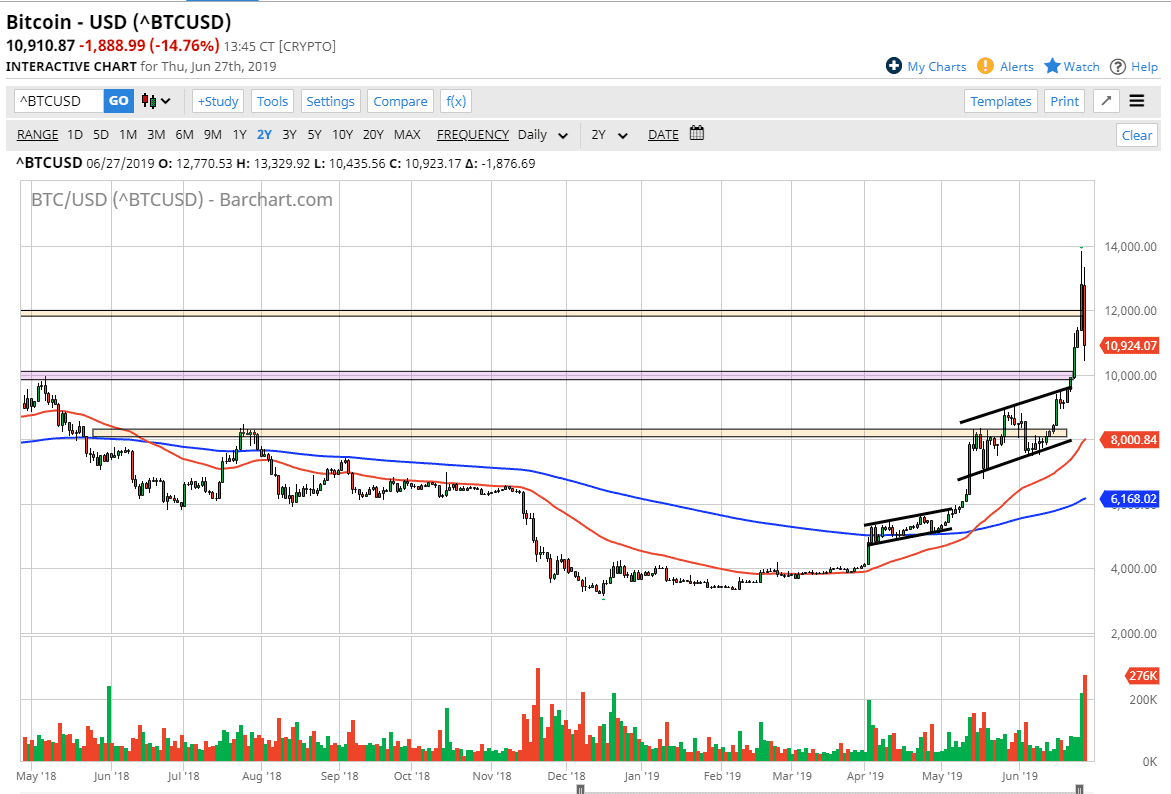

If you been watching my videos here at Daily Forex, you know I’ve been talking about how this market has gone far too parabolic, and that it would be relatively soon that we would see a loss of more than 10% in a single day. During the day on Thursday, we were as low as 20% down, but have recovered slightly since then. I think this is a good lesson though, as unfortunately there were some people out there willing to buy at $13,000 or even closer to $14,000.

One thing that you should pay attention to is that the volume was much higher on Thursday that it was on Wednesday, as we have made a low or high during the day, and most certainly a lower low. It is because of this that I believe Bitcoin will pull back a bit here, perhaps down to the $10,000 level. Essentially, that’s the only thing you can do is wait for some type of value as the market has gotten far ahead of you.

What we need is either a pullback of some significance, or we need to see some type of consolidation, perhaps a sideways market for a while to build up confidence in the market, and then go higher. It’s really the only two things that can happen after parabolic move, we will either sell off drastically, or we will tread water and build up the necessary inertia.

Notice how I have not mentioned selling Bitcoin at this point. Yes, I truly believe that we are going lower but that doesn’t mean that you should be a seller. Trading countertrend is a great way to lose money, so I tend to avoid it at all costs. Looking for value makes much more sense, so if you just simply wait for a few days you should get a supportive candle at lower levels that you can take advantage of.