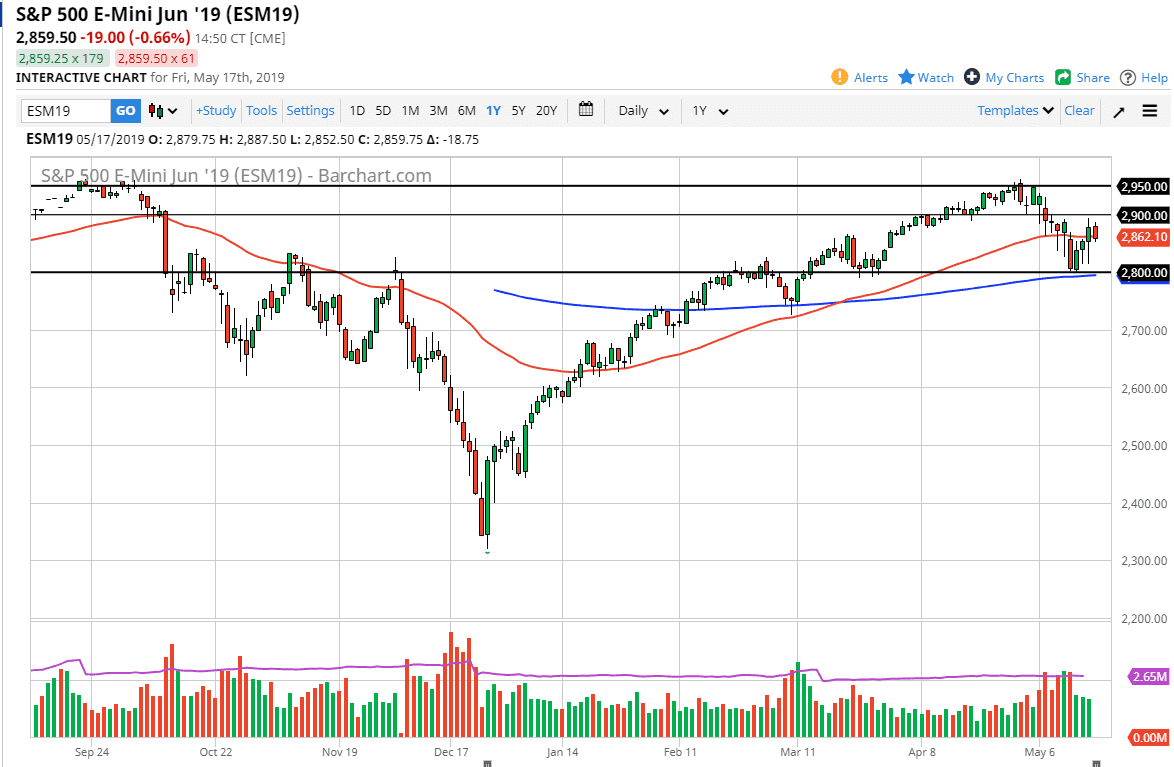

S&P 500

The S&P 500 has fallen just a little bit during the trading session on Friday, reaching down towards the 50 day EMA. This is a market that continues to be very choppy, as we are continuing to struggle for directionality. After all, the market has to deal with a lot of different crosswinds, and the fact that we were heading into the weekend it makes sense that people probably want to take a little bit of risk off the table.

Beyond that, the 2900 level above looks to be offering resistance, so if we were to break above there the market could go towards the 2950 level. To the downside, if we fall from here, there should be plenty of support down to the 2800 level. The market is in and uptrend, and the fact that we have been so resilient tells me that we will continue to see a lot of volatility, but there’s definitely a bit of a bias to the upside.

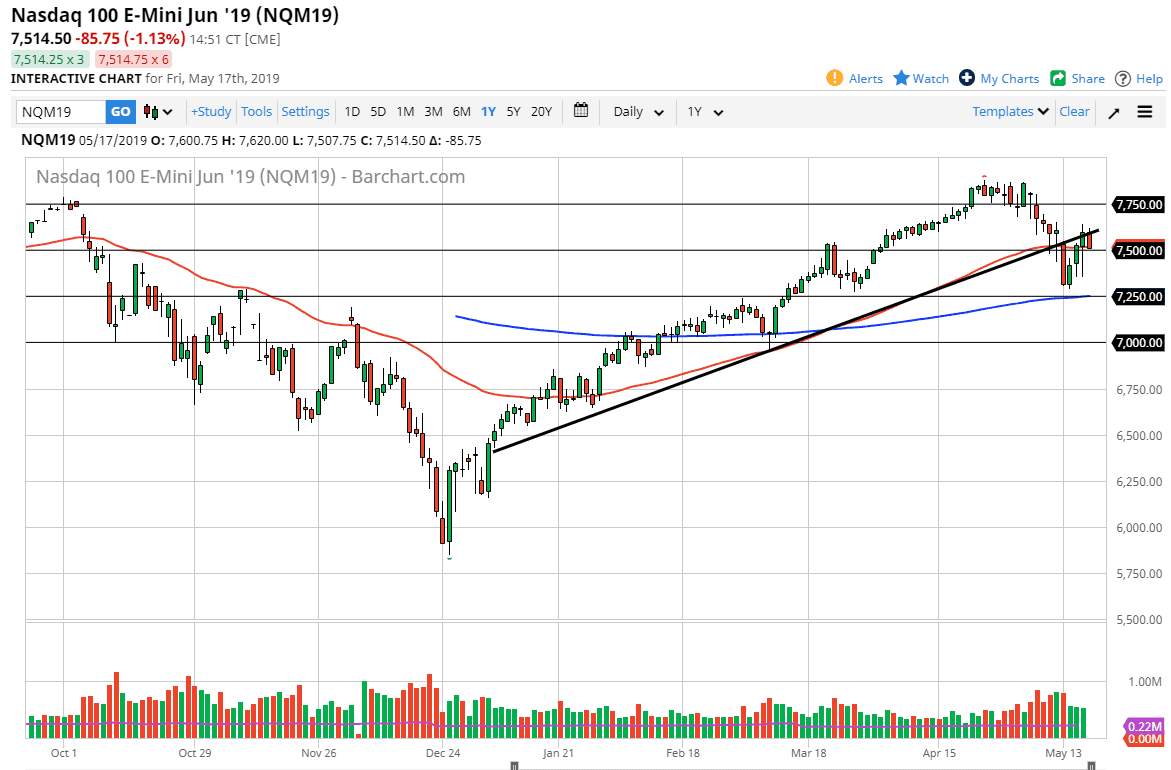

NASDAQ 100

The NASDAQ 100 also fell just a bit during the trading session, reaching down towards the 7500 level. That’s an area that is offering support, so it’s not a huge surprise to see that we stopped right there at the close. I think that the NASDAQ 100 continues to be very sensitive to the US/China trade talks, which of course are all over the place. The uptrend line that we have broken down through and reach towards the bottom of, should be massive resistance. If we can break above the highs of the week, the Thursday session, then we could go to the 7750 level. Otherwise, we could pull back and try to find buyers closer to the 7350 level, with the 7250 level being the “floor” in the market.