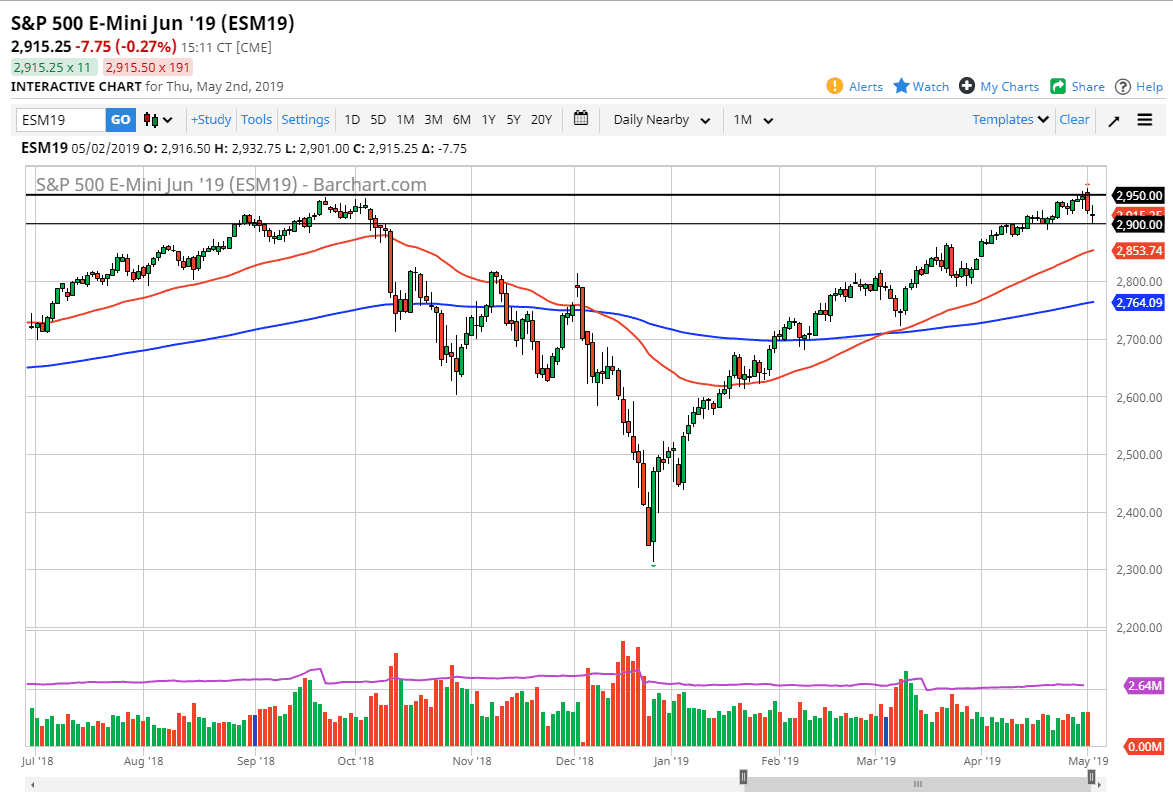

S&P 500

The S&P 500 went back and forth during the trading session on Thursday after initially gapping lower. At this point, the market is awaiting the jobs number on Friday, and between now and then it’s very unlikely that the market is going to be quiet. As soon as we get that announcement, the markets will probably go crazy for a little while. All things being equal though, the end of the day did show a bit of a “heads up” as to where the battle may be fought.

The 2900 level has offered a significant amount of support during the day, after being plowed into. We bounced 16 points off that level, so it tells me there will be a lot of interest in that region if we fall significantly after the announcement. To the upside, the 2950 level will be massive resistance. Typically we will see the market go back and forth and cause as much damage as possible. With that in mind, I’m looking to pick up value if we get a chance.

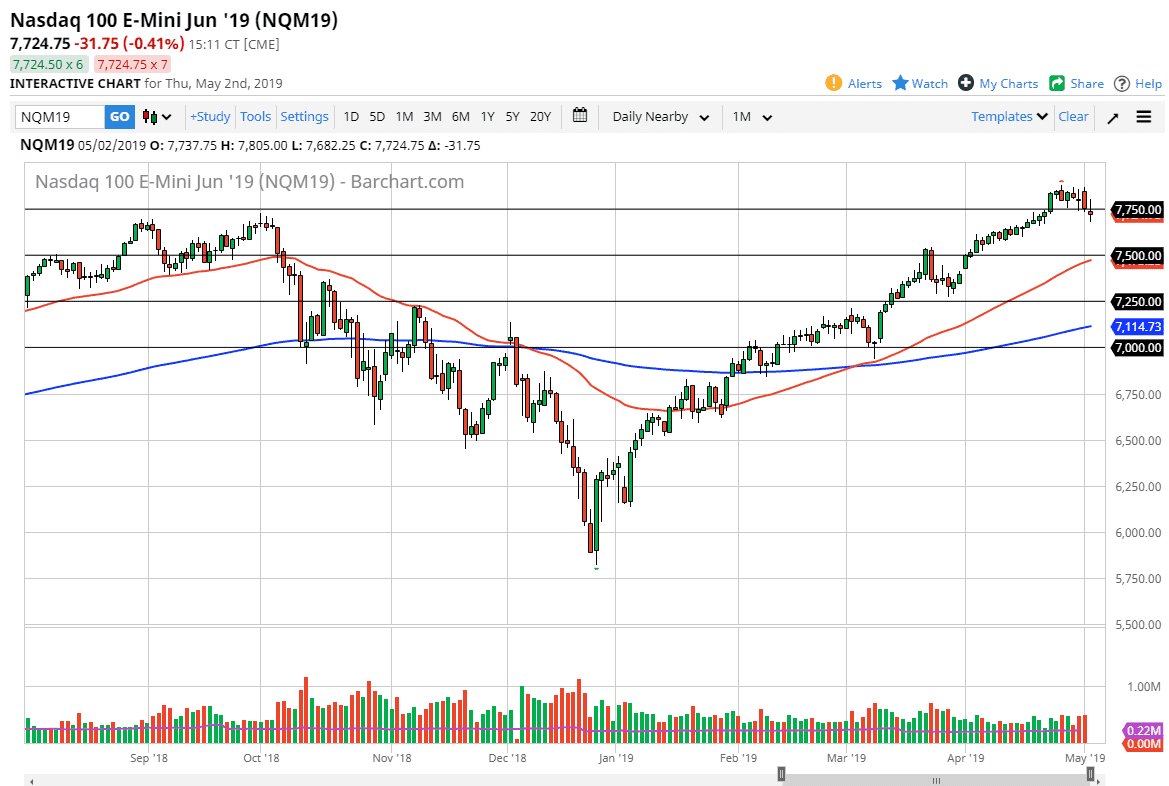

NASDAQ 100

Interestingly enough, the NASDAQ 100 did break down below the 7750 level, defined the 7700 level as a buying opportunity. The market ended up with a neutral candle stick which makes a lot of sense considering that we have so much riding on the jobs figure during the next session. It does look a little bit vulnerable, but I’m not willing to sell the NASDAQ 100 until we break down below the 50 day EMA at the very least. We are nowhere near that, so if this market falls apart I may just simply look for some type of stability, perhaps on Monday to start buying.