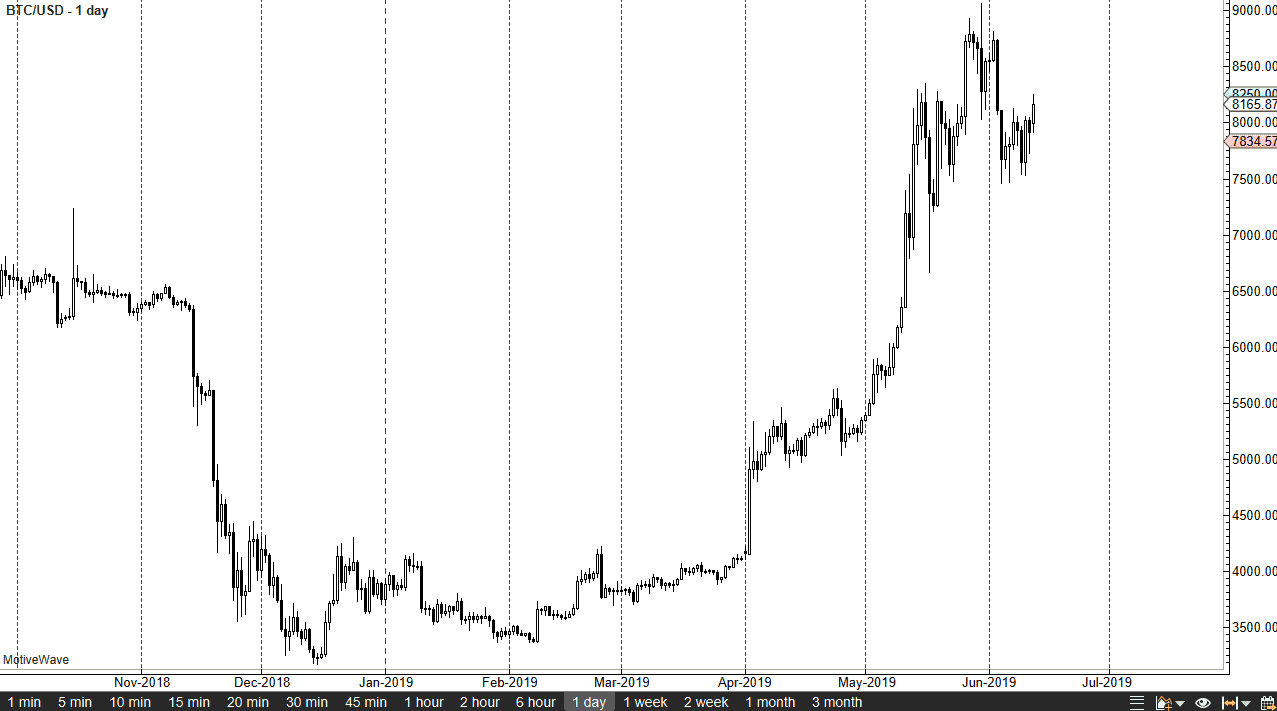

Bitcoin markets continue to grind back and forth, with a slightly positive session on Wednesday. However, I think there are a lot of things going on at the same time that we should be paying attention to. While overall we have looked rather bullish, the reality is that we are starting to head into an area that seems to be somewhat difficult to get past. There are couple of different ways to look at this chart, so I will explore them.

We are most certainly seen a lot of noise near the $9000 level. As we approached this area we start to look at the possibility of a fight to get to the $10,000 handle as well. Obviously, that is a psychologically important figure, so it makes sense that it will take a lot of work to get beyond that. The question now is whether or not we can anytime soon? What you want to see if you are bullish of Bitcoin is that the market sits in this general vicinity and does nothing for a while. We have the 50 day EMA just underneath on the chart, and that could come into play near the $7500 region. If we can simply churn and digest the gains, we have an opportunity to go higher.

However, something that is of concern is that perhaps we could end up forming a bit of a head and shoulders. Granted, this is me trying to anticipate that so while we can’t make the play yet, we are starting to form one and we did get a little bit ahead of ourselves. The good news is that if we did break down below the $7000 level, which I assume would start to kick that off, we are looking at worst a $2000 drought, and it wouldn’t necessarily be the end of a rally.

All things being equal though, until we break out of this $2500 range that I have marked on the chart, I assume that short-term pullbacks continue to be buying opportunities. With that I remain bullish, at least in the short term but I want to see this market do very little in the way of up or down movement and embrace the ability for a while.