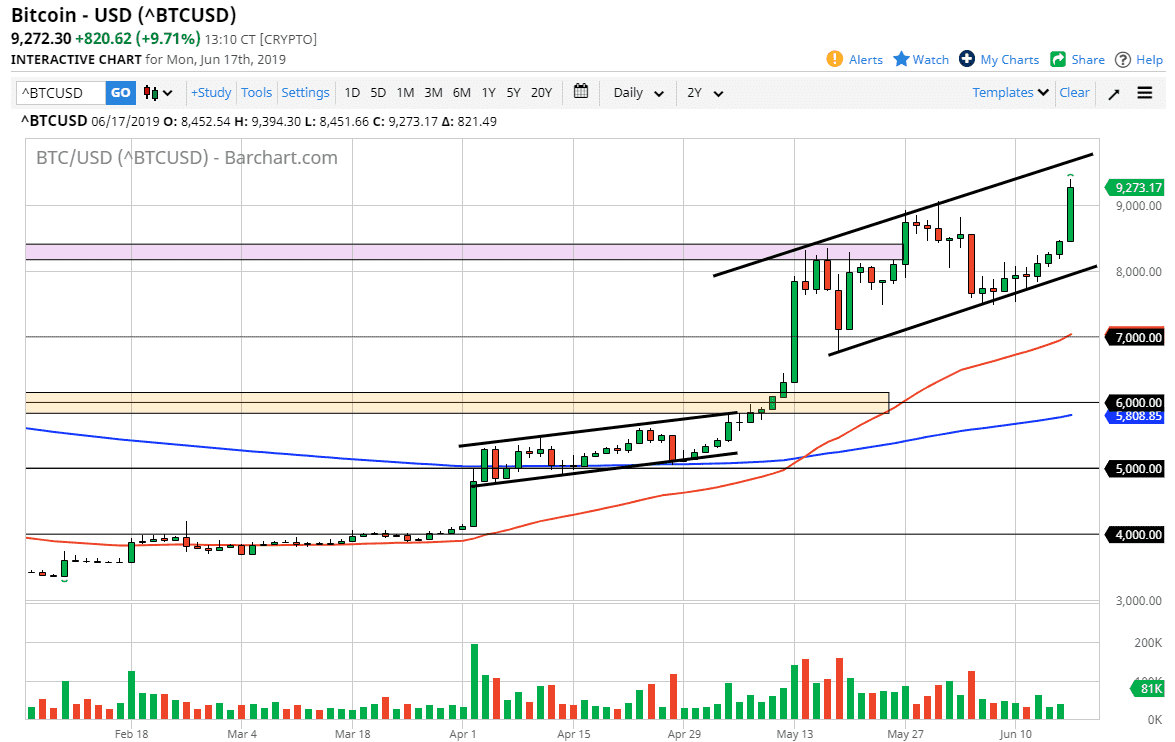

Bitcoin rallied significantly during the trading session on Monday, not only breaking above the $9000 level but also breaking higher by 10%. At this point, it’s obvious that the buyers are still very much in control this market, and as you can see we have an upward channel drawn on the chart. Ultimately, the market has been very strong, and the Monday session only confirms this.

Central banks are continuing to look very easy, and with the FOMC Statement coming out on Wednesday, traders will parse as to what the underlying meaning is going to be. If there are signs of further dovish behavior coming out of the Federal Reserve, it’s very likely that the US dollar will fall, which will help push this pair higher.

That being said, we are a bit overextended so it’s very likely that we get some type of pullback. That pullback should be an opportunity to pick up Bitcoin “on the cheap”, as it is obviously very bullish. At this point in time it looks as if the $8000 level will be supportive, not only because it is a large, round, psychologically significant figure, but it is also where the uptrend line of the channel crosses. At this point, I think that it is only a matter of time before value hunters come back to push this market to the upside. Just above current trading, I would anticipate that the $10,000 level will be targeted and create a lot of resistance as it is such a large, round, psychologically significant figure.

All things being equal, even if we were to break down below the $8000 level, it’s very likely that the 50 day EMA would also come into play as it would be supportive by its very technical nature. At this point, value is what we should be looking at.