Gold markets went back and forth during the trading session on Friday, as volume would have been an issue going into the major holiday weekend. With that being the case, it’s very likely that we continue to go back and forth in this general vicinity.

While I already mentioned that the Gold markets went back and forth all day, I don’t think that this is going to change because there wouldn’t have been much in the way of volume as people were more worried about the holiday weekend. Volume is very thin, especially considering just how volume as the Thursday session was in comparison. There is a lot of fear in the market so that could throw Gold markets around quite drastically, especially considering that the US and China can get it together.

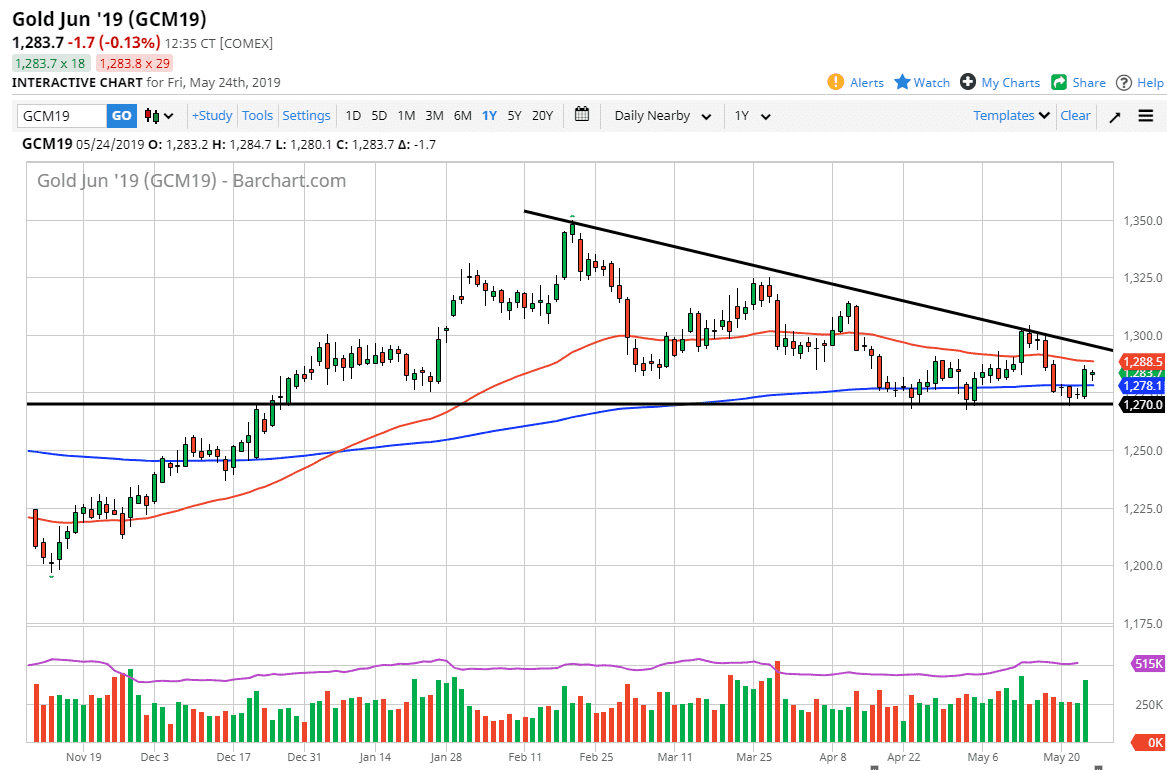

Looking at this chart, it’s obvious that we have a significant downtrend line, near the $1300 level. If we can clear that level on a daily close, then I think it’s very likely that the gold market could go to the $1315 level, and then possibly the $1325 level after that. To the downside, there is a significant amount of support at the $1270 level, as we have seen several different times. With this being the case, move below that level will send this market much lower, perhaps down to the $1250 level, the $1225 level, and then possibly where I see the longer-term floor in the market is at the $1200 level.

Gold will continue to move back and forth in this general vicinity and you should keep in mind that Monday is Memorial Day in the United States, so volume will be a major problem. We will have periodic electronic trading, but no serious volume will be present unless of course there is a major headline that crosses the wires.