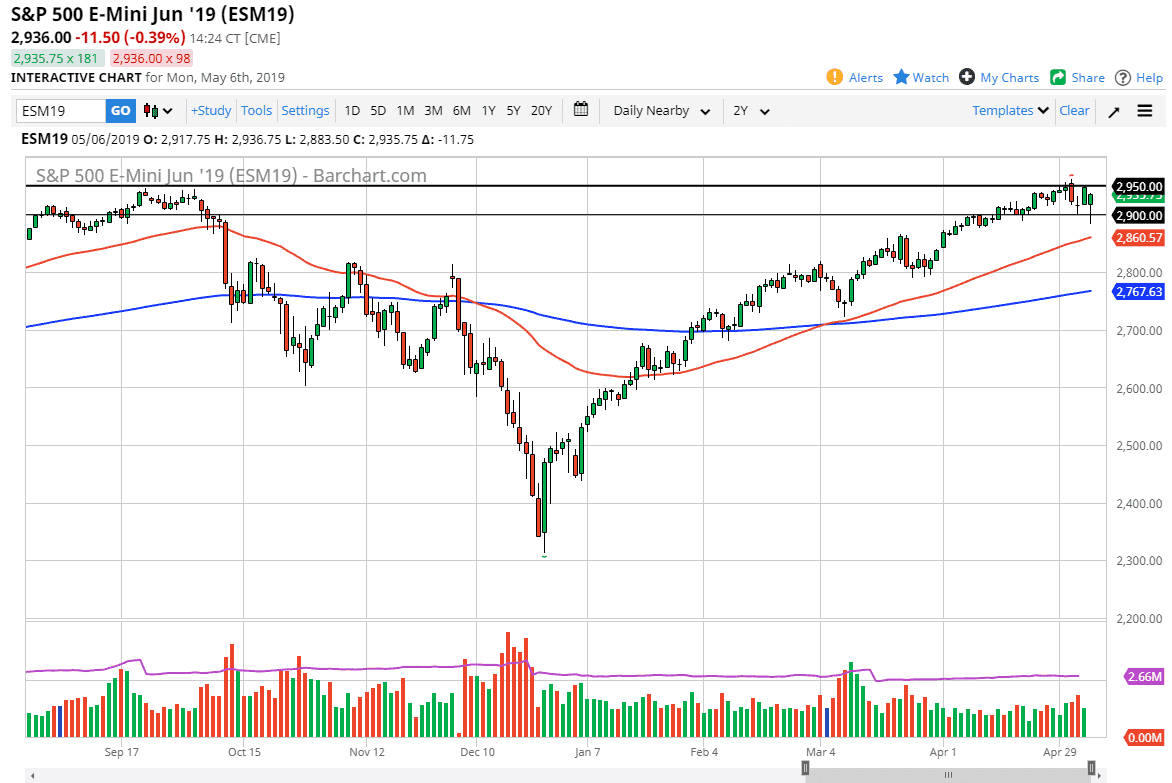

S&P 500

The S&P 500 initially pulled back a bit during the trading session on Monday, in reaction to the Donald Trump tweeted suggesting that the Chinese were going to be facing further tariffs due to a lack of progress in the negotiations. In reaction, it was suggested that perhaps the Chinese were coming to the United States, and that of course can through the markets into a tizzy. We saw the market shoot straight down after gapping lower, breaking all the way down to the 2890 level. That is the area I’ve been talking about for a while though, so having said that it wasn’t a huge surprise to see the buyers came in and pick things up. Overall, it appears that market participants have shrugged off all of the noise, as it has since been announced that the Chinese are in fact still coming to the United States for the meeting. With that in mind, we continue to see buyers pick up value as it occurs.

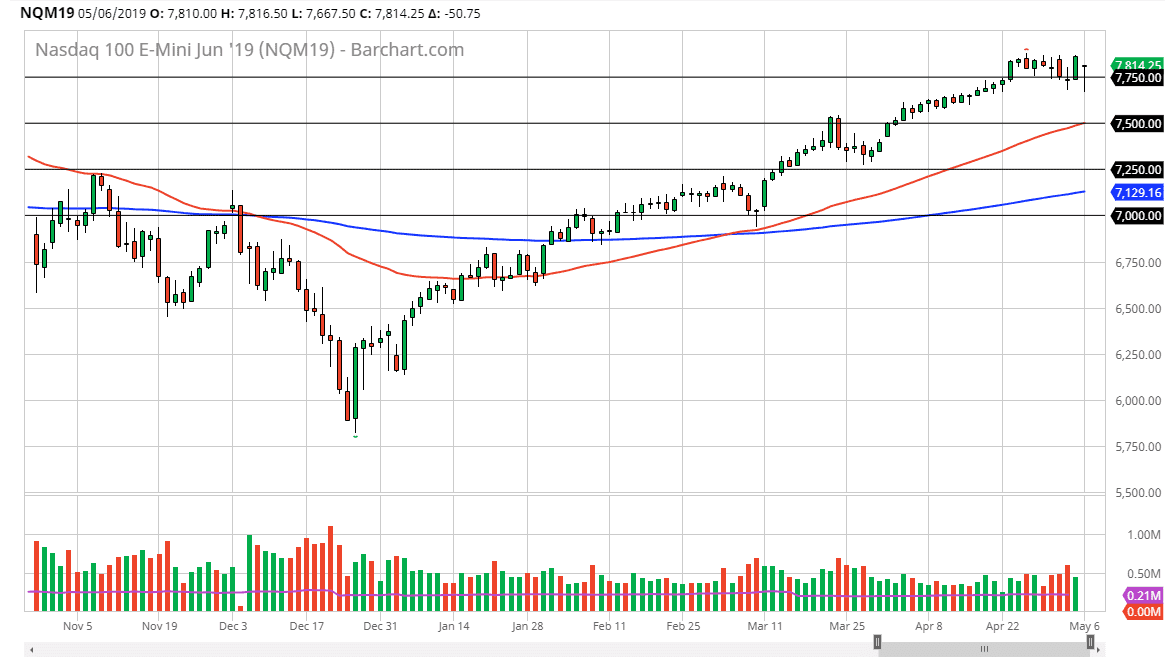

NASDAQ 100

The NASDAQ 100 also sold off rather quickly at the open, but then found buyers underneath the 7700 level again, turning around to form a bit of a hammer. That hammer of course is a very bullish sign and it means that we continue to see a lot of value hunting in this marketplace. We are most certainly in a nice uptrend, in all US stock markets for that matter, with the NASDAQ 100 being one of the leaders. Because of this I look at short-term pullbacks as buying opportunities and it’s obvious that the rest of the market does as well.

I believe that we will eventually go looking towards the 8000 handle, and perhaps even higher but obviously the 8000 handle is a large enough psychological figure that we are likely to see a bit of a reaction up there. Selling isn’t even thought right now.