WTI Crude Oil

The WTI Crude Oil market initially rallied on Tuesday but gave back quite a bit of the gains to turn around of form a bit of the shooting star. The shooting star sits just below the $65 level, so it does look like we are in serious trouble. Beyond that, when you look at the weekly candle stick from last week, it looks terrific as well. The question now is where we go next, which of course is the only thing that matters. Looking at this chart, if we break down below the $62.50 level, then we could drop down to the 50 day EMA. The $60 level also could offer support, so if we were to break down below there, then it could be the beginning of a significant trend change. On the other hand, if we do break out to a fresh, new high, then we could make a move towards the $70 level.

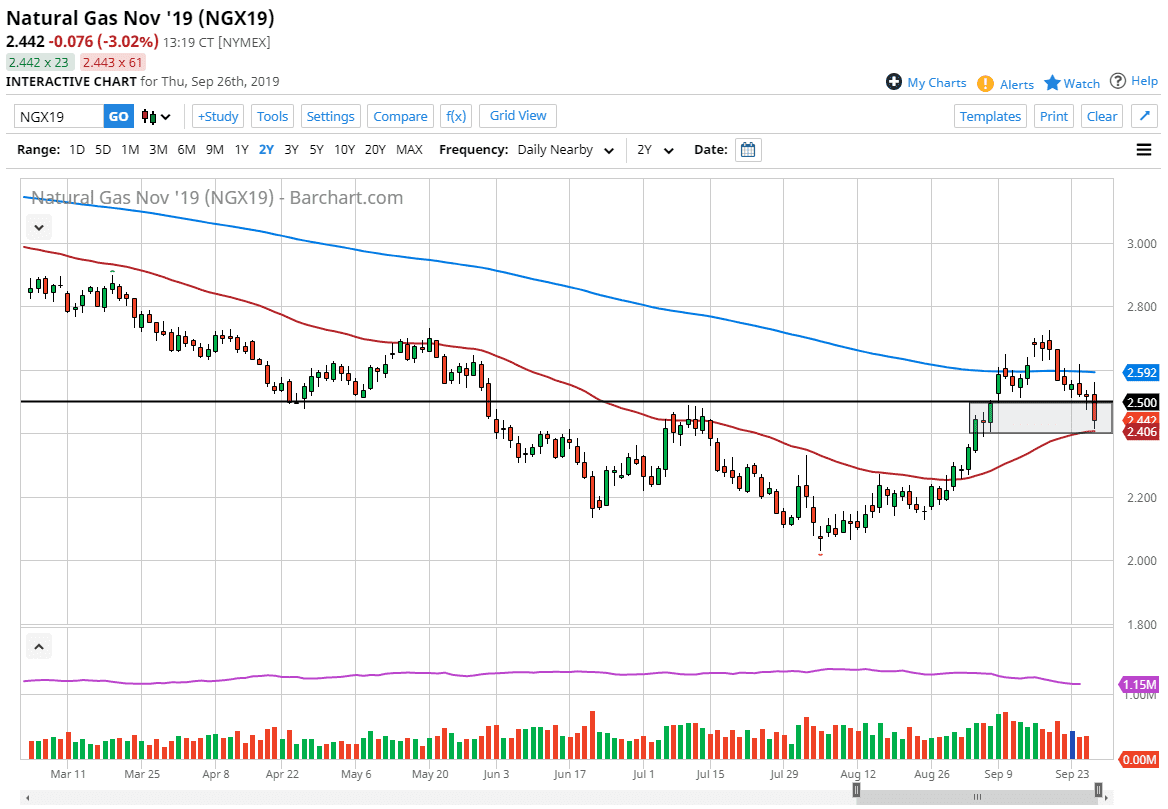

Natural Gas

Natural gas markets went back and forth during the course of the trading session on Tuesday as well, initially going higher. However we found plenty of resistance above and we fell enough to form a shooting star. If we broke down below the bottom of the range for the day, the market should then go down to the $2.50 level. At this point, the market looks very likely to continue to find sellers every time we again, as we are in the wrong time of year to expect significant demand. With that being the case, I look at any time we see a rally as a potential trading opportunity, because I believe that there is no case for higher pricing, despite the fact that supply is low currently. We are entering drilling season, meaning that we should fill up those tanks rather quickly.