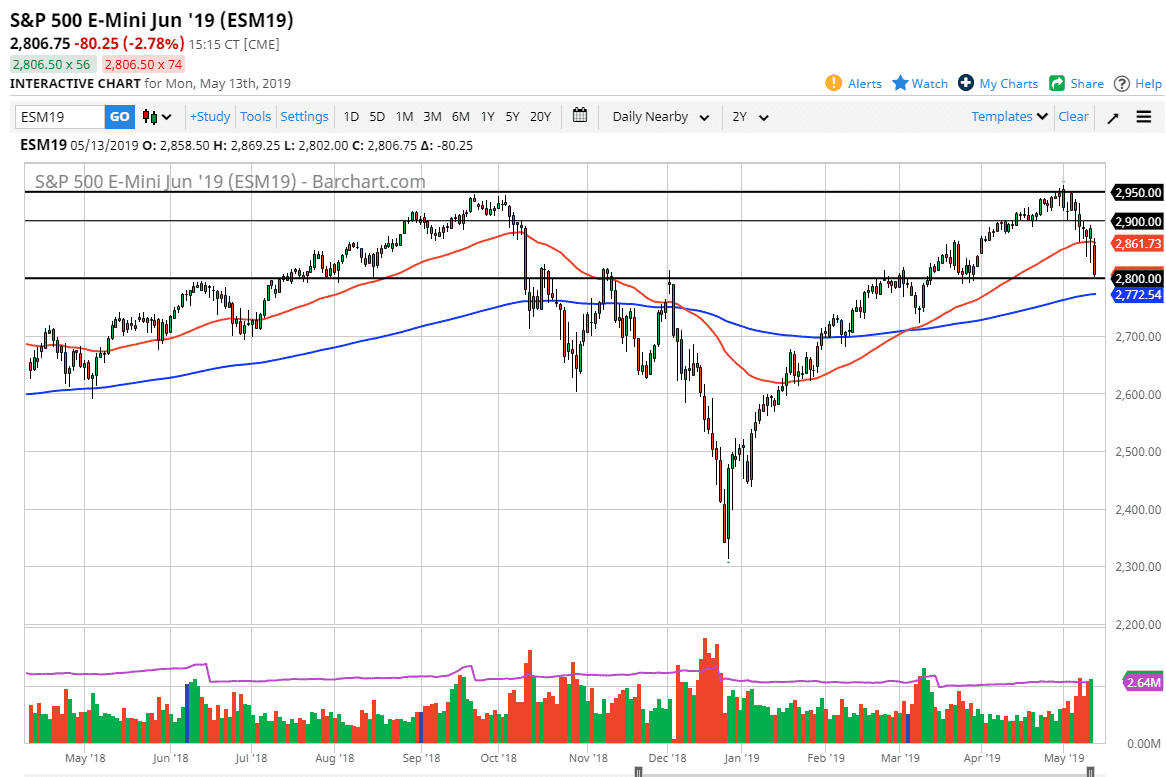

S&P 500

The S&P 500 collapsed during trading on Monday, slicing all the way down to the 2800 region at the close. We did make an attempt to recover a bit during the afternoon, but quite frankly the markets have all but thrown in the towel at this point. The 2800 level will be crucial, so it would not be surprising at all to see the market bounce a little bit from here. However, we just broke the back of a couple of hammers in that is a very negative sign. What I anticipate seeing next would be a bounce that is followed by selling. This of course could change if somehow the Americans and the Chinese come to terms, but that doesn’t look very likely to happen in the short term, so at this point it’s obvious to me that the market is coming a bit unnerved and unsettled. With all that being said, I’d be looking to fade rallies that show signs of exhaustion on short-term charts, but I would not hang onto a position for very long.

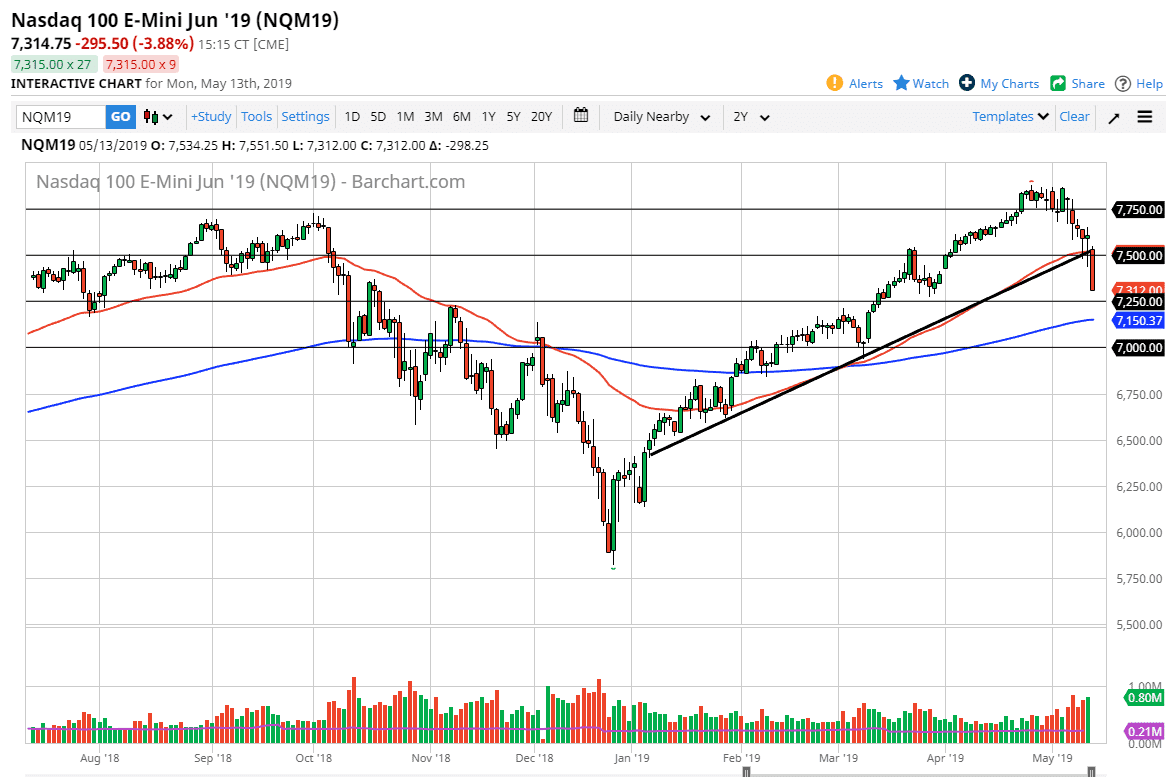

NASDAQ 100

This really only one way to put it: the NASDAQ 100 looks horrible. After the action for the session on Monday, we have sliced down towards the 7300 level, an area that does show a bit of promise of support, but it’s only a matter of time before we give up even more gains from what I am seeing. We closed at the very bottom of the candle stick, and that’s never good either. Ultimately, I think this will be much like the S&P 500, offering selling opportunities on rallies that fail on short-term charts. The tricky thing is going to be the timing. I would certainly not be a buyer of these markets unless something changes with the US/China trade situation.