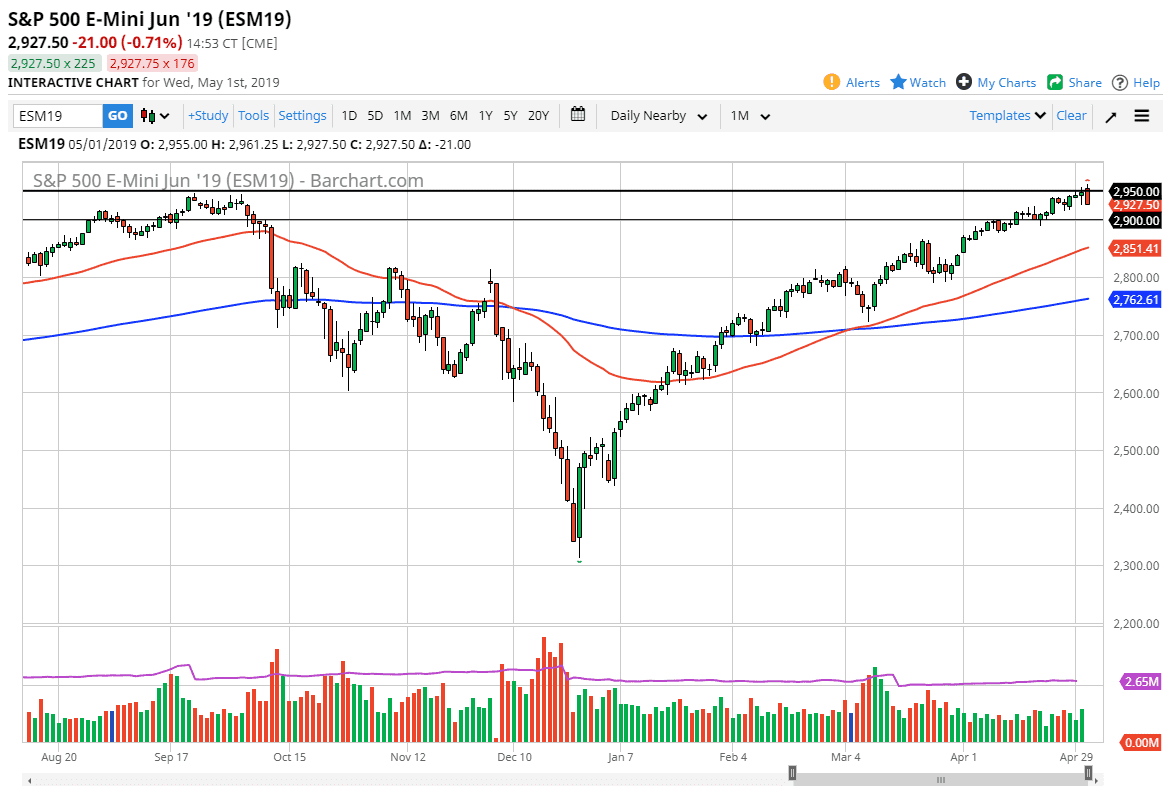

S&P 500

The S&P 500 initially tried to rally during trading on Wednesday but then turned around to fall rather significantly. This was essentially a tantrum by market participants when Jerome Powell didn’t explicitly say that a rate cut was coming. At this point, it’s very likely that we may see a little bit of follow-through to the downside, but it’s very possible that we should see support underneath. If you are patient enough, this should be a nice buying opportunity. I think that the 2890 level is essentially a “floor” in the market, so as long as we stay above there I think that there will be buyers looking to get involved. This market was a little bit overdone, but ultimately it should be an opportunity for those of you who are patient enough. One would have to think that the 2900 level should attract a lot of attention due to the phenomenon of it being a large, round, psychologically significant figure.

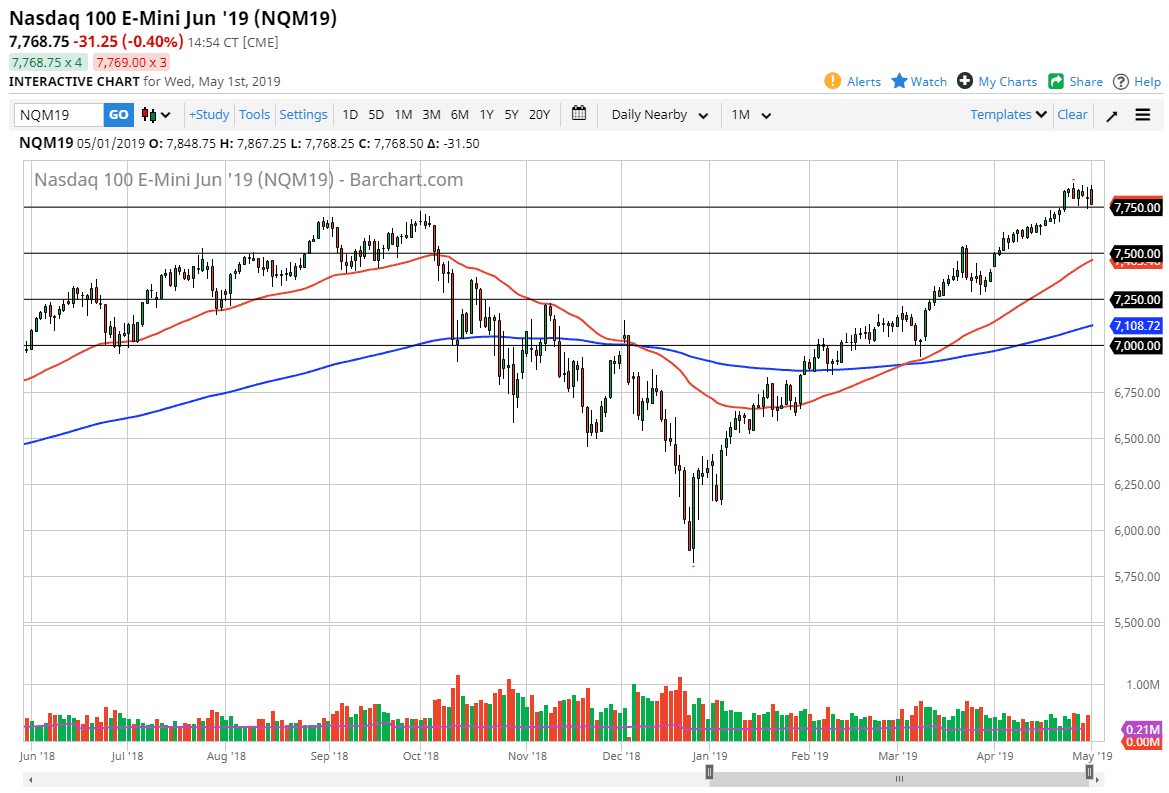

NASDAQ 100

The NASDAQ 100 initially tried to rally during the trading session on Wednesday, but then broke down towards the 7750 level as those press conference words across the wires. Overall though, we are still very well supported in this area so it would not surprise me at all to see some type of support. However, even if we break down from here I think that the 7500 level will offer a significant support level. Because of this, I’m looking for short-term pullbacks to give me supportive candle such as a hammer to take advantage of. Remember, the Federal Reserve isn’t the only game in town and as long as the earnings continue to be fairly decent, the stock market will in turn react accordingly.