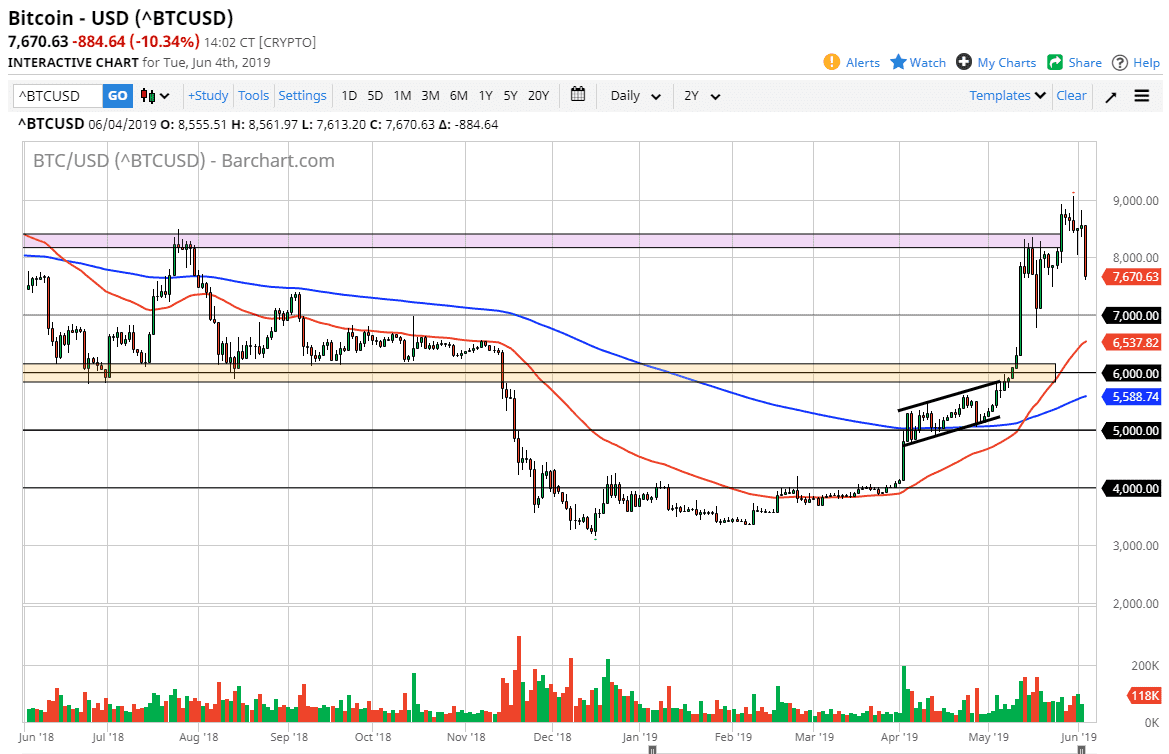

Bitcoin markets took a hammering during the trading session on Tuesday, breaking back below the $8000 level. This isn’t much of a surprise though, because quite frankly we had gotten a bit ahead of ourselves recently. Remember, just two months ago we were down at $4900 and trying to break above the $5000 level. We have almost doubled since then and started to pull back. This is a good sign, I do not like the idea of trying to hang on for some type of massive “moonshot” like some traders had been doing a couple of years ago.

Looking at the chart and the candle stick for the trading session on Tuesday, I think it’s likely that we see a bit more negativity. The fact that it is such a long candle stick tells me that there is a lot of selling pressure during the day, and quite frankly I anticipate that we will go looking for the next support level, which is currently at the $7000 level. I think that there will be plenty of buyers willing to jump in at that point, as it would represent a bit of value after the market had shot so high.

If we were to break down below the $7000 level, the next target would be $6500, which features the 50 day EMA which is pictured in red. Even below there I see a lot of support at the $6000 level as well. Either way, I have no interest in shorting this market and I think that it does offer a significant amount of value. I believe that we will continue to go towards the $10,000 level, which of course will attract a lot of psychological interest. Ultimately, I think it’s going to be difficult for this market not to reach that level.