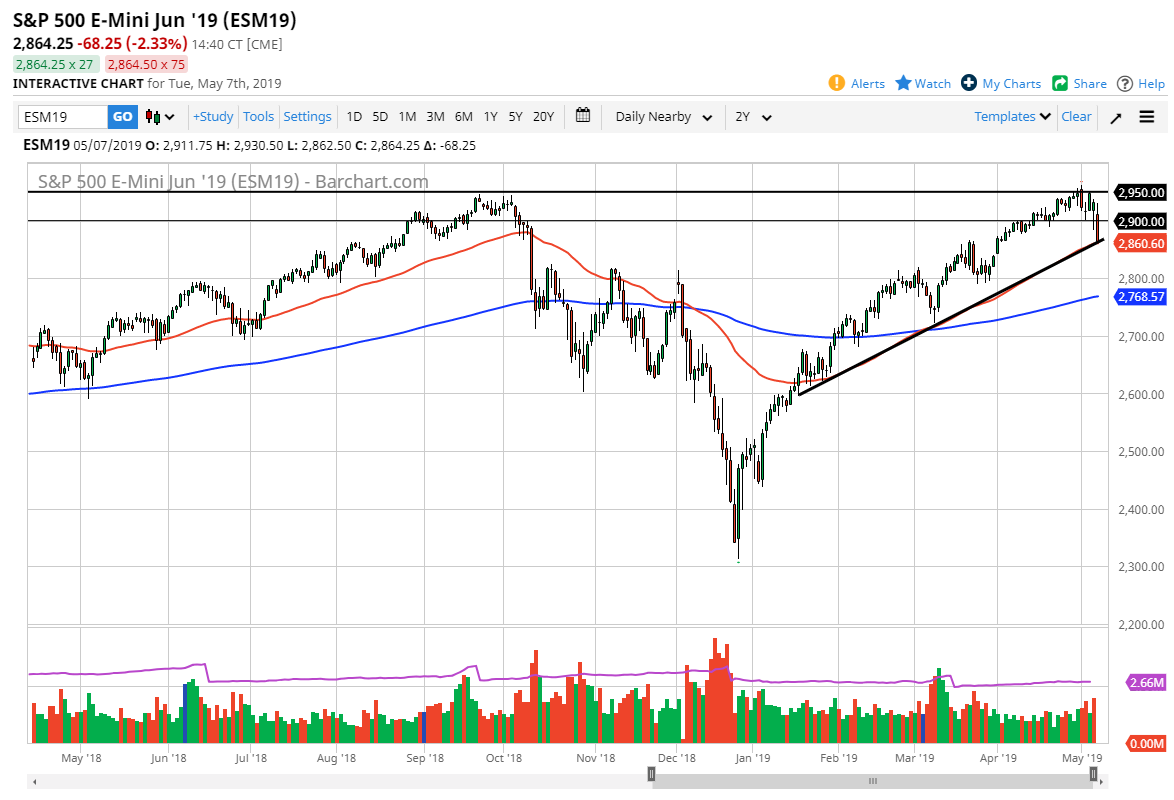

S&P 500

The S&P 500 initially tried to rally during the trading session on Tuesday, but then got absolutely crushed as we sliced through the bottom of the hammer from the previous session. That being said, we are sitting right at the 50 day EMA and an uptrend line so there is the possibility that value hunters will come back. Quite frankly though, after this type of brutal selloff, it’s better off to wait until the markets form another daily candle that show signs of life. Remember, the Chinese are coming to talk about trade relations with the Americans, and I suspect that’s essentially the only game in town right now. If that’s going to continue to be the case, were probably all going to be sitting there watching Twitter. I suggest staying out of the market.

NASDAQ 100

Obviously, the NASDAQ 100 has done the same thing, but it is not sitting at the 50 day EMA or some type of massive support level. Because of that it’s likely going to drift a bit lower. I suspect that the 7500 level could be massive support, but I also believe that we need to see some type of daily candle stick to give us a hope before putting money to work. With that in mind, it’s very difficult to buy this market, but then again after this type of selloff one has to wonder how much further can go. All it would take is some type of positive words coming out of negotiators and this market will turn around and shoot straight up in the air. That being said, one has to start to wonder whether or not the US/China trade agreement won’t end up being a “sell the event” scenario?