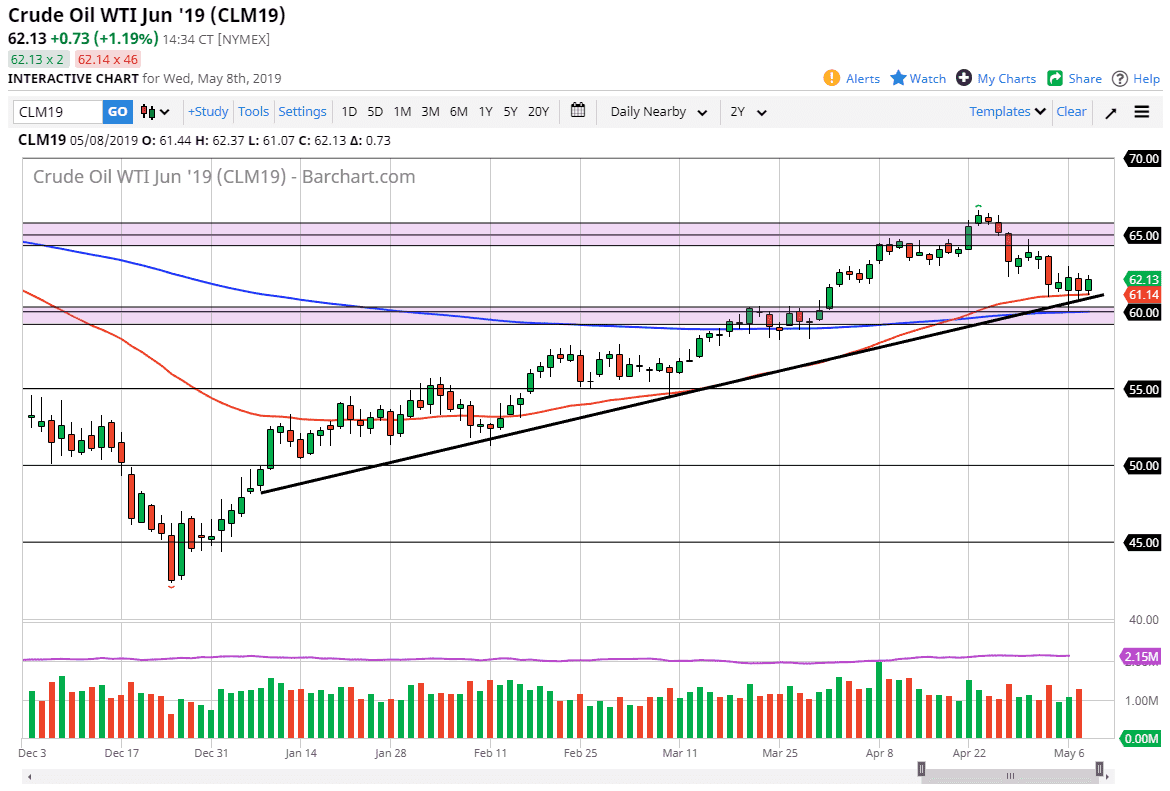

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session on Wednesday, as we got a better than anticipated drawl down of US inventories. Beyond that, we are at a technically important level in the form of the 50 day EMA, and of course the uptrend line that sits just below. The $60 level is massive support, and I think that there are plenty of buyers underneath to pick this market up. However, if we were to break down below the $59 level, the market is very likely to unwind in break down to the $55 level.

All things being equal, it looks as if we are probably going to go looking towards the $65 level, but it is going to take some time to get there. One thing that could help is if the US and China get their acts together and put together some type of deal. This should increase perceived demand of energy.

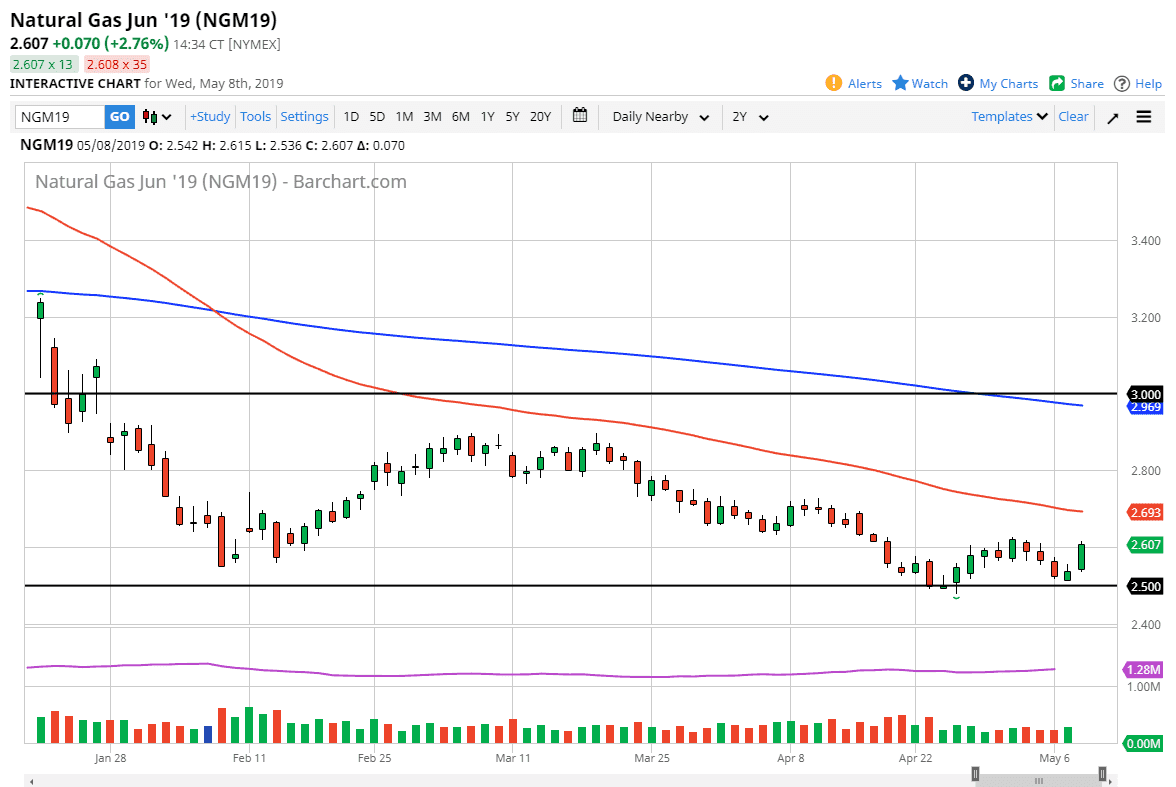

Natural Gas

Natural gas markets rally during the day on Thursday, reaching towards the $2.60 level. That’s an area that could be the beginning of resistance, but we close towards the top of the range so it’s likely that we will see a bit of continuation to the upside. I am not willing to buy natural gas though, because I think there should be an easy selling opportunity relatively soon. I’m looking for signs of exhaustion that I can take advantage of in order to short this market.

The $2.70 level is the next obvious place, just as the $2.75 level would be. The $2.70 level features the 50 day EMA, so that of course is very negative as well. This is the wrong time of year for natural gas to pick up strength or any type of significant move.