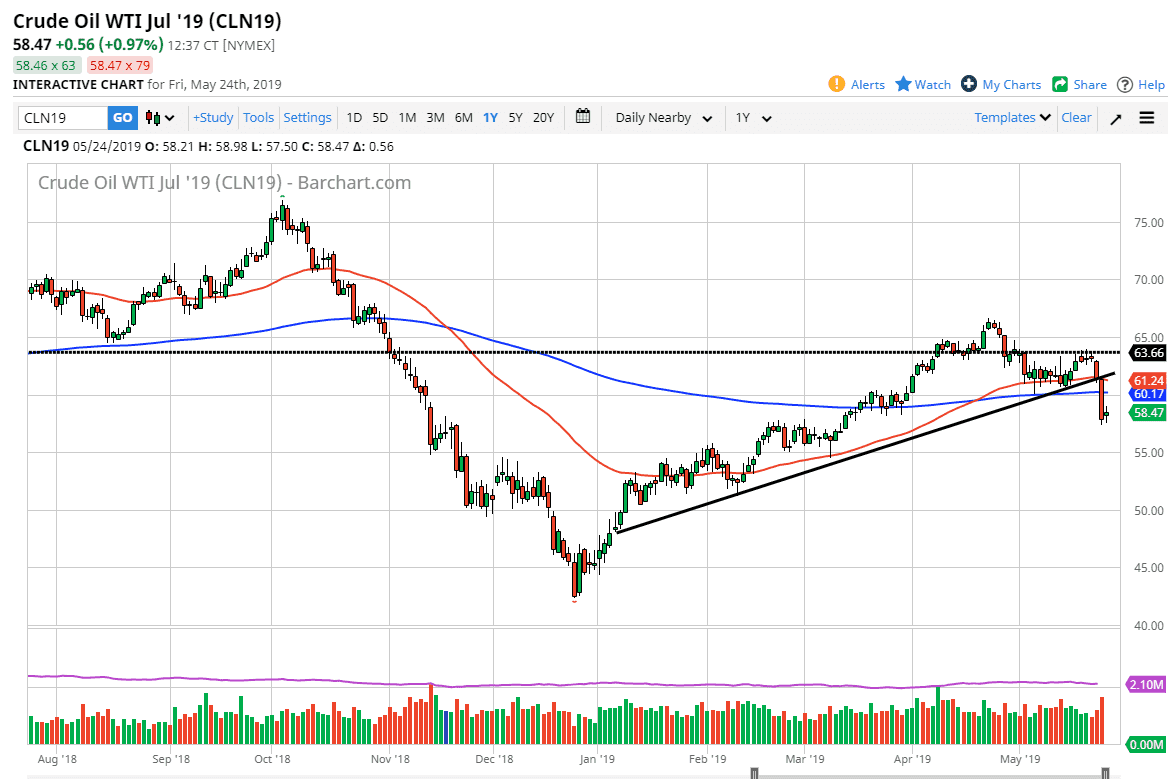

WTI Crude Oil

The WTI Crude Oil market went back and forth during low volume trading on Friday. After all, we had seen the lot of selling pressure during the Thursday session and we were going into the Memorial Day weekend in the United States. This means that there would be very little in the way of volume on Friday. At this point in time, we had broken down below a major trendline, and now it looks like any rally will be sold into. I anticipate that the move down to the $55 level is all but assured, but we will have the occasional rally. Those rallies should be opportunities that you can take advantage of as we have seen a complete collapse in the idea of global growth, and at this point it makes sense that as long as the US/China negotiations continue to keep hope low.

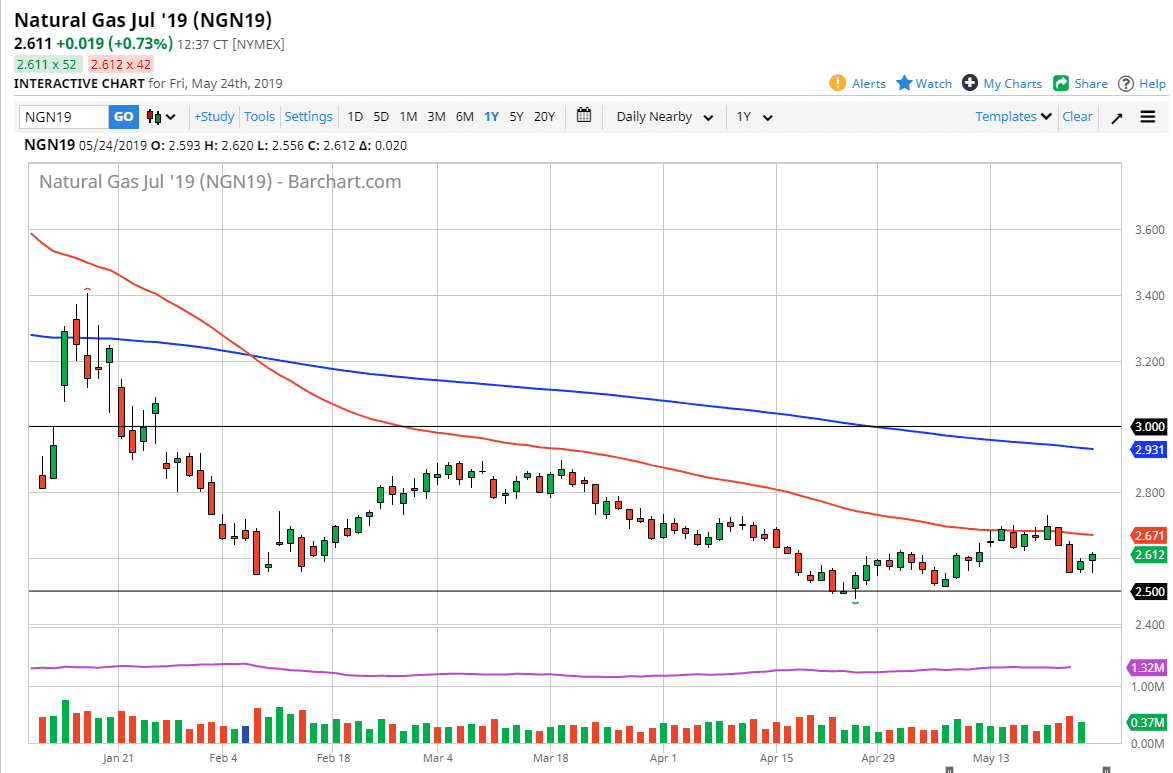

Natural Gas

Natural gas markets initially pulled back a bit but then turned around to show signs of life on Friday. At this point in time though, we are at extreme lows so it makes sense that sellers will probably come back in on any type of pop. The 50 day EMA is near the $2.67 level, so I suspect that given enough time we will see sellers in that general vicinity, perhaps extending to the $2.70 level. Otherwise, if we can break above the level then it’s likely that the market would go to the $2.80 level, perhaps even the $2.90 level after that.

The $2.50 level underneath is the “floor” in the market, and as a result it’s very likely that we will see a major “flush” if we do turn around and break this market down. Selling rallies continues to be the way going forward.