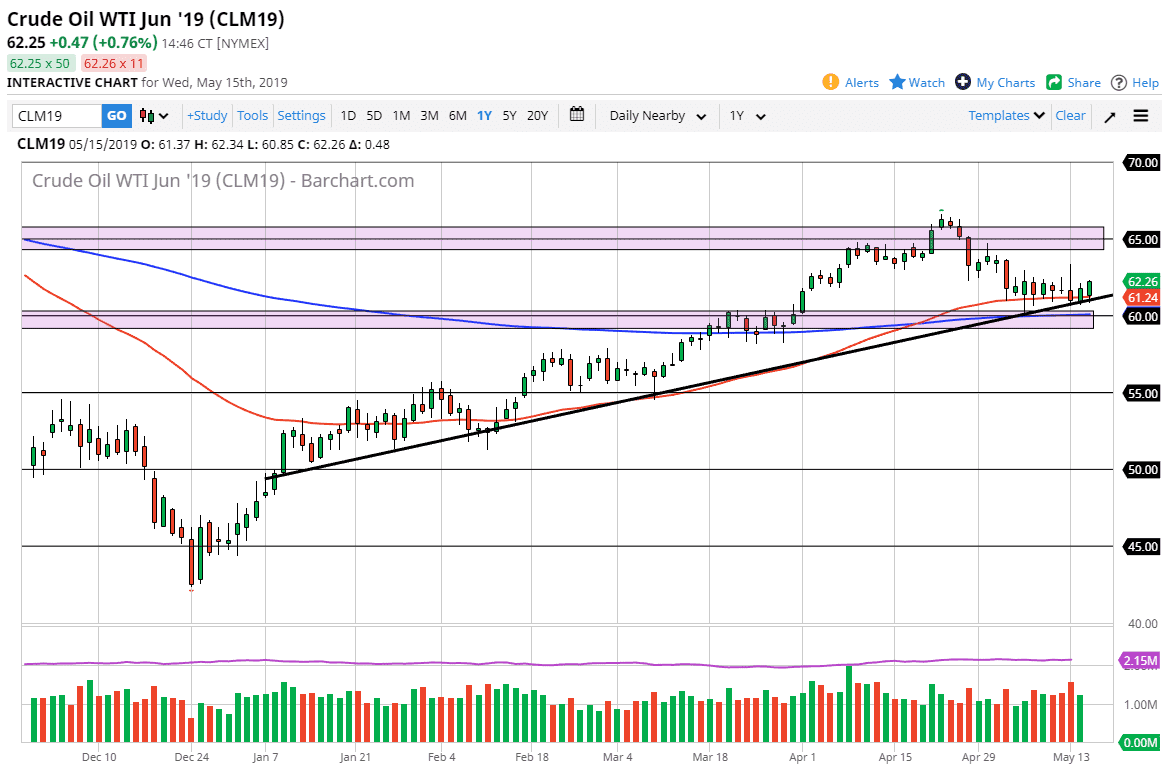

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session on Wednesday, showing the trend line to be reliable and still in effect. The 50 day EMA has offered support, and as a result I believe that short-term pullbacks will continue to offer short-term buying opportunities. The biggest problem of course is that there is a lot of resistance above and of course there’s a lot of uncertainty when it comes down to the US/China trade situation. As long as that’s going to be an issue, it’s probably only somewhat able to rally, because there will always be concerns about demand.

I believe that the $64 level above is significant resistance that will be difficult to overcome. Otherwise, if we break down below the $60 level, there is support all the way down to the $59 level to keep the market alive. If it breaks down below there, then oil will more than likely reach towards the $55 level.

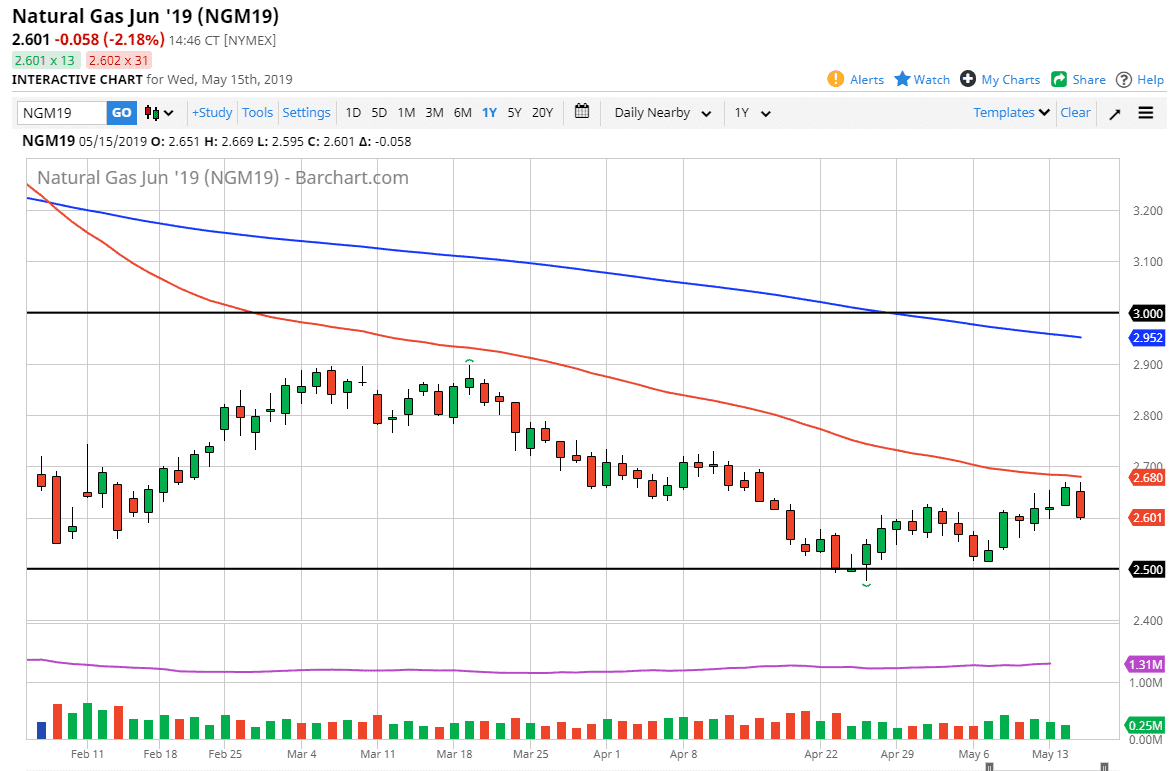

Natural Gas

Natural gas markets initially tried to rally during the trading session on Wednesday but found enough resistance again at the 50 day EMA to turn over and roll over. As we did that, the market reached towards the $2.60 level, an area that is important as it is a large round number, but at this point it’s an area that was previous resistance and could now be supported. However, we are in the longer-term downtrend and of course we have close towards the bottom of the candle stick. If we do, the market probably goes looking towards the $2.50 level yet again, an area that is massive support from a longer-term perspective. As far as buying is concerned, I have no interest in doing so.