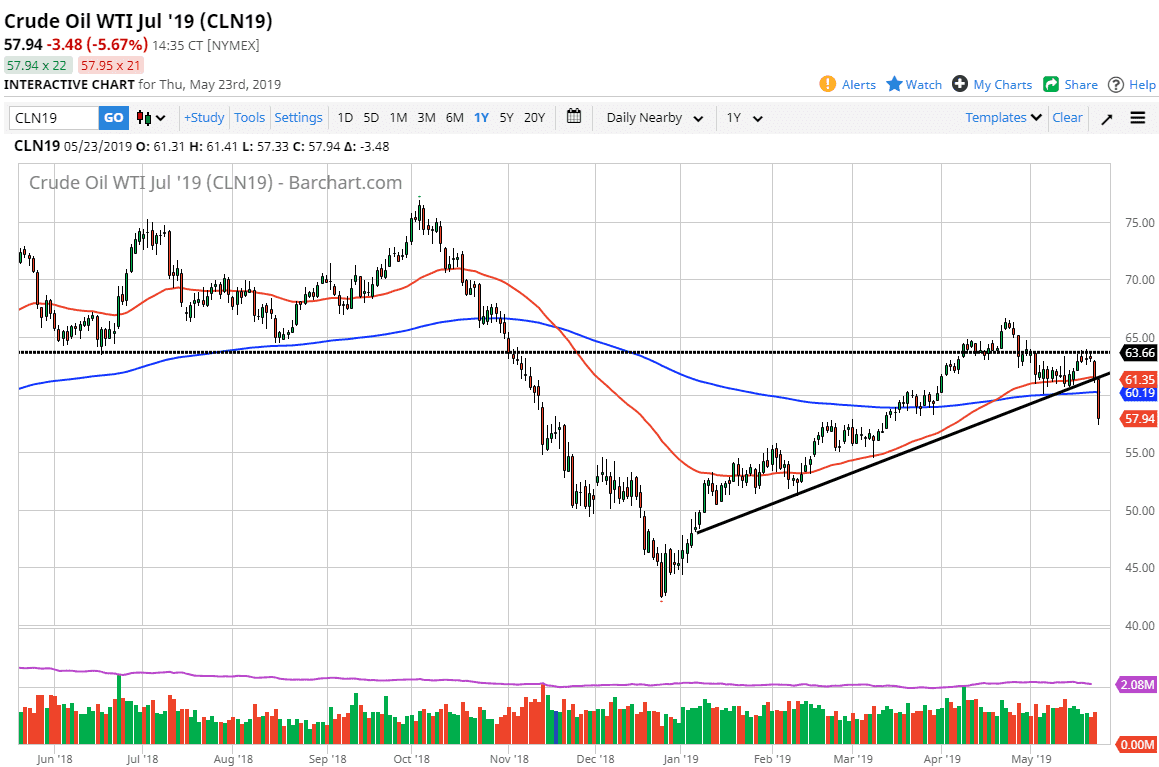

WTI Crude Oil

The WTI Crude Oil market fell rather hard during trading on Thursday, slicing through the uptrend line that of course has been so obvious. The fact that we have done that, and then slice through the 200 day EMA, the $60 level, and even the $58 level, this is an extraordinarily negative turn of events. It’s obvious that short-term rallies should offer opportunities to start selling, and with that being the case I will start to look towards the short-term charts in order to find signs of exhaustion that I can take advantage of.

If we broke above the $62 level, that would be a nice turn of events, but this market looks completely broken at this point. I believe that we will continue to see a lot of concerns when it comes to global growth and the US/China trade war, so it’s very likely that crude oil will continue to get hammered.

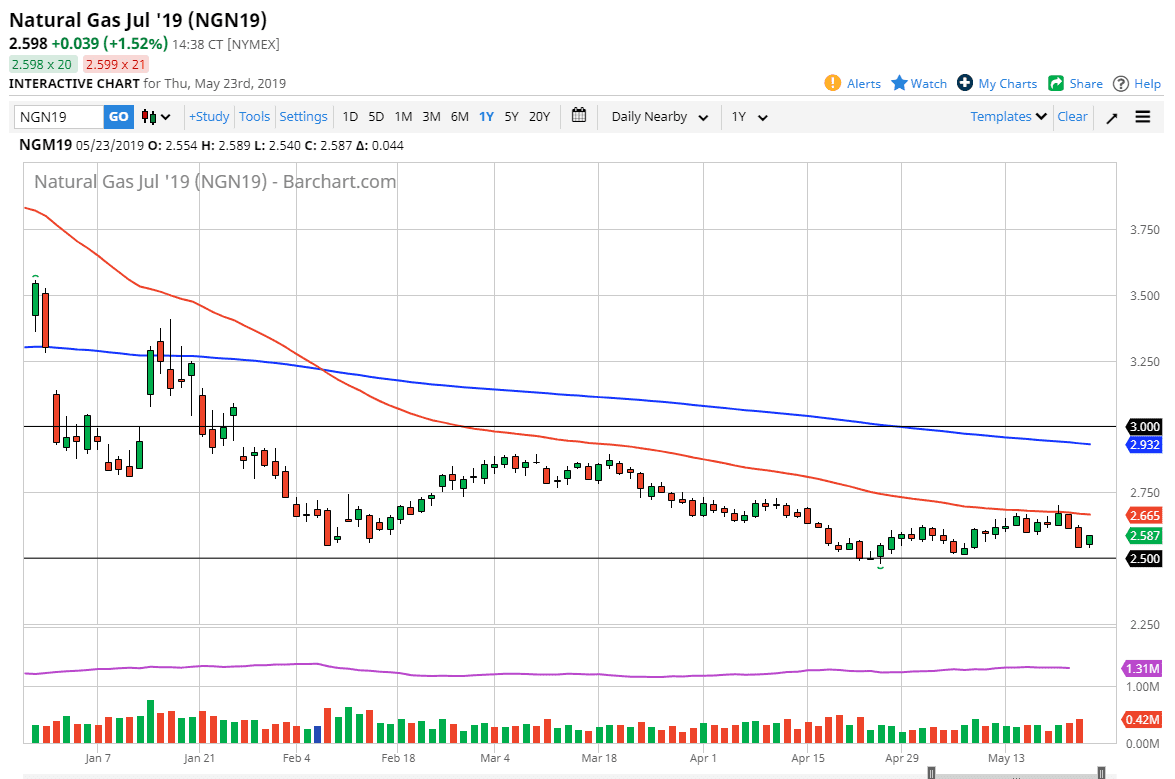

Natural Gas

Natural gas markets bounced slightly during the trading session on Thursday, but as you can see it is still far from being a bullish market. The $2.60 level above should be massive resistance, and then the 50 day EMA is hanging about above, and that should continue to cause issues. The $2.50 level underneath should be massive support, and if we can break down below there, the market could unwind to the $2.25 level. One thing that you should keep in mind is that the natural gas markets are very seasonal, and this is not a good season for natural gas in general. Expect volatility, but I’d be a seller short-term rallies that show signs of failing on lower time frames such as 15 minutes or so.