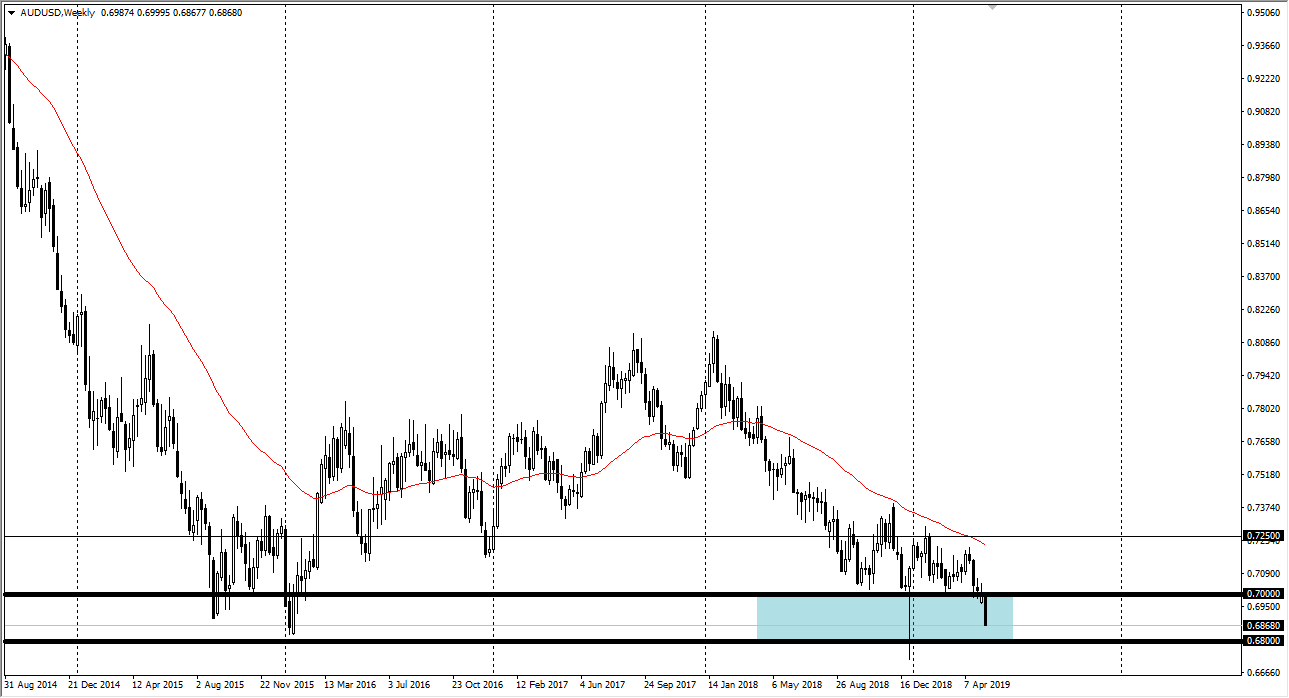

AUD/USD

The Australian dollar has sold off rather drastically during trading over the past week, as we are now starting to cut into a lot of support. That being the case, I suspect that we will probably work our way down to the 0.68 handle, which is massive support. A breakdown below that level will more than likely send this market to the 0.65 handle. At this point, it’s very likely that we could see a bit of a bounce, but I believe that it’s probably best to leave this market.

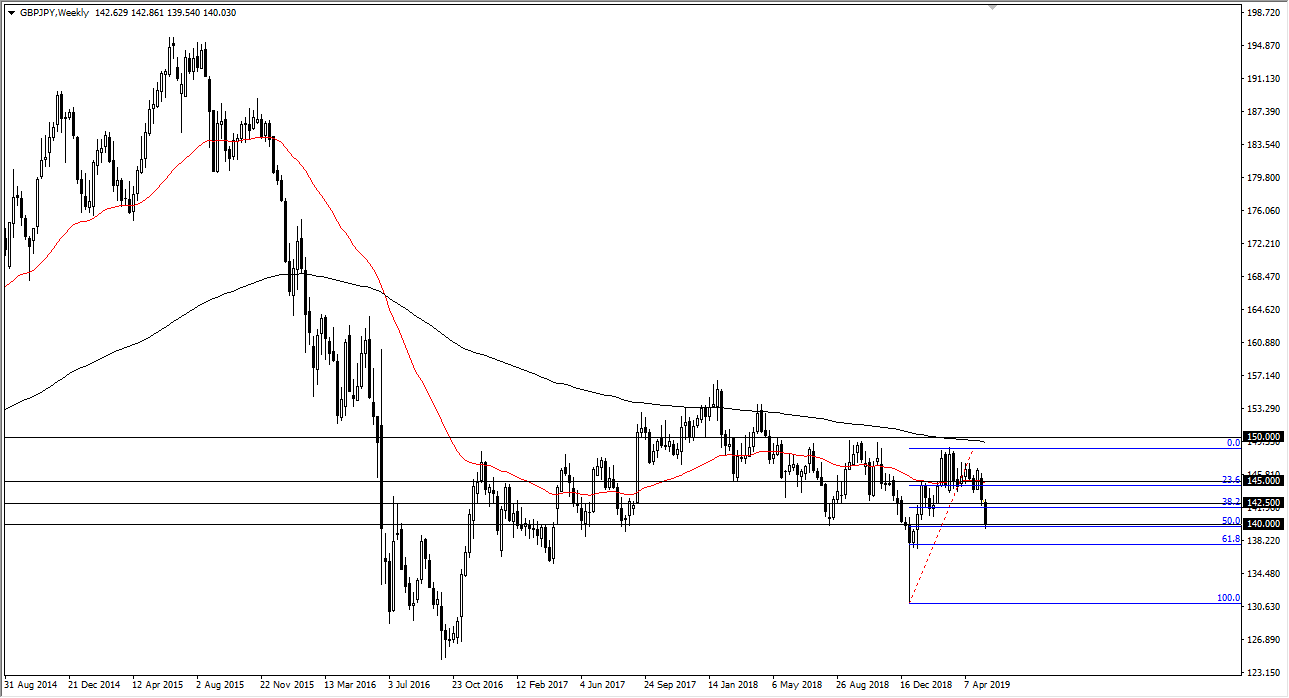

GBP/JPY

The British pound has fallen rather hard against the Japanese yen during the past week, reaching towards the ¥140 level. However, we have seen a bit of buying pressure in that area, so a bounce is very likely. If the stock markets can recover, that gives us a little bit of the “risk on” attitude that we may need, and beyond that if we can get some type of certainty when it comes to Theresa May leaving office, we could get a bounce. However, if we break down below the weekly candle stick, then I believe that we go down to the ¥138 level next.

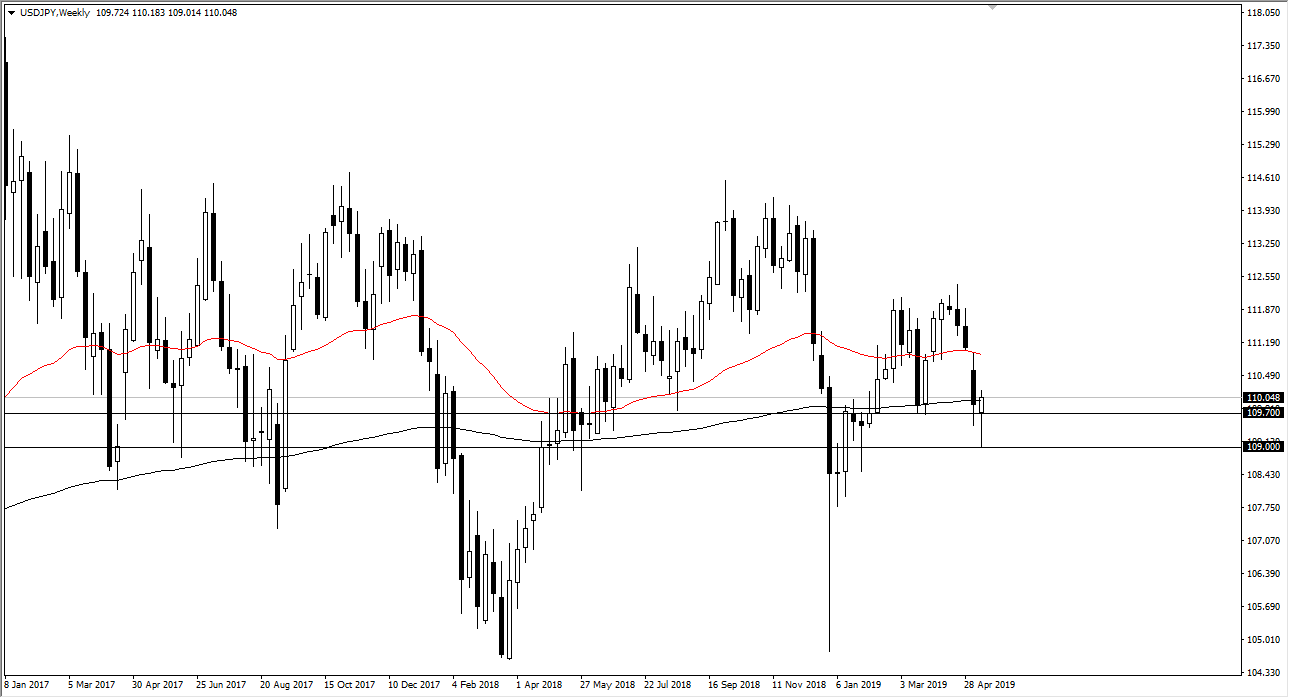

USD/JPY

The US dollar spent most of the week falling against the Japanese yen, but right along with the S&P 500 did find buyers in more of a “risk on” attitude in North America. The fact that we have formed a hammer is a good sign, and it looks very likely that we are going to try to job and fill the gap above near the ¥111 level. If we break down below the ¥109 level, that would be very negative.

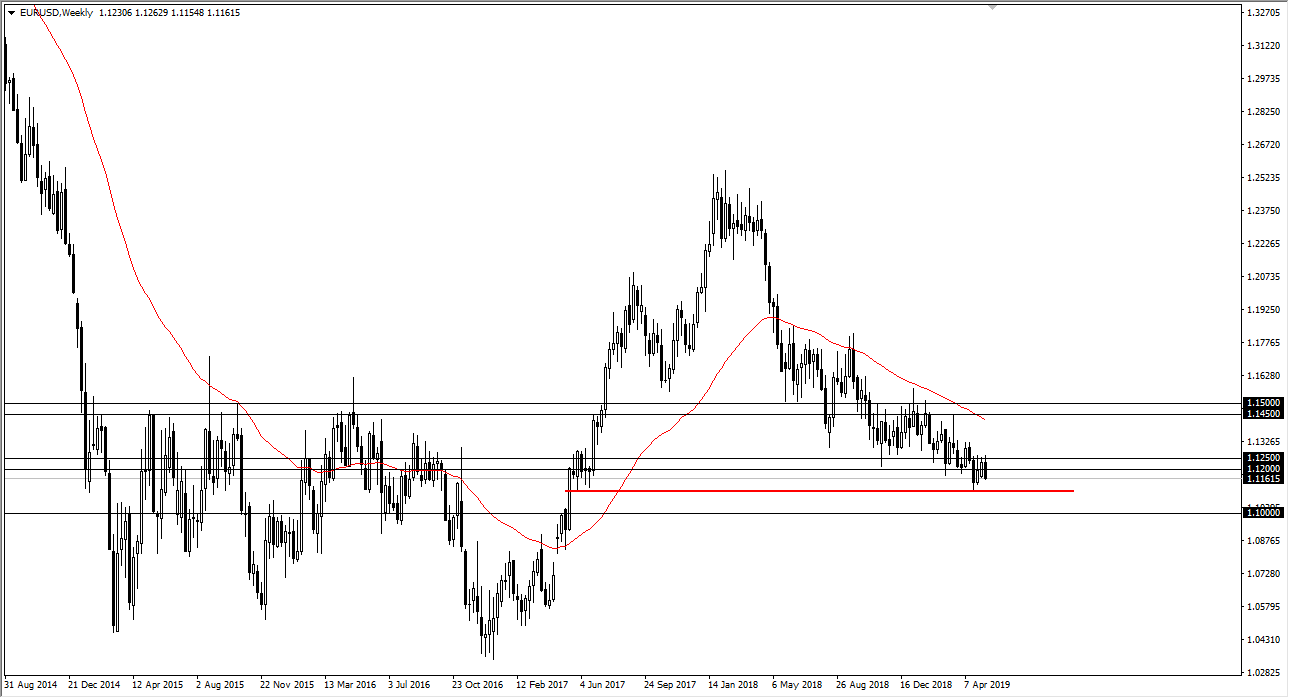

EUR/USD

The Euro continues to grind lower, and quite frankly I think that short-term rallies are going offer nice selling opportunities. It’s very likely that we could go down to the 1.11 handle, possibly even the 1.10 level.