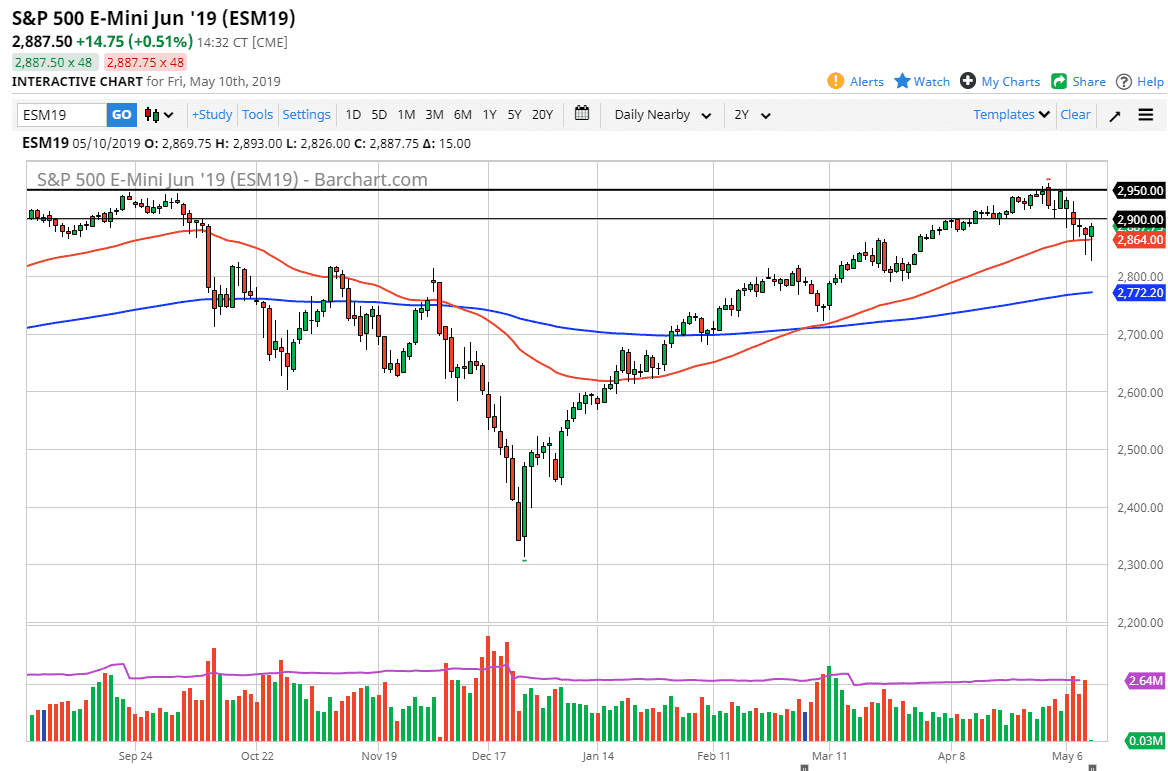

S&P 500

The S&P 500 has been very volatile during trading on Friday as we continue to see a lot of momentum in both directions due to the concerns about the US/China trade talks. Ultimately, this is a market that I think will continue to see extraordinarily volatile moves, but it seems as if the participants are hell-bent on going higher. After forming these last couple of hammers, it’s obvious to me that you can’t short this market. The 50 day EMA has caused the lot of support, and the fact that we have formed both of these hammers of the last couple of days tells me that there is plenty of buying pressure. If we can break above the 2900 level, then the market could go much higher. The alternate scenario of course is that we break down below these couple of hammers, which would be a massive break of support, and perhaps send this market down to the 2800 level or even the 200 day EMA after that.

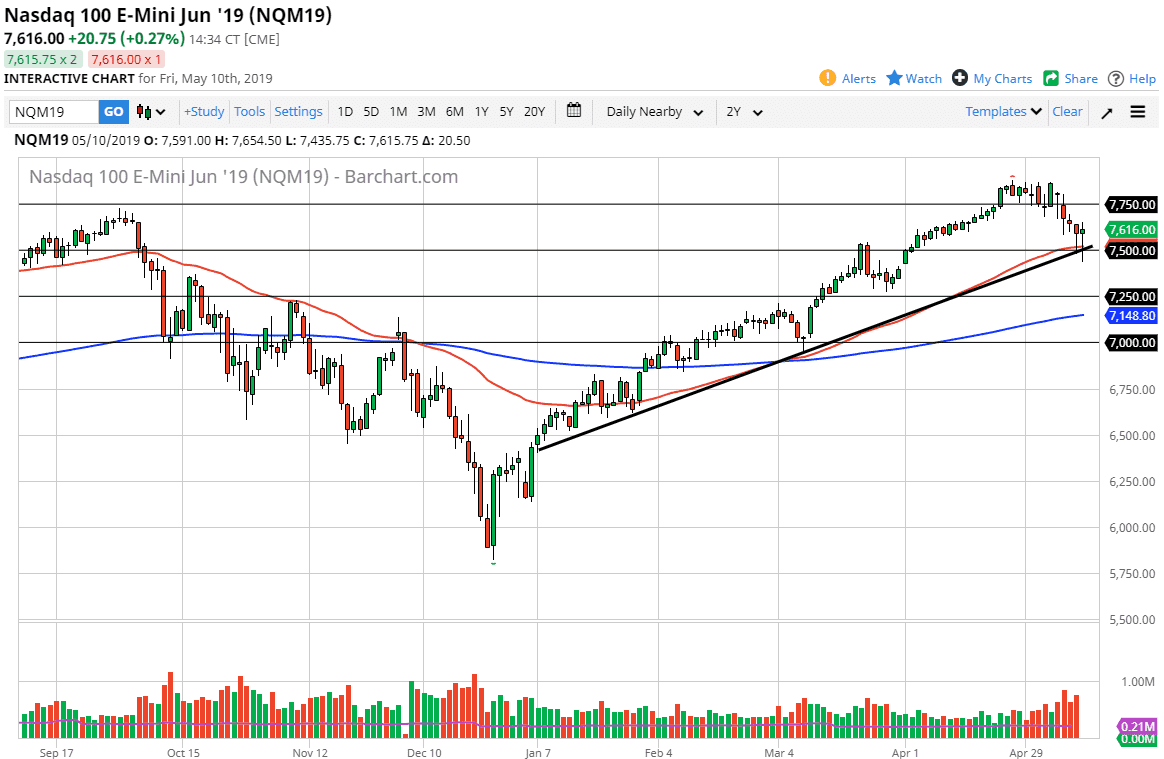

NASDAQ 100

The NASDAQ 100 has also formed a couple of hammers, and it now looks likely that we are going to go higher. Now that the uptrend line has held the market in check, and the 50 day EMA now looks to be supportive as well. By forming a couple of hammers, it looks like we are ready to go higher. However, if we break down below the lows of the Friday session, the market probably drops down to the 7250 level underneath that.

Over the weekend, we could get more tariffs coming out of China, and that could throw the market back into another tizzy, but at this point it’s obvious that there are plenty of value hunters out there willing to step in.