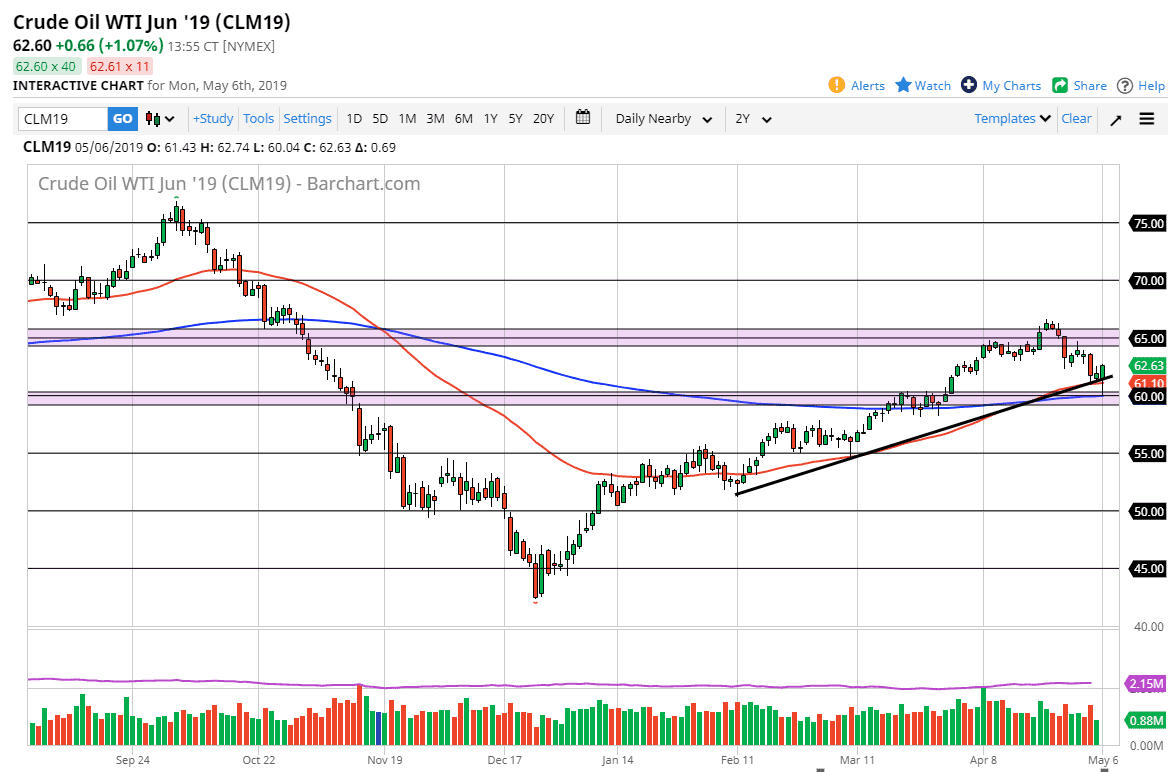

WTI Crude Oil

The WTI Crude Oil market had a wild ride during the trading session on Monday, as Donald Trump tweeted that he was going to raise tariffs against the Chinese. This of course has people selling oil in the beginning, because there was a lot of fear about global growth. The market fell to the 200 day EMA, which is basically hanging around the $60 level but found a lot of buying in that area to turn things around and form a massive hammer on the daily candle stick. That being the case, we have saved the trend line, and now it looks like we could probably go towards the $65 level. A break above the recent high just above there could have the market going much higher. Ultimately, if we were to turn around and start selling off again and break down below the lows of the day we could unwind quite a bit.

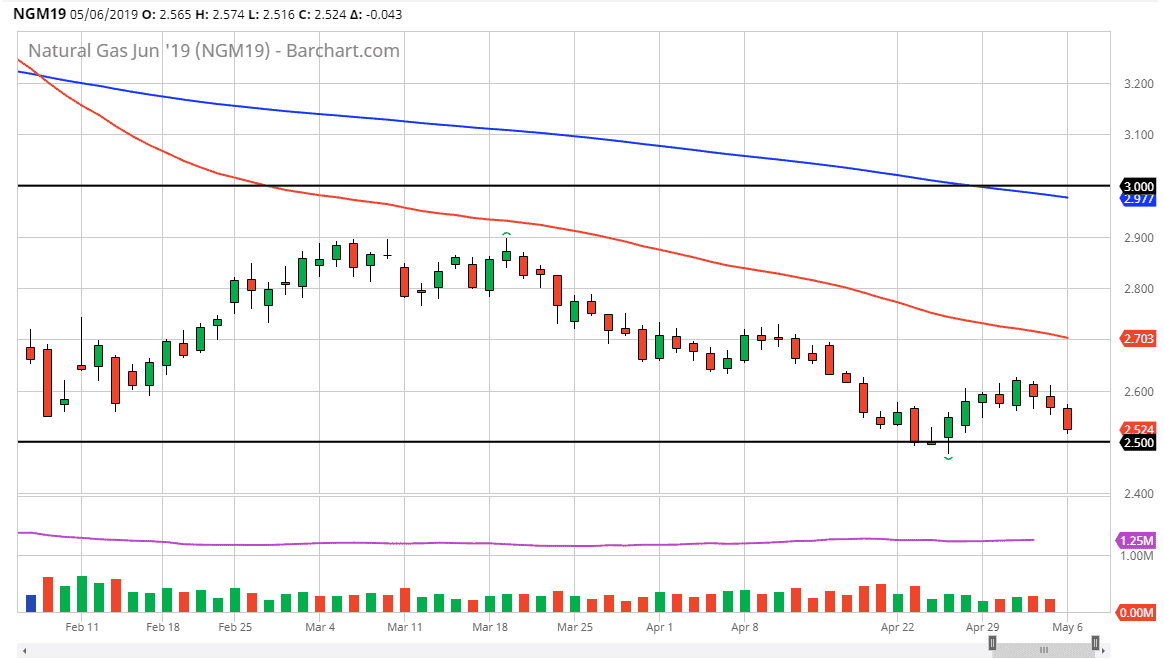

Natural Gas

Natural gas markets fell again during the trading session on Monday, as we continue to see a lot of negative pressure in the natural gas markets. The $2.50 level underneath continues to be massive support, as it is an area where we’ve seen the lot of buying in the past. By breaking that level to the downside, we could reach towards the $2.25 level, as the market tends to move in $0.25 increments.

If we do rally, it’s very likely that we are going to see an exhaustive candle above that we can start selling. The $2.70 level features the 50 day EMA andread which of course should attract a lot of attention as well and as a result it’s likely that I would be a seller at signs of failure.