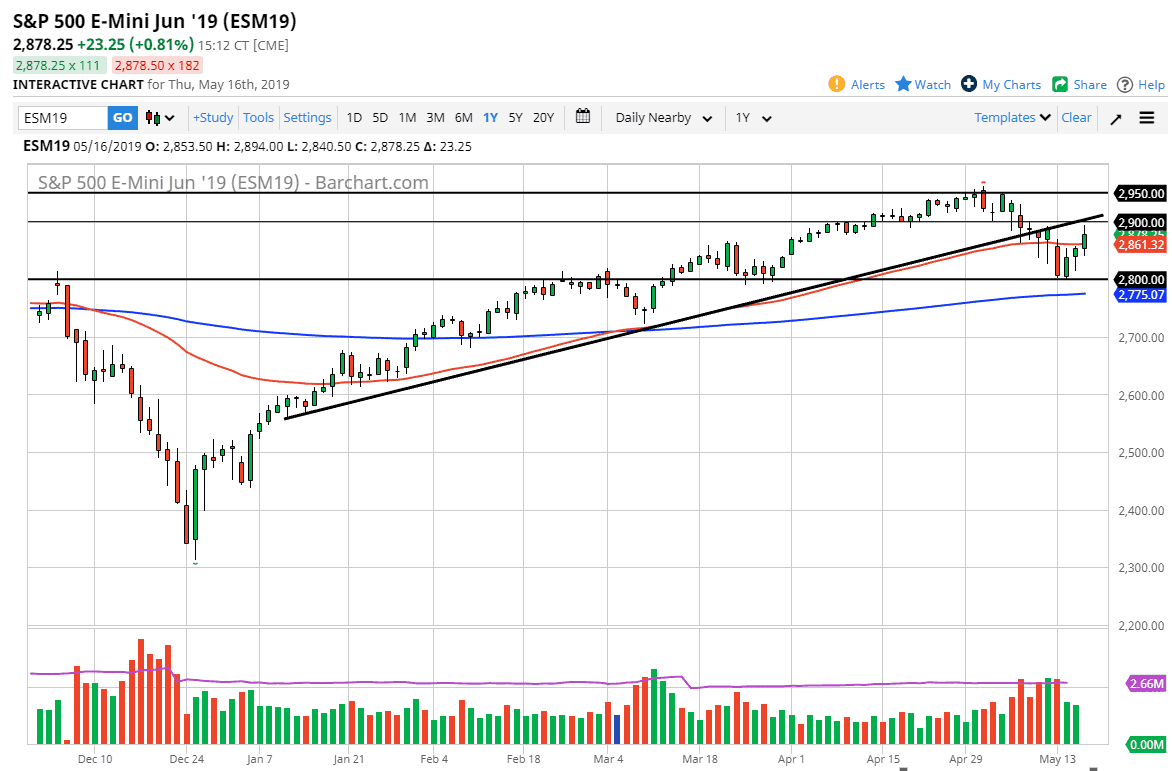

S&P 500

The S&P 500 had an eventful day on Thursday, reaching towards the 2900 level that failing to break above it. I find this interesting because if we are going to see trouble in the S&P 500, it’s going to be a right there. The fact that we could not hang onto the gains in that region is a bit telling to me, and I will be watching for signs of weakness. After all, it is the bottom of the trend line that had been holding the market for some time. With that being the case, I believe that the Friday session is going to be very interesting. Do not be surprised at all if we rollover.

However, if we break above the 2900 level for more than an hour, that is assigned that the market has recovered completely. We did wipe out all of Monday’s gains, so that of course is a very positive turn of events, but as you have seen recently, there are a lot of potential landmines out there.

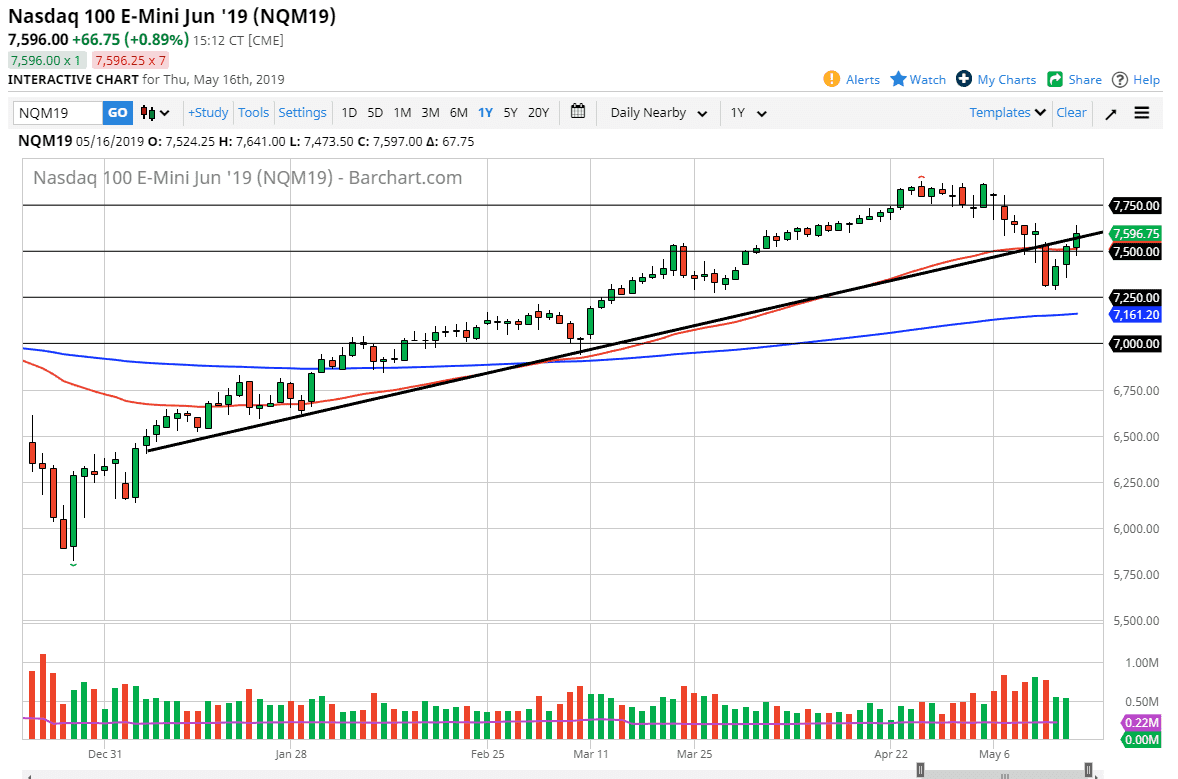

NASDAQ 100

The NASDAQ 100 also rallied significantly, breaking slightly above the uptrend line. By doing so, that is a sign that we could go higher, and we have in fact filled the gap which is also a good sign. The question now is whether or not we can continue to go higher. Simply put, if the NASDAQ 100 can break above the highs of the day on Thursday, then it’s very likely that we will go higher. On the other hand, if we cannot continue the upward momentum, the NASDAQ 100 may be a bit of a leading indicator as to where the S&P 500 goes, perhaps sending it lower as well. Friday is going to be crucial.