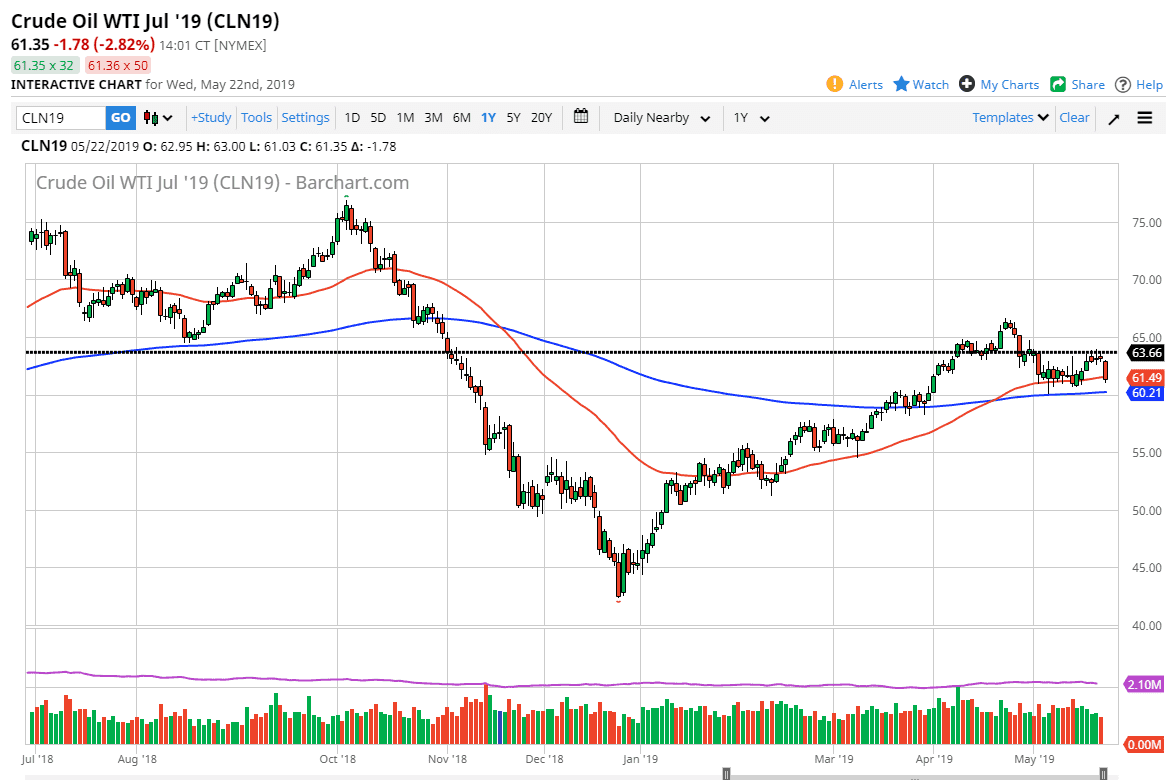

WTI Crude Oil

The WTI Crude Oil market fell significantly during the trading session on Wednesday, slicing through the 50 day EMA. Looking at this chart, it seems as if the crude oil markets are suffering at the hands of a poor inventory figures coming out, and of course concerns about the overall global growth with the United States and China bickering. At this point in time, the $61 level looks to be the beginning of support that extends down to the $60 handle.

The 200 day EMA is sitting just above the $60 level, so I would anticipate that that level will be very difficult to break below. That being said this is a very negative candle stick though. However, it’s very likely that there will be a big fight on our hands of the next couple of days. Short-term bounces are possible, as we could end up rotating between $60 and $65 overall. A lot of what’s about to happen will come down to how this week closes.

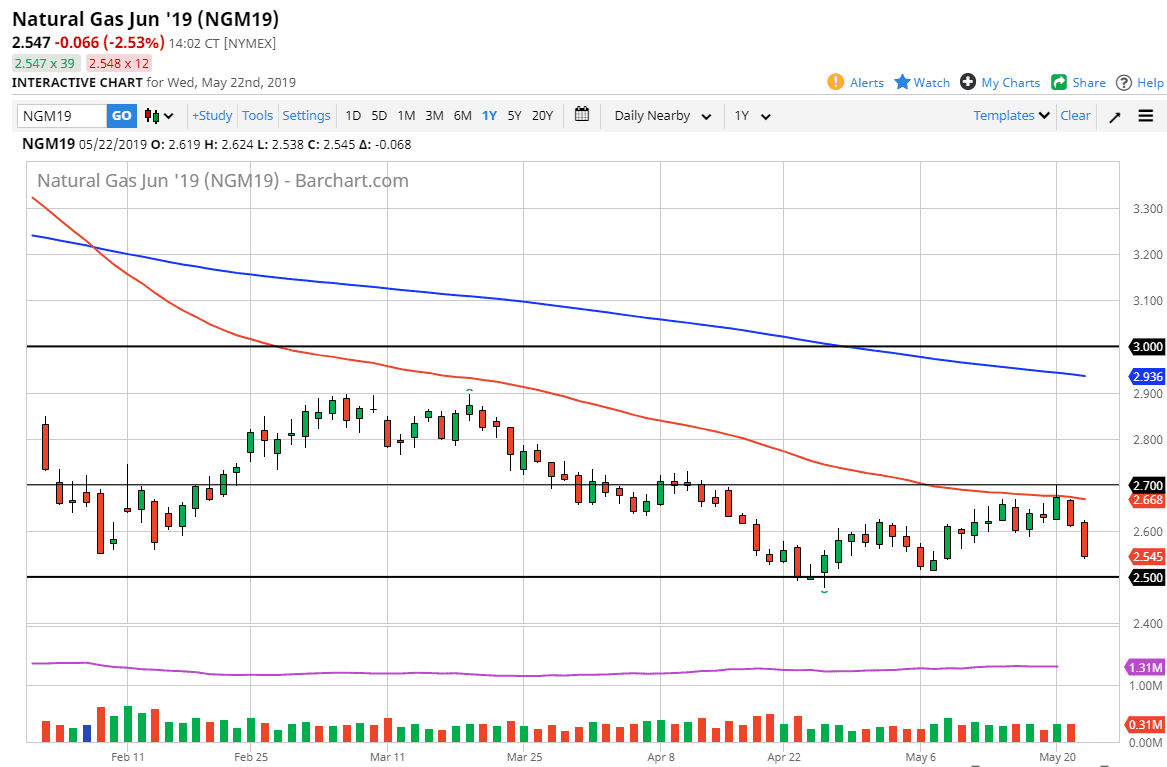

Natural Gas

Natural gas markets fell as per usual during the trading session on Wednesday as we continue to reach down towards the $2.50 level. That being the case, it’s very likely that we will continue to see significant volatility, and I like the idea of selling this market on short-term rallies, as I do think that we will revisit the $2.50 level. The $2.60 level being broken is a good sign that the sellers have taken over again, and at this point I think we will simply continue the overall grind lower. I have no interest in buying this market, because this is the wrong time of year to expect natural gas to go much higher for any significant amount of time.