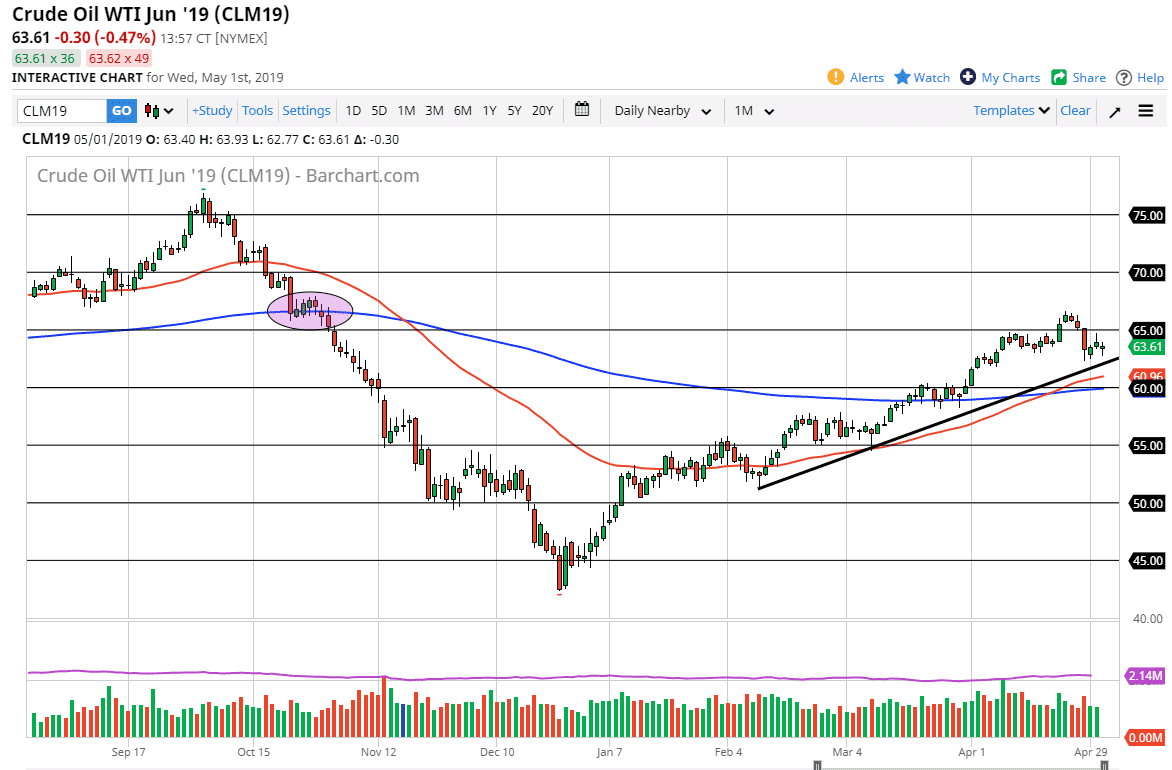

WTI Crude Oil

The WTI Crude Oil market initially pulled back during the trading session on Wednesday but has seen enough buying pressure underneath to push things back and show signs of a recovery. However, there is a lot of resistance just above at the $65 level and it should be pointed out that last week’s candle was horrific looking. I think at this point the oil market is getting ready to make some type of longer-term statement, so expect it to be very difficult to break above. With that being the case it’s very likely that we go back and forth over the next several days. The uptrend line should be paid attention to, just as the 50 day EMA should as well. The $60 level would be the first sign of significant support on a break down if and when we get it. To the upside, if we were to be able to make a fresh, new high then we could go looking towards the $70 level.

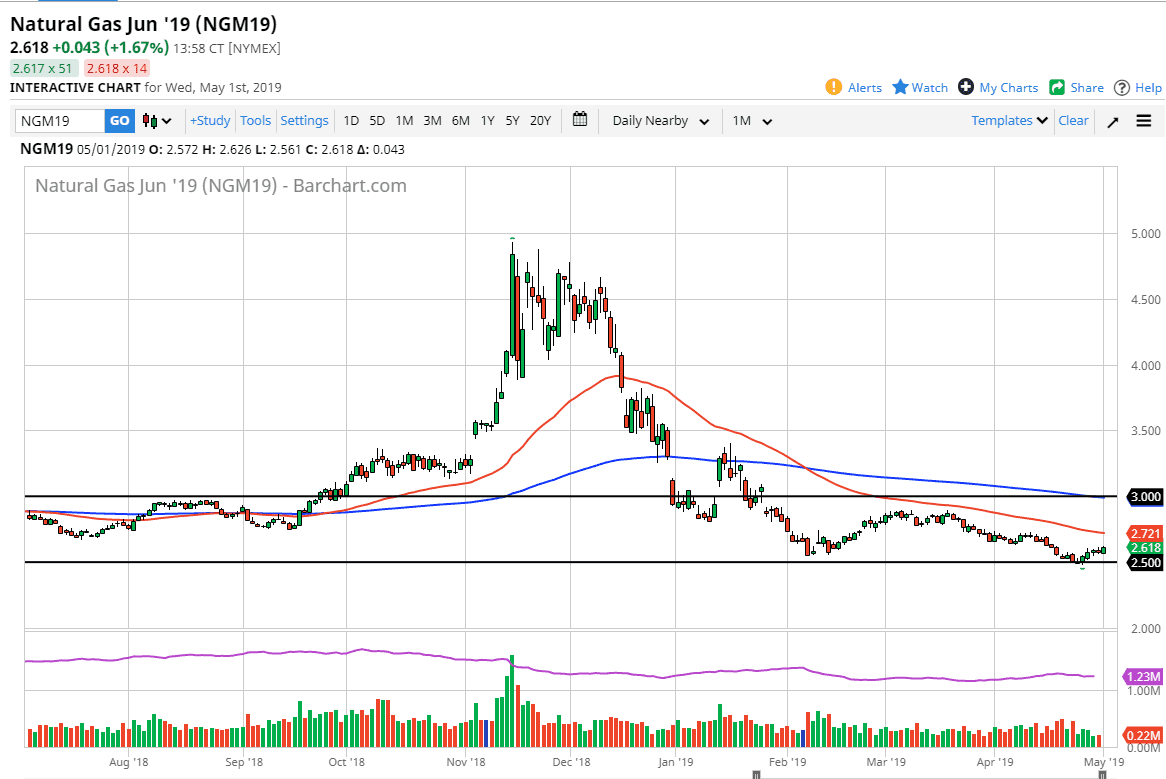

Natural Gas

Natural gas markets rallied during the trading session on Wednesday, as we continue to bounce from extreme and oversold condition. The $2.50 level underneath is significantly supportive, as it is a large, round, psychologically significant figure, and one that we have been bouncing from for some time. With that in the back of our mind, it’s easy to see that the market was due for a bounce. However, the $2.70 level offers resistance on short-term charts, and of course we have the resistance barrier built and at the 50 day EMA which is just above there. Ultimately, this is a market that offers short-term buying opportunities but it’s much easier to simply sell as soon as markets get a little ahead of themselves.