Looking at the Bitcoin chart, it’s easy to suggest that not much happened during the trading session on Wednesday. And while that would be correct in a sense, the reality is that there was a lot going on around the world influencing currencies, which of course will also influence the cryptocurrency markets. Remember, when you are trading Bitcoin, you are actually trading Bitcoin against the US dollar or some other typical fiat centrally processed currency. The chart you are looking at in this article is the BTC/USD pair.

This means that it functions just like a Forex pair, so this could just as easily be the GBP/USD pair, measuring the value of the British pound. Because of this, the fact that the Federal Reserve released a statement during the day on Wednesday does in fact have an effect on the crypto markets. The reason it does is because it has such a huge effect on the US dollar. It now appears that the Federal Reserve is willing to cut rates going forward, and typically that is negative for the greenback. If that’s going to be the case, then it makes sense that the BTC/USD pair should rally over the longer-term. In fact, I think that’s been part of what has driven this market higher, a simple reaction to the idea of a softening greenback over time.

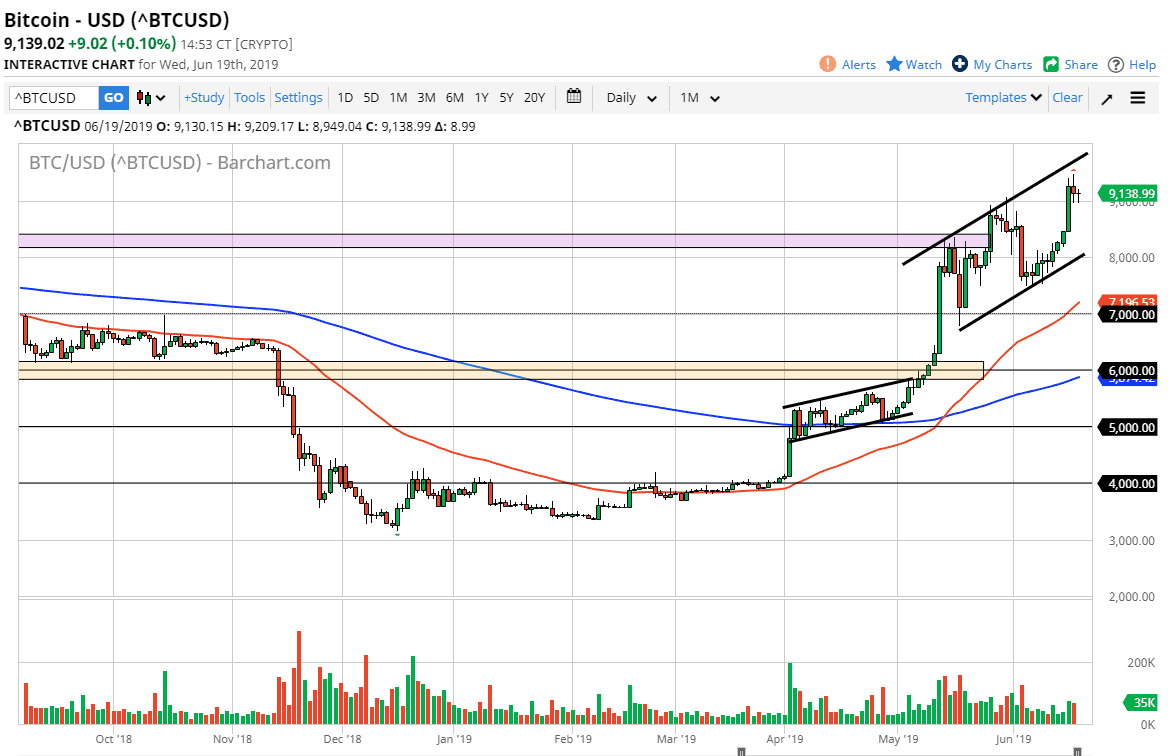

The fact that the $9000 level has offered support shouldn’t be a huge surprise, because it has been resistance in the past and of course it is a large, round, psychologically significant figure. Although I think we could break down below there, we also have a nice uptrend channel that we have been in. I think nothing is changed, so simply looking for pullbacks to buy Bitcoin will continue to be the way going forward. Although $9000 is support, I think there’s even more to be found at the $8000 level.