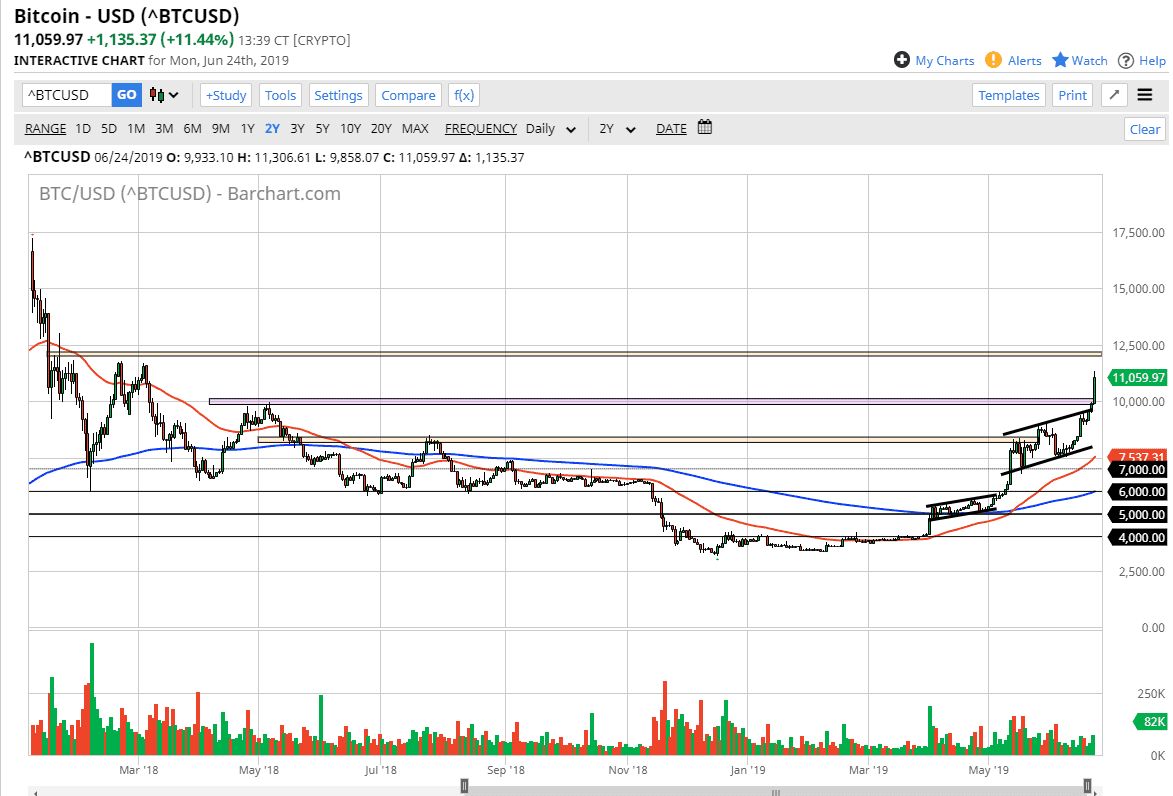

Bitcoin rose yet again during the trading session on Monday, as we are well above the $10,000 level now. That being the case, it looks as if the buyers have taken over yet again and we are going higher. I suspect that the next target is probably $12,000 but I also like the idea of buying pullbacks, just as I have all along. While I know some of you may not believe this, the way Bitcoin acts sometimes isn’t sustainable. If you are trading a couple of years ago, you certainly know that to be true, perhaps even painfully so.

To the downside, I suspect that the $10,000 level is now going to be support as it was previous resistance. Beyond that, it’s also the scene of a resistance line that kept this market somewhat lower. We were in a channel, and now we are broken out of it. Because of this, I think there is plenty of buying opportunities underneath, so simply wait for value to present itself in Bitcoin. After all, I’ve been telling you this all along and eventually you do get the ability to buy at lower levels. I don’t think anything’s changed here, and that’s how you should be trading in an uptrend anyway, simply identifying when it gets a bit on the cheap side, and then taking advantage of it.

Beyond the $10,000 level, we also have significant support near the $8000 level as well. That being said, I don’t think we get that low but even if we do, I’m going to be looking for a bounce to suggest buying again. As you all know, I’m not a “bitcoin believer”, and I think we will crash again like we did just a couple of years ago. However, one thing that I learned a long time ago is that you don’t fight the tape. Right now, the tape tells us that Bitcoin isn’t going to crash anytime soon, and it is in fact going much higher.