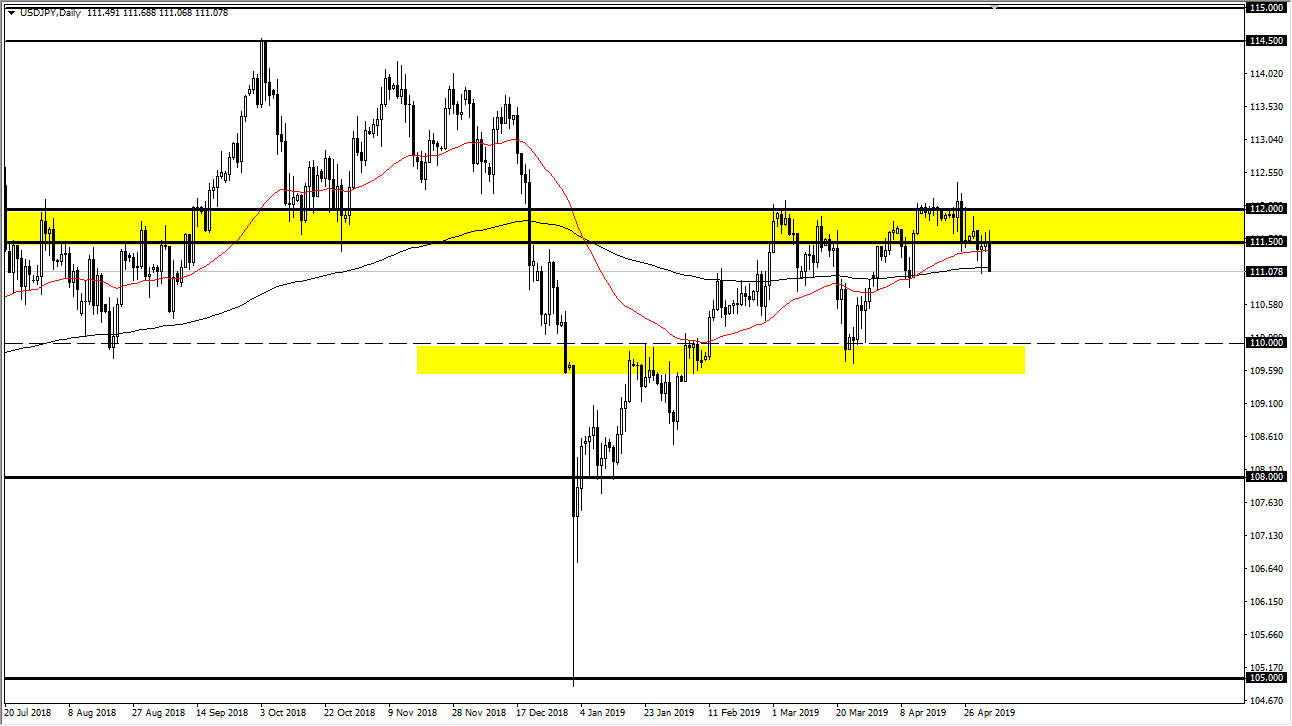

USD/JPY

The US dollar initially tried to rally during the trading session on Friday, but as the jobs number came out sold off rather hard to reach down towards the bottom of the hammer from the Wednesday session. We also are testing the 200 day EMA, and it looks very likely that the ¥111 level will continue to be important. If we were to break down below that level, this pair could drop to the ¥110 level, as it is the next major support level. On the other hand, if we rally from here, I think we will continue to see a lot of resistance at the ¥112 level. If we break above there, it’s likely that we will try to take out the recent highs and then go to the ¥113.50 level. All things being equal, this is a very ugly looking candle stick.

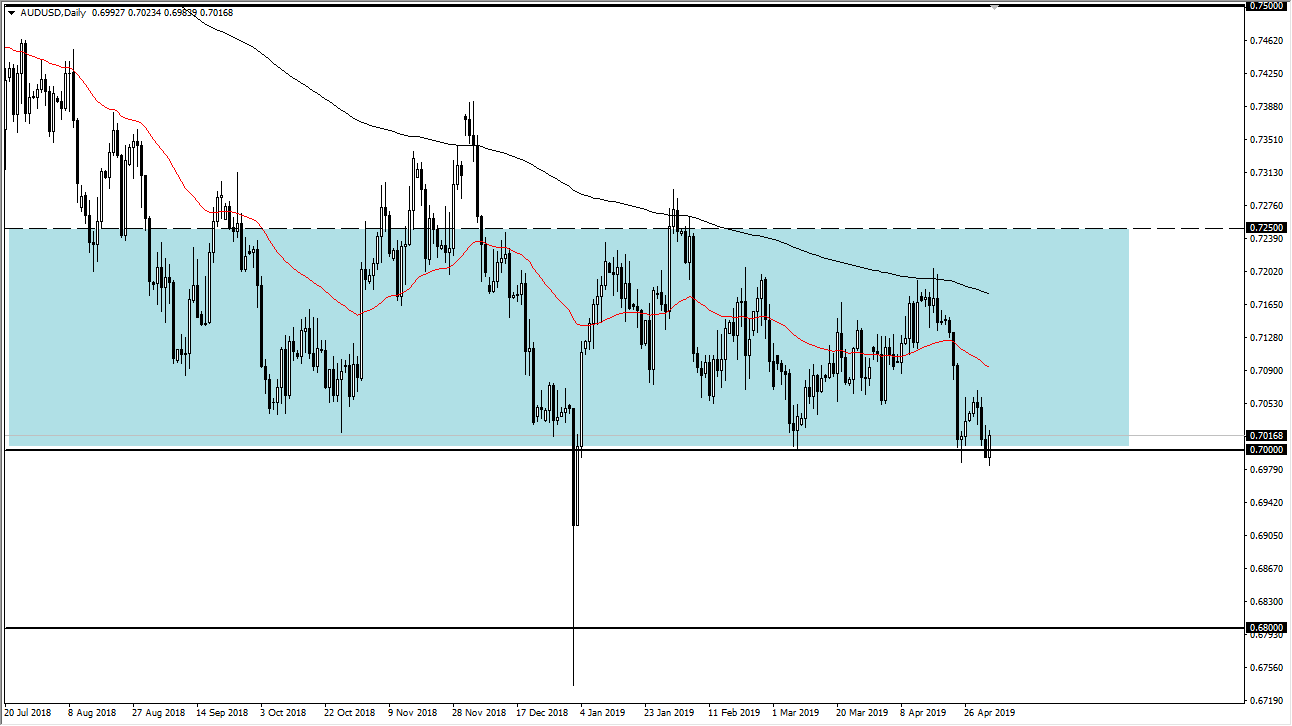

AUD/USD

The Australian dollar initially fell during the trading session on Friday, but then turned around to show signs of life again at the 0.70 level. This is a market that has seen a lot of support at the 0.70 level that extends down to the 0.68 handle. Overall, I think that it is the “floor in the market”, as it is so important as far support is concerned on the longer-term chart. By breaking down to this area and bouncing again, it’s very likely that we can continue to find short-term buying opportunities.

Longer-term, I believe that we are trying to form a bottom and a trend change. What we need is some good news coming out of the US/China situation to get this pair going. If we were to turn on a break below the 0.68 level, that would be disastrous and probably symptomatic of the larger financial problem.