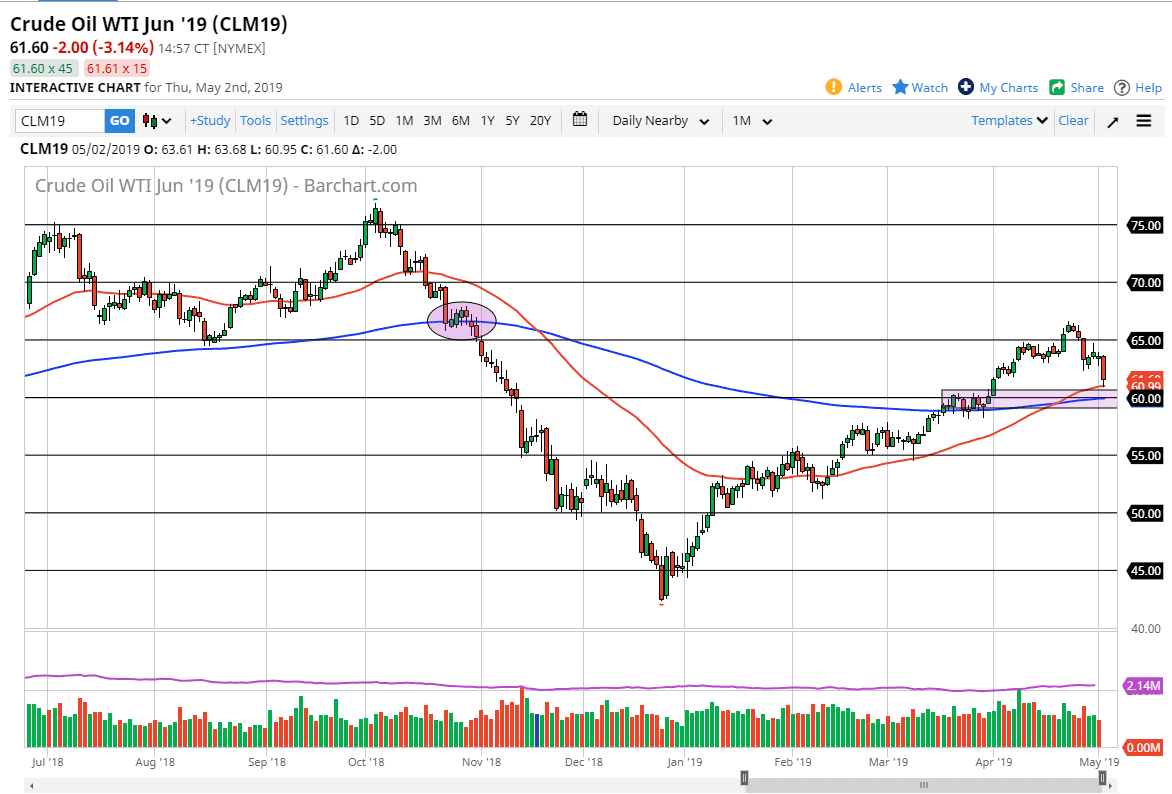

WTI Crude Oil

The WTI Crude Oil market got absolutely hammered during the trading session on Thursday, as we reached down towards the 50 day EMA. Beyond that, we see significant support at the $60 level, which is not only a large, round, psychologically significant figure, but also the scene of the 200 day EMA and blue. Ultimately, the market has needed to pull back for a while so this may be a buying opportunity. However, with today being the jobs number on Friday, if we slide below the $59 level, it’s likely that the market breaks apart and reaches towards the $56 level.

However, we did see some resiliency and the market late in the day, so it appears that we are at least trying to bounce. If we do, I suspect that the $65 level above is going to be very difficult to break through. In other words, if we hang on now, it’s likely that we are trying to form a new range.

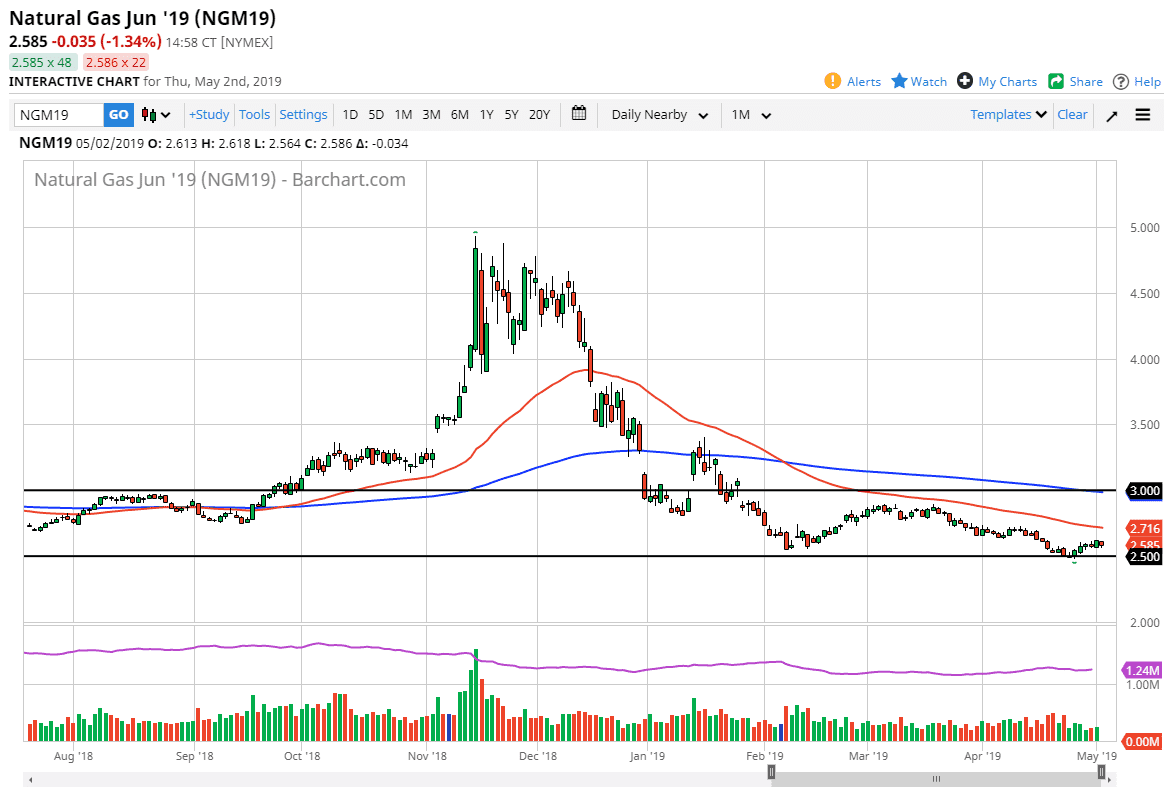

Natural Gas

Natural gas markets fell a bit during the trading session on Thursday, as we continue to see a lot of bearish pressure in this market. The 50 day EMA is pictured in red on the chart near the $2.71 level, and that of course should offer quite a bit of resistance as well. I think that the play in this market of course is to sell rallies that show signs of exhaustion on short-term charts. That’s been the way for a while, so I don’t think it changes anytime soon although I recognize that we could bounce a bit. The alternate scenario is that we break down below the $2.50 level, and then we could just break down to the $2.25 level.