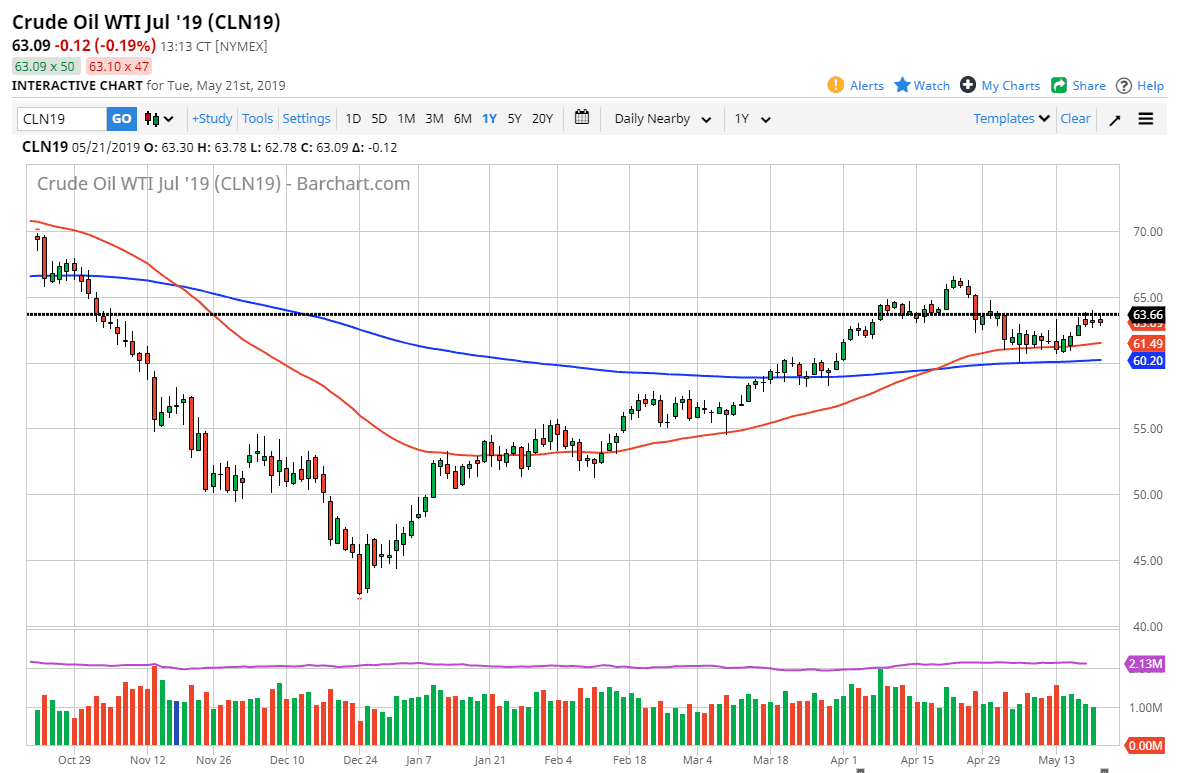

WTI Crude Oil

The WTI Crude Oil market went back and forth during trading on Tuesday, as we continue to see a lot of resistance near the $63.66 level. This is a market that is looking very likely to consolidate at this point, because there is so much noise between there and the $65 level. Beyond the resistance though, there is also support underneath at the 50 day EMA that extends down to the $60 handle. With all of that being true, I anticipate that we are looking at a range bound market that will simply chop around. This is good for short-term traders though, as I believe that we don’t really know where to go with tensions in the Middle East perhaps driving the cost of crude oil higher, but at the same time a potential trade war driving down demand.

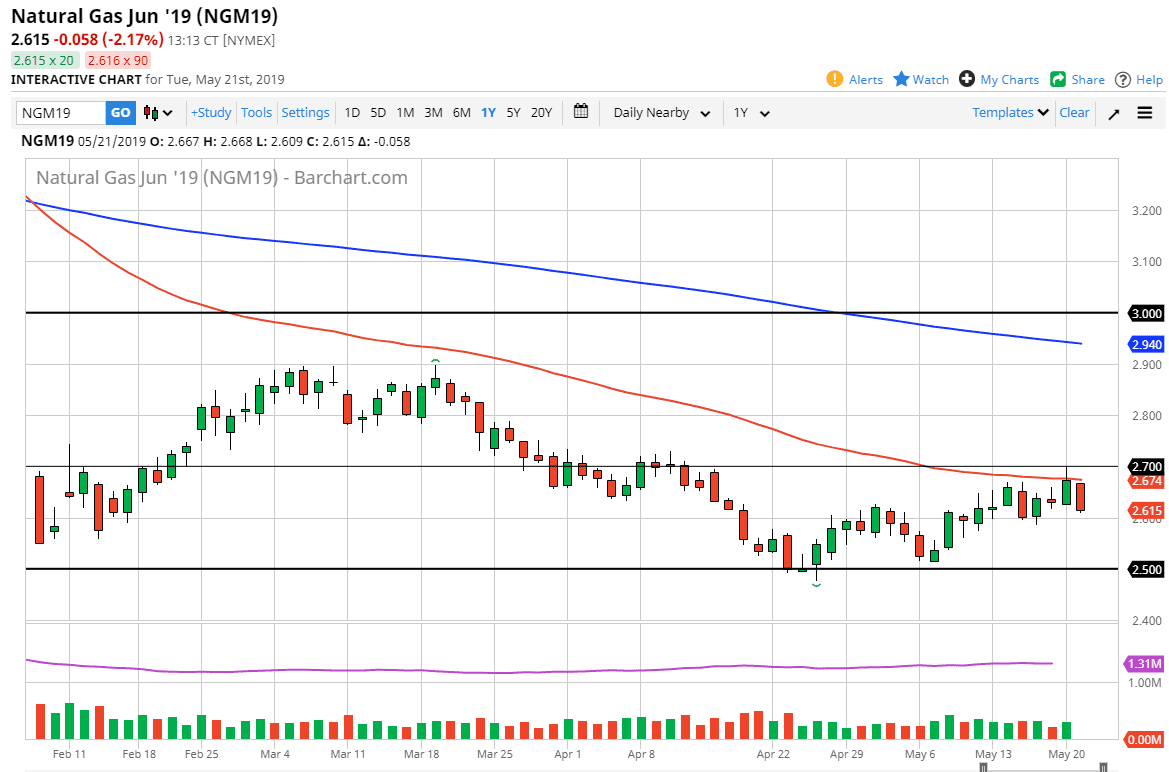

Natural Gas

Natural gas markets fell during trading on Tuesday, drifting down towards the $2.61 level rather rapidly. The $2.60 level should be support, and therefore we could see a little bit of a bounce from there but I fully anticipate that eventually we will break through it and go looking towards the $2.50 level which has been such a major floor in the market. Beyond the bearish candlestick, we also have the 50 day EMA that has acted as resistance, so ultimately I think it makes sense that we continue to see sellers.

In the short term, I expect that the $2.70 level is essentially the ceiling in the market as well. With that, I would focus on short-term charts that show little rallies that can be faded based upon exhaustive candles. You are probably going to have to play short-term time frames as although this is a very negative market, the risk to reward ratio is favor 15 minute charts and the like.