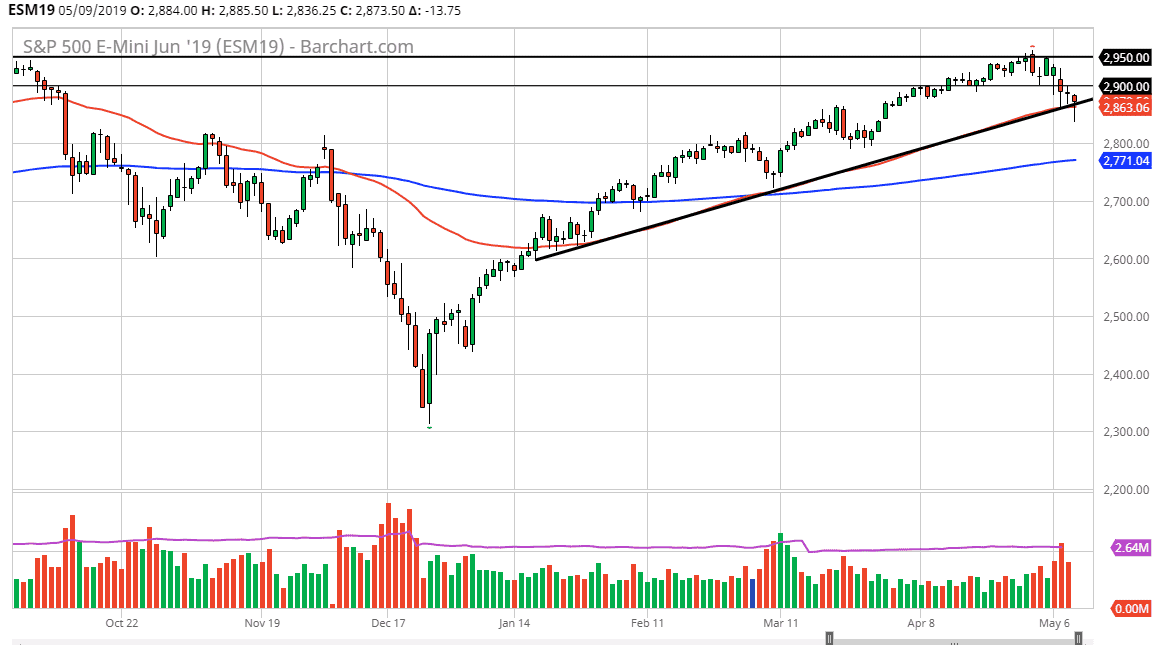

S&P 500

The S&P 500 fell rather hard during the trading session on Thursday as we continue to see a lot of risk aversion in the markets. With the US and China trying to hammer out a deal on Friday, and all of the posturing ahead, it’s not a huge surprise that we have been all over the place. The breakdown was rather ferocious, but we have turned around to form a bit of a hammer sitting right on top of the trend line and the 50 day EMA. I think what this means is that by the end of the day on Friday we should have a bit more clarity. It looks as if they tried to break it down during the day but failed. That’s not to say they can’t do it again on Friday, just that the market wasn’t quite ready to panic. At this point in time, I suspect it’s probably best to leave this market alone until we get the close for Friday.

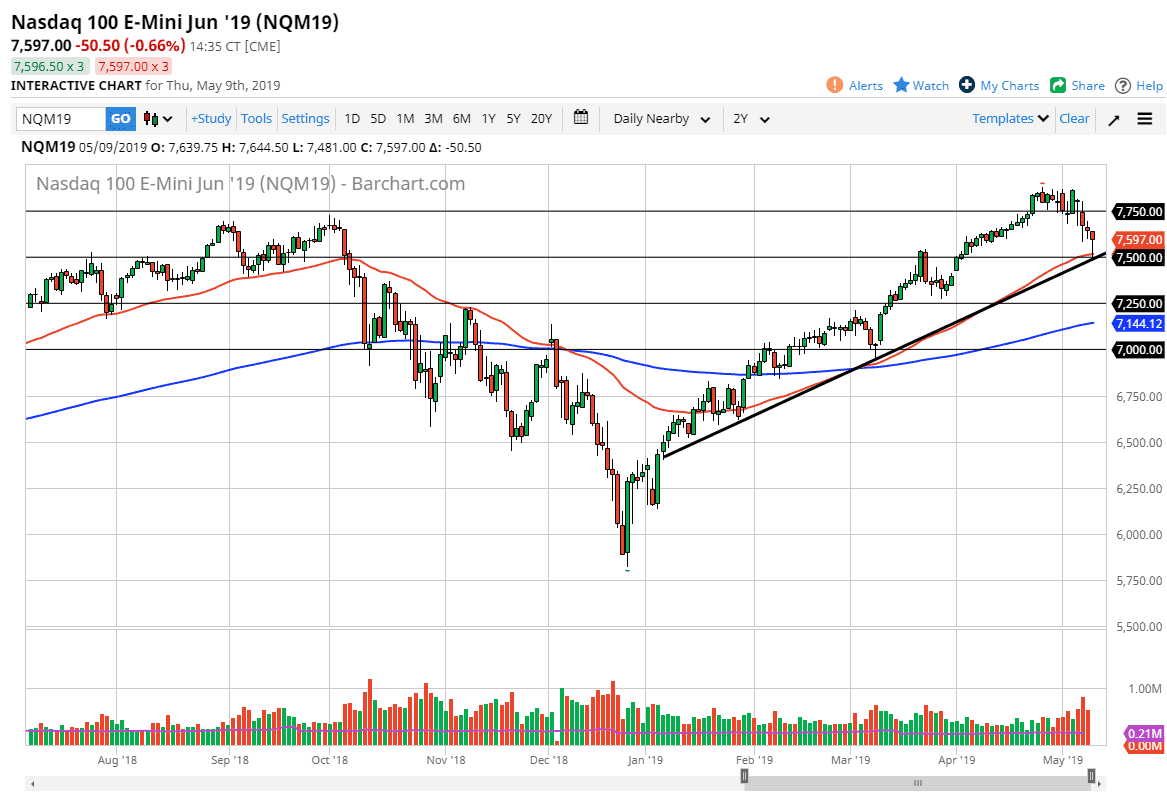

NASDAQ 100

The NASDAQ 100 also did a very similar thing but seems to be a bit more supported underneath at the 7500 level and the uptrend line. The only reason I say that is that we are a bit farther away from the trendline here then we are in the S&P 500, so if we do rally it’s very possible that this might be the market to be involved in. It would make sense though, considering that so much of the technology companies are highly levered to China.

The alternate scenario of course is that we break down below the candle stick for the day, which could send this market looking towards the 7300 level right away. After that, we could be looking at the 200 day EMA which is pictured in blue on the chart. To the upside, I anticipate the 7750 level as resistance.