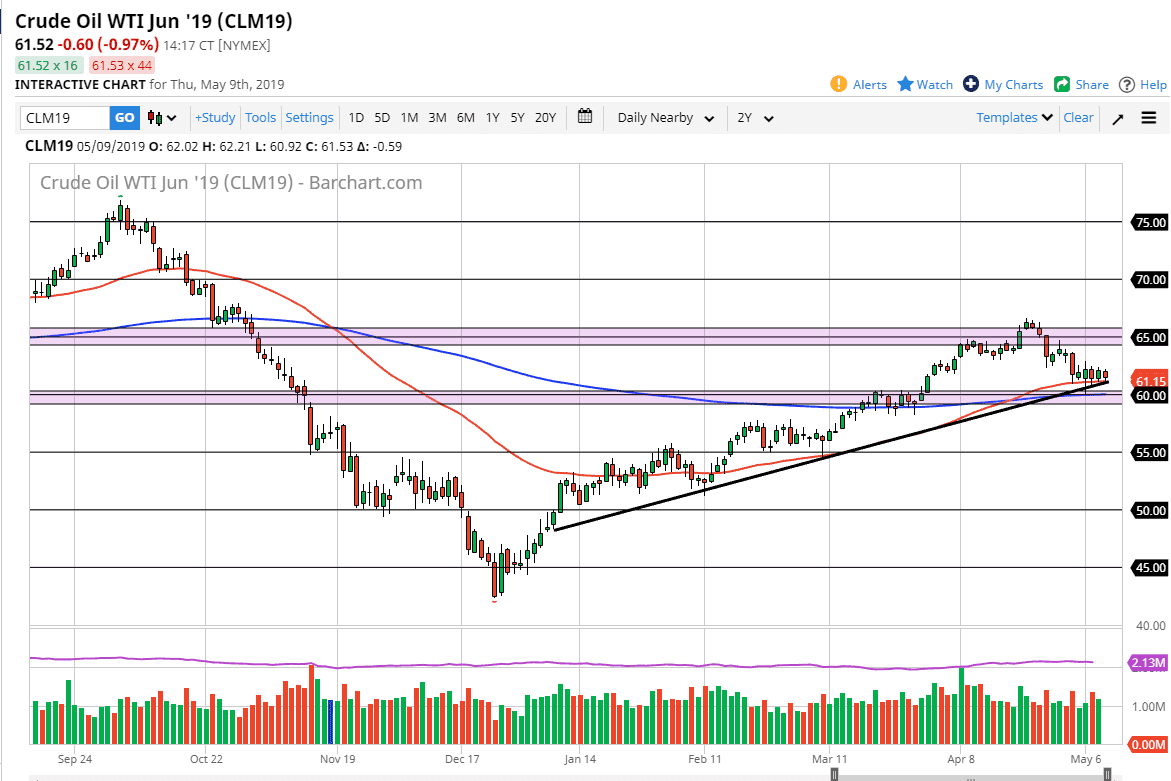

WTI Crude Oil

The WTI Crude Oil market fell a bit during the trading session on Thursday as we got a bit of a “risk off” move to kick off the session, but we did get a bit of a reprieve, bouncing from the 50 day EMA. More importantly we continue to use the uptrend line as support, so although we have done very little during the week, one thing that we have accomplished is showing that there is significant support. That of course is crucial for the uptrend, but at the same time we can also make an argument for a major break down if we fall from here.

That being said, I believe that there is support all the way down to the $59 level so I’m not willing to sell unless we break down below there and there is negativity coming out of the US/China trade talks. Alternately, we could probably go looking towards the $64 level above, based upon good news coming out of that meeting. I think it’s that simple.

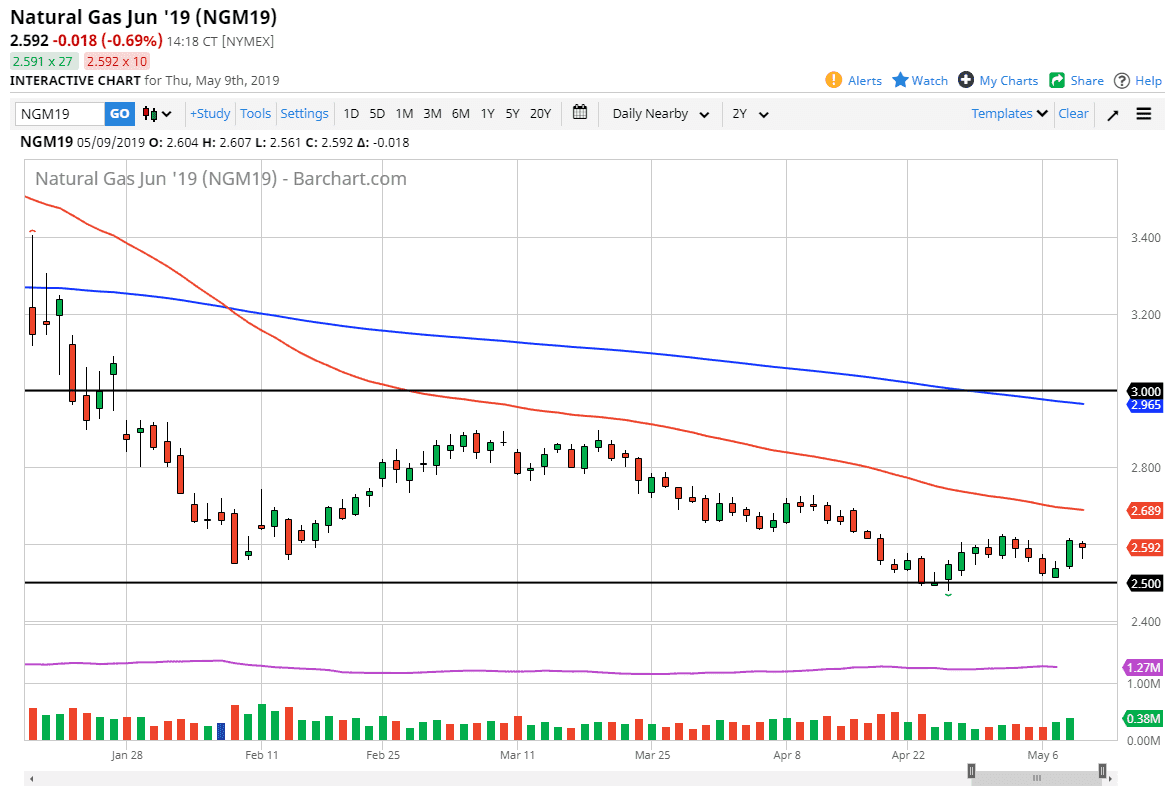

Natural Gas

Natural gas markets continue to be a bit exhausted, and this rally of course is a good sign of the last couple of days, but quite frankly I think it’s only a matter time before the sellers come back. I believe at this point the red 50 day EMA above is probably going to offer a bit of resistance, so I’d be a seller in that area. I don’t have any interest in shorting here though, even if I know that we are very negative. The $2.50 level underneath is massive support, so I would like to get a little bit of space between here and there to start selling. Even if we break above the 50 day EMA, I think that the $2.75 level could also offer the market some exhaustion that we can sell.