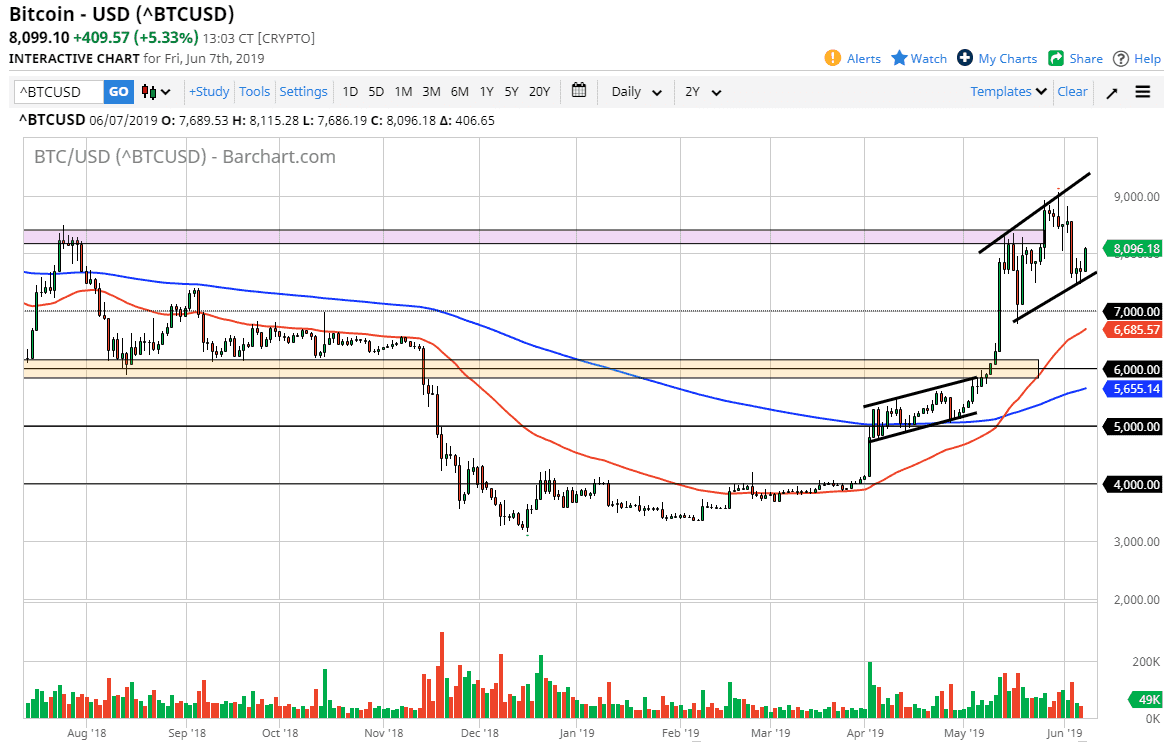

Bitcoin markets rallied during the day on Friday as we have seen the US dollar get hammered. That being the case, it makes sense that the bitcoin market would rallying as it measures the value of the cryptocurrency against the greenback. Beyond that, there’s a nice little uptrend line that we are starting to follow, and therefore it looks like we will continue to grind higher.

The last couple of sessions have been rather stable, so the fact that we broke above the highs of the Wednesday and Thursday candle tells us that the buyers are starting to step in and as we have crossed above the $8000 level. By doing so, that puts the highs back in play, and I think that it’s only a matter of time before we break above there and go looking towards the psychologically significant $10,000 level. At that level, I would expect a lot of resistance as it is such a large, round, psychologically significant figure.

All things being equal, it’s very likely that we will continue to see more of a grind higher as the easy money has already been made. I also recognize that the $7000 level should be massive support and if we were to break down below there we will probably have to test the $6000 level which I have as a “line in the sand” when it comes to this market.

With all of that being said, I suspect that short-term pullbacks continue to offer value that should be taken advantage of. Looking forward, bitcoin is clearly in a bullish tone, so therefore selling is all but impossible. That doesn’t mean we go straight up, but it certainly means that there is one direction you need to be thinking.