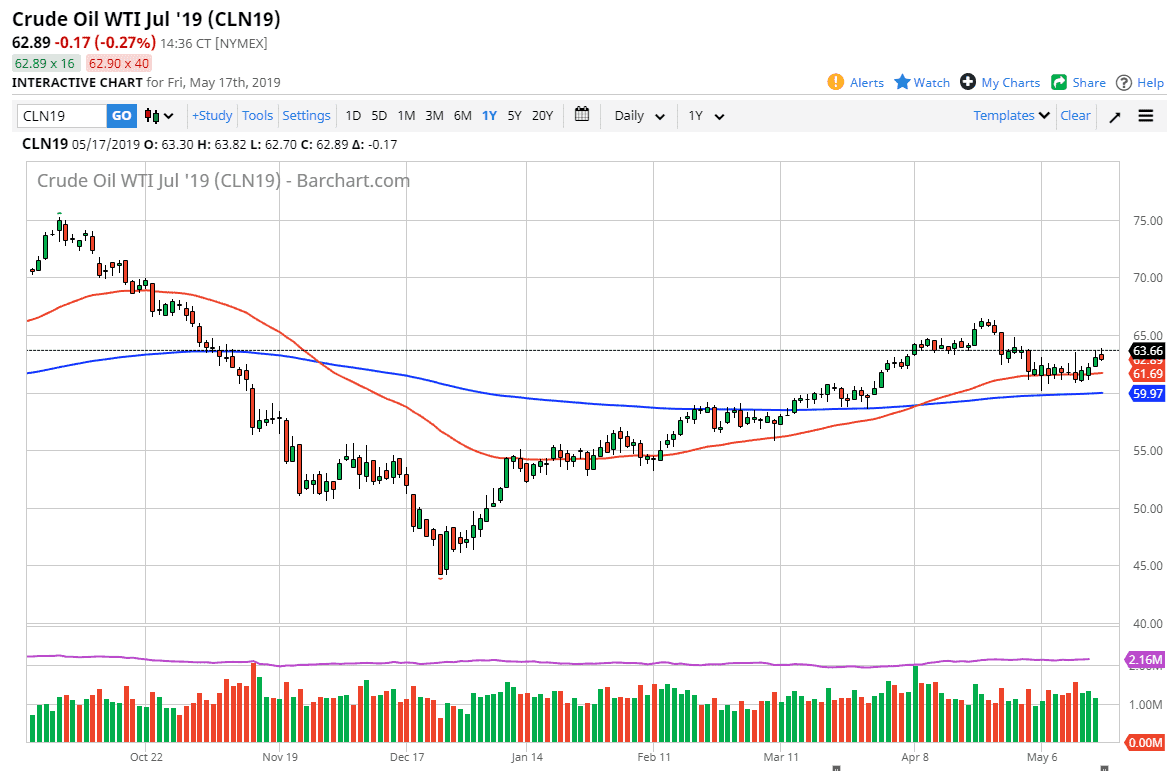

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session on Friday initially, but struggled at the $63.66 level. At this point, the market found quite a bit of resistance and therefore rolled over rather significantly. By selling off the way it had, it shows that the area is going to continue to be difficult to overcome, but I also see a significant amount of support at the 50 day EMA which is colored in red.

I also think that the $60 level will be massive support, as we have the 200 day EMA just below it. The large, round, psychologically significant figure of course will have a lot to do with where we go next to. Short-term pullbacks should be buying opportunities, as we could grind all the way to the $65 level. This is a marketplace that looks very bullish but should be very noisy and back and forth.

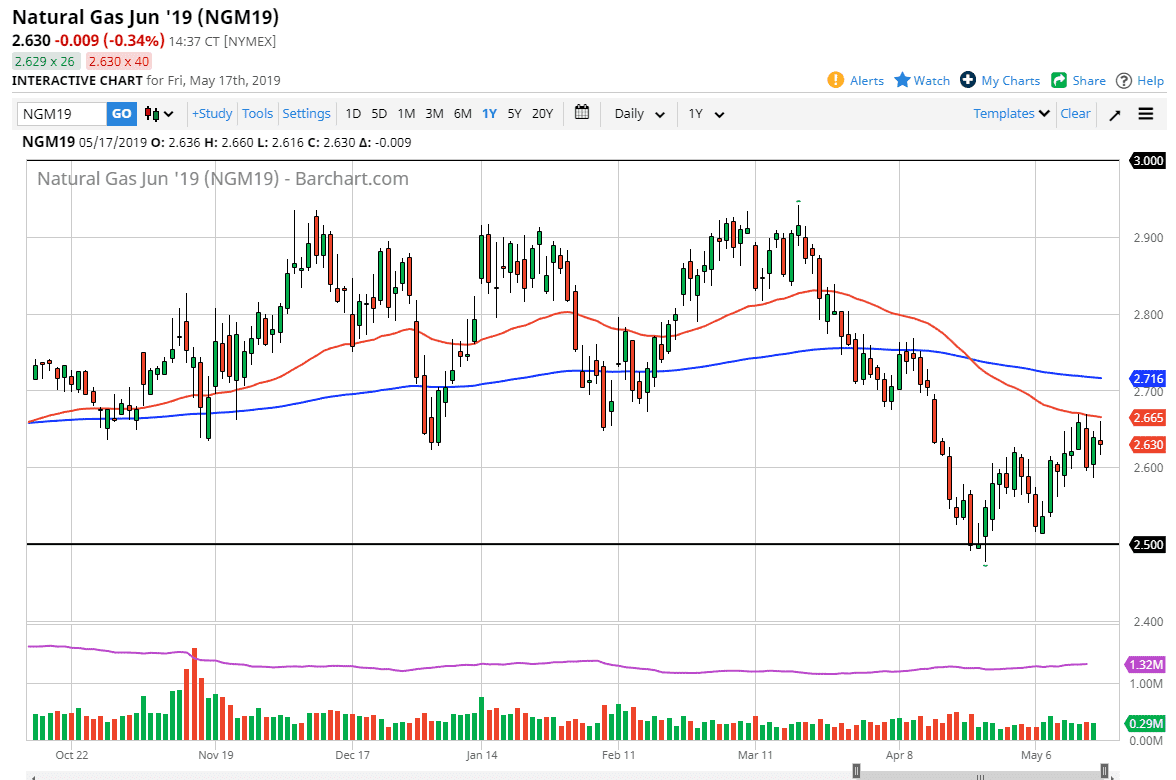

Natural Gas

The natural gas markets went back and forth during the trading session on Friday, initially rallying to the 50 day EMA, before pulling back to form a shooting star. This may be a sign that we are ready to roll over. If we can break down below the $2.60 level, then it’s very likely that we could go down to the $2.50 level. The alternate scenario of course is that we can break above the 50 day EMA, as it should send this market looking towards the $2.70 level. At this point in time, this is a market that still is bearish overall so I’m looking to sell signs of exhaustion or break down below that big figure at $2.60 below.