Bitcoin markets went back and forth during the trading session on Tuesday, as we reached towards the $9200 level. We gave back some of the gains though, but at this point it’s very obvious that the market is bullish but calming down as we head into the Wednesday session. If you think about though, that makes perfect sense as the Federal Reserve is going to have a major statement coming out for the Wednesday session. Unfortunately, most crypto traders don’t understand that they are going anything other than trading one currency against another. In one sense, it’s basically the same thing as Forex trading.

That being said, it’s very crucial as to what the Federal Reserve says and what they are going to do in relation to interest rates or quantitative easing. If they are extraordinarily dovish, it’s very likely that the US dollar will fall significantly, and that should drive the value of crypto higher as the ECB has already stated that they are going to loosen monetary policy in the near term, or at least have opened the door to doing so. That makes money go to where it may be treated a bit better, and at this point cryptocurrency makes sense.

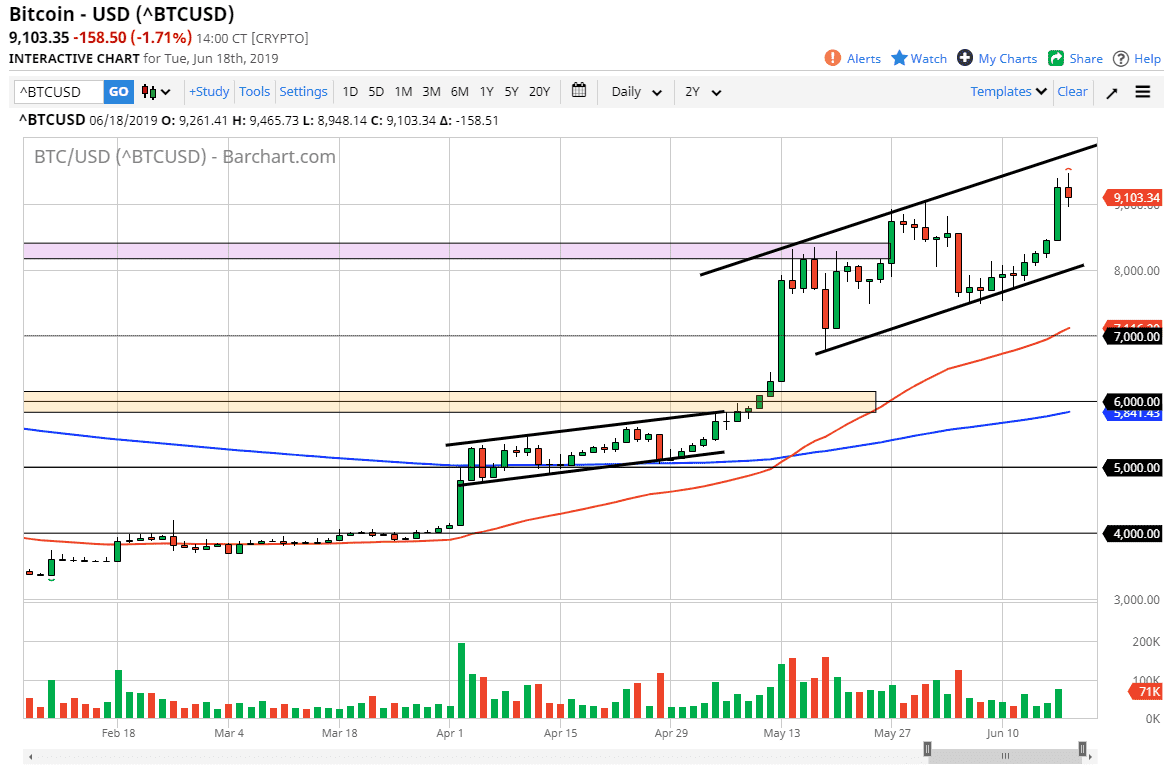

That being said, looking at this chart it’s obvious that we are towards the top of the overall trading channel, so I think that what we are looking at is the likelihood of a pullback. So far the $9000 level has offered a bit of support, and at this point I think it’s only a matter time before we probably break down to look for even more support underneath. To the upside, I still believe that we are going to reach towards the $10,000 level but I believe that you may have an opportunity to pick up Bitcoin at lower levels.