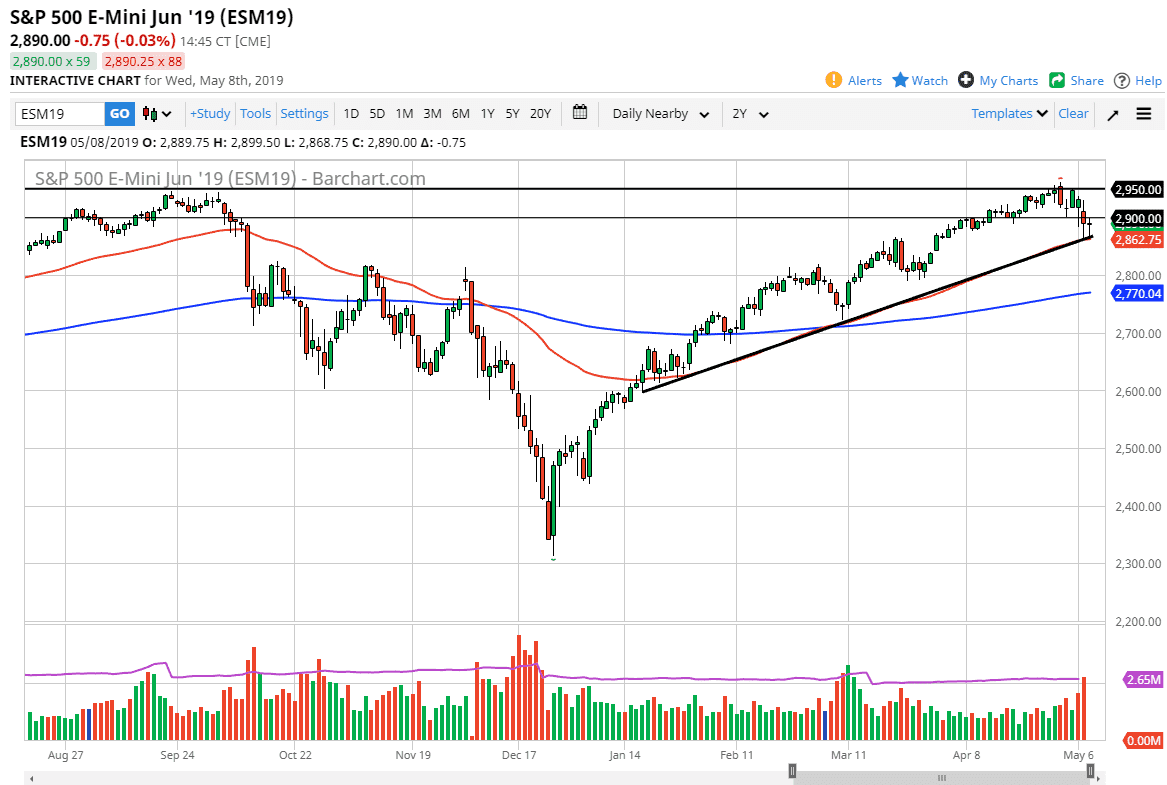

S&P 500

The S&P 500 went back and forth during the trading session on Wednesday as we continue to see a lot of volatility in US stock markets. In after all, the markets are reacting to the US/China trade drama, which seems to be somewhat never-ending. With that in mind, it’s difficult to hang onto trades for longer term, at least not if you are highly levered to. However, if you can hang on to a longer-term trade, this looks as if it was the beginning of a potential buying opportunity.

The 50 day EMA is walking right along the uptrend line that you see on the chart, so that of course is a very bullish sign. The 2950 level above will be a target, and if we can clear above that level it’s likely that we will continue to go higher, perhaps reaching towards the 3000 handle. The alternate scenario is that if we break down below the 50 day EMA and the trend line, we probably go looking towards the 2800 level.

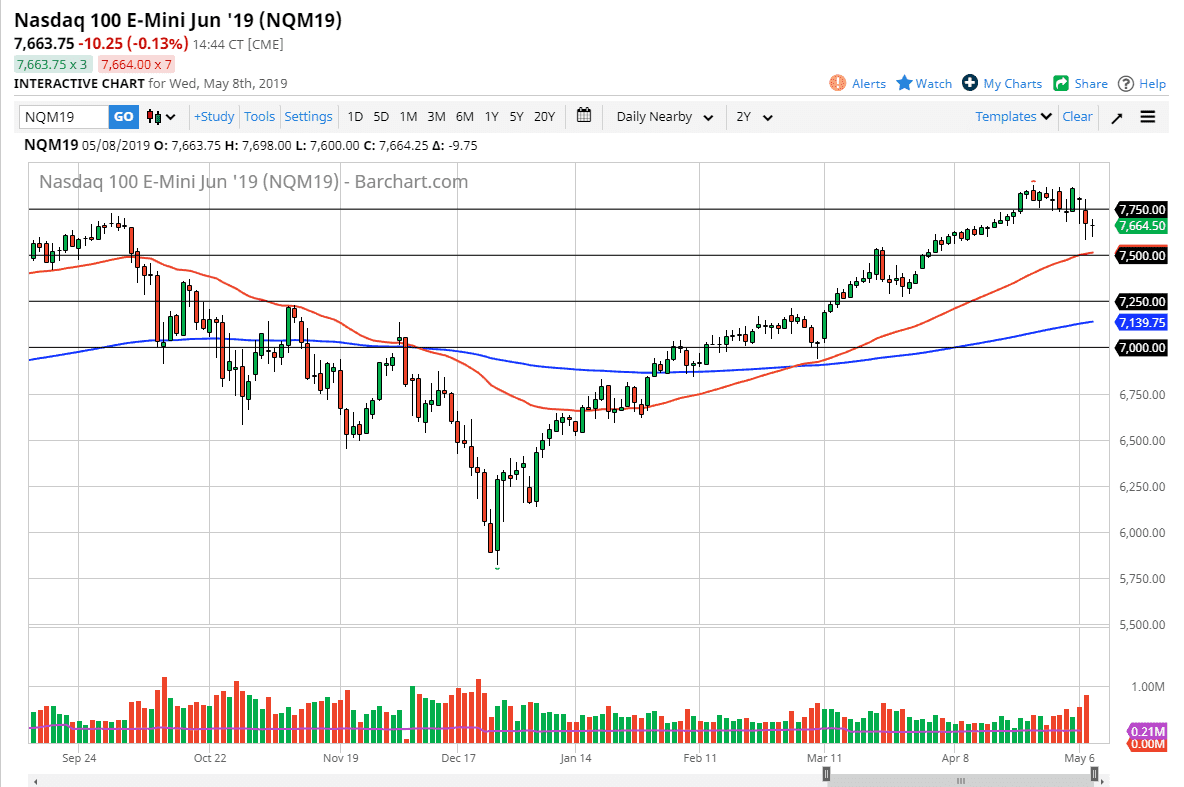

NASDAQ 100

The NASDAQ 100 also formed a hammer during the trading session, initially falling towards the lows from the previous session, but then turning around to show signs of life. The market looks likely to continue to go to the upside, but it should be noted that we are likely to get a lot of volatility due to various headlines crossing the wires about trade negotiations. In general, as long as we can stay above the 7500 level I think that the market will probably continue to be somewhat buoyant. It’s been noisy, but at the end of the day we have not killed the bullish rally, so all things being equal you should assume that eventually value hunters come back.