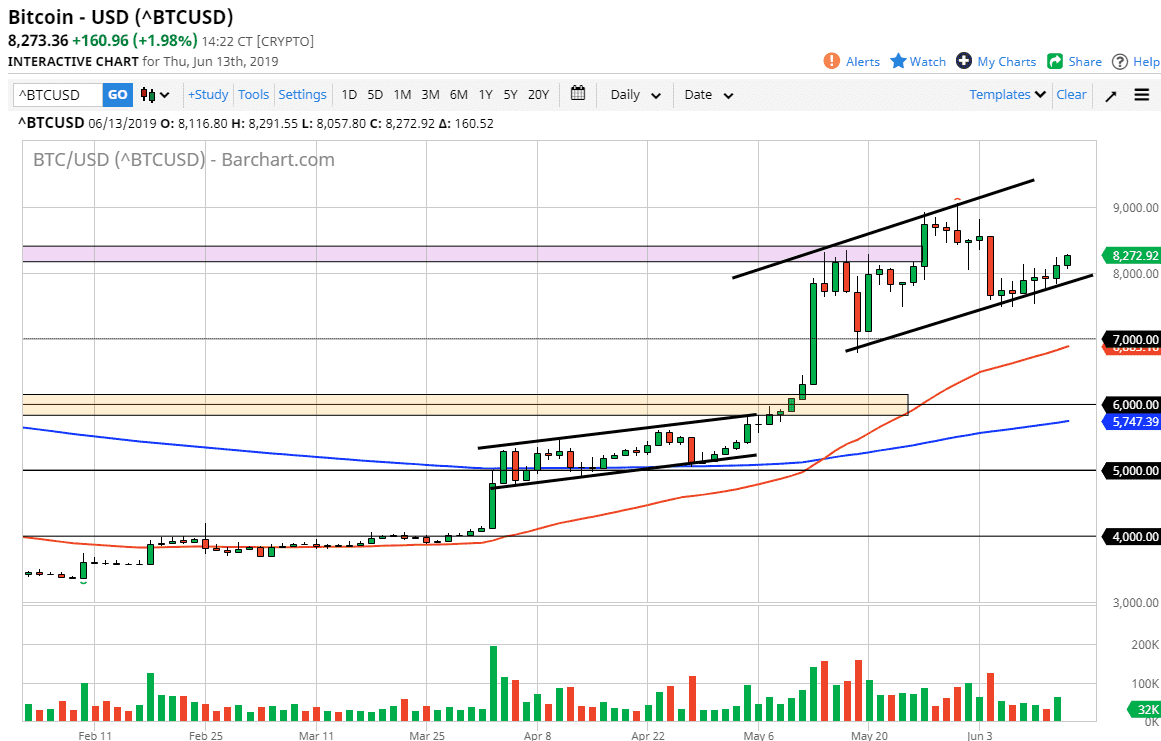

The bitcoin markets rallied a bit during the trading session on Thursday as we continue to grind higher. When you look at the chart it’s very easy to see that there is a bit of a channel going on and we are testing the bottom of it. The market has been true to form, showing signs of support every time we dip a bit. Now that we are clearly above the $8000 level I think we are going to grind higher intake out that major red candle from a couple of weeks ago.

Looking at the chart, it’s been a slow and gradual move higher. That’s a good sign though, because it shows a massive amount of tenacity in a market that had gotten so hammered as we sliced through the $8000 level. Ultimately, this is a market that has been bullish for some time, and now that we are grinding slowly it shows that we are starting to see some confidence in a market that had gotten way ahead of itself. That’s a good sign, especially considering that bitcoin has been prone to mass of selloffs in the past.

With this, I think that we continue to go higher and it’s very likely that we are going to go towards the $9000 level. If we did break down below the last couple of candlesticks, and perhaps even the $7500 level, then we could go down to the $7000 level. At that point, the 50 day EMA would probably offer a significant amount of support based upon typical technical analysis. If we can break above the $9000 level, it’s very likely that we could go towards the vital $10,000 level which will of course attract a lot of attention. At that point, it’s likely that we will see a serious fight.