Bitcoin rallied just a bit during the trading session on Thursday, as we continue to see a bit of a “risk on” move, as the US dollar has gotten hammered after the dovish Federal Reserve. With that in mind, it makes sense that Bitcoin gains against it. That being said, I believe there is plenty of support below that will be looking at getting involved in what is an obvious uptrend.

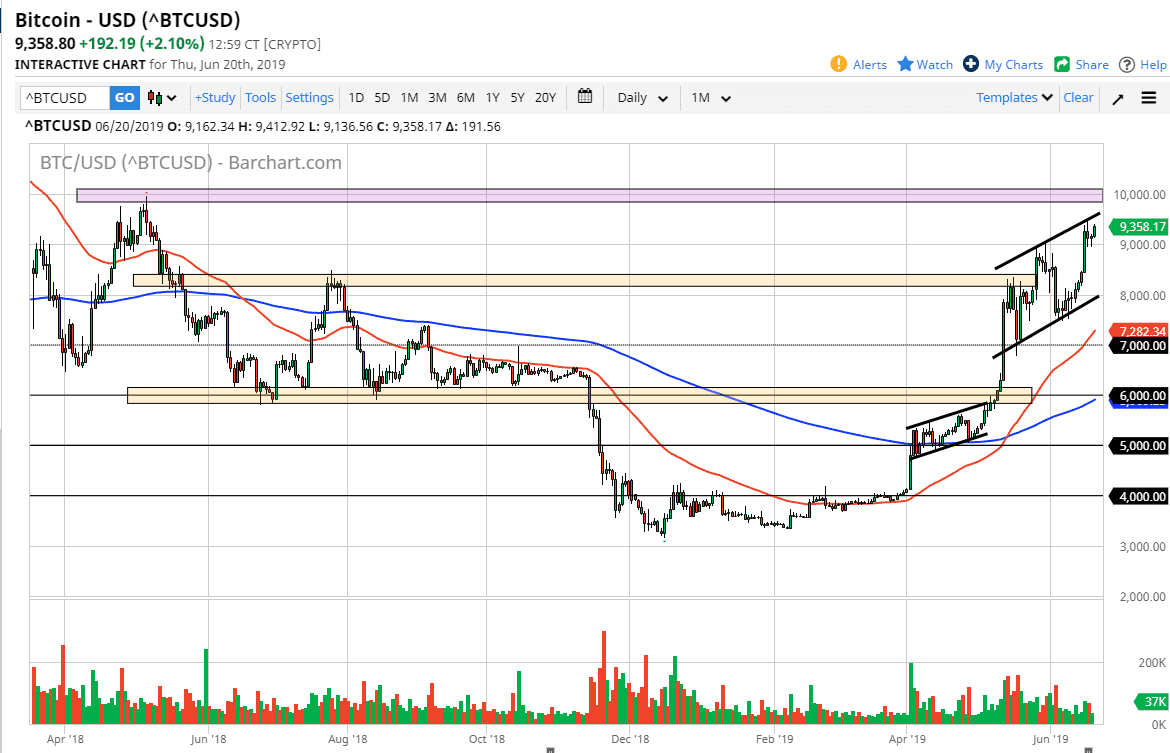

The market has been in a bit of an up trending channel that I have marked on the chart as well, and I think that the market has become an obvious long at this point, but we are getting closer to the $10,000 level, which of course will cause quite a bit of psychological resistance and of course interest by traders around the world. After all, it wasn’t that long ago that Bitcoin was essentially dead.

Looking at this chart, I think that we could go to the $9000 level underneath where buyers have shown a in the last couple of days, but beyond that we could go down to the $8500 level, possibly even the $8000 level under that which is even more support. The 50 day EMA is just below there and moving north, so I think it’s only a matter time before value hunters would get involved. I have no interest in shorting this market right now, because I think that the US dollar is going to be a short against most fiat currencies let alone crypto.

I think that it will take several attempts to get above the $10,000 level, as it would be a significant turn of events and a major newsworthy event as well. Overall, I think that this is a market that has gotten a bit ahead of itself though, so I’m looking for a bit of weakness that I can take advantage of.