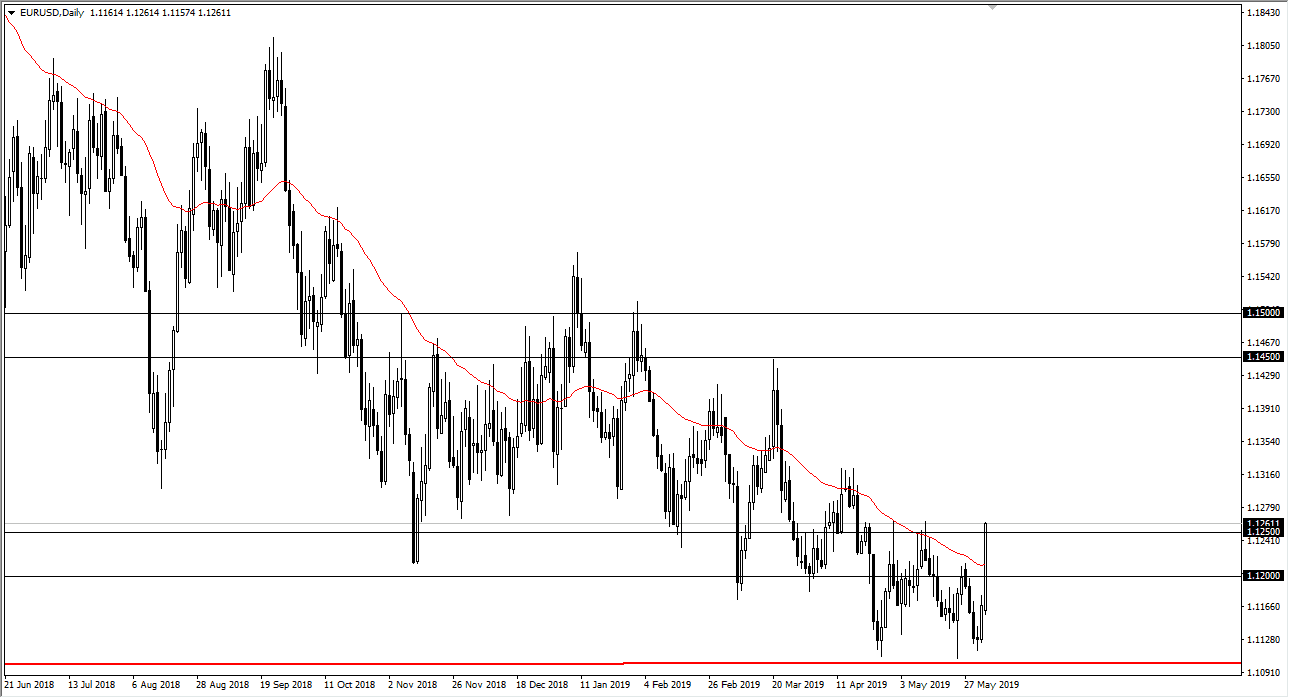

EUR/USD

The Euro rallied significantly during the trading session on Monday, reaching towards the 1.1250 level. That is the top of a major resistance barrier that started at the 1.12 level underneath. At this point, it’s likely that we could see a bit of exhaustion set in, but if we were to break above the 1.1275 handle, it’s likely that we could continue to go much higher. At that point, if we can break higher, then we could go to the 1.14 level above. To the downside, we could very easily returned to the 1.12 handle. That being said, this has been an inn very impulsive candle stick, and that of course is a very bullish sign. The question now is whether or not that bullish pressure can send this market much higher. You have several levels to pay attention to guide you now.

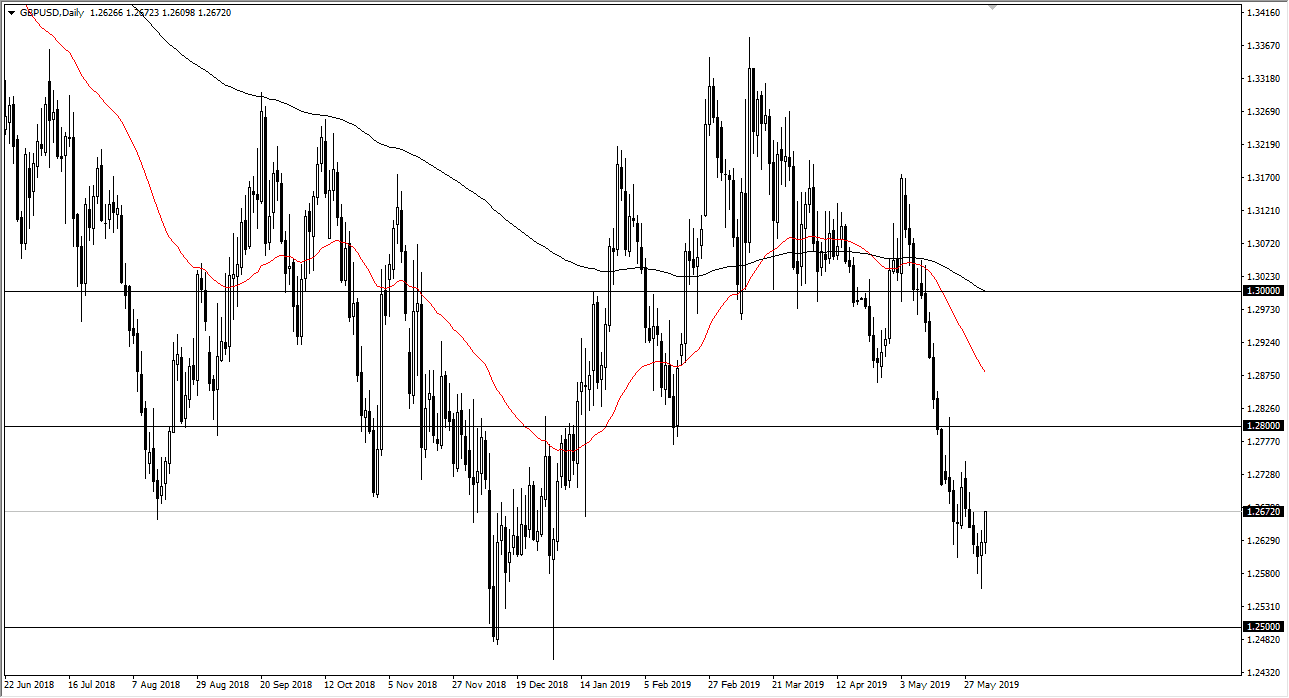

GBP/USD

The British pound rallied during the day to recover some of the losses that we have seen as of late, which is rather impressive considering how negative this market has been. We have seen a decided move against the US dollar, and that has helped this market. However, the 1.27 level above is going to be resistance, and most certainly the 1.28 level will be. With that in mind I like the idea of fading rallies at the first signs of trouble. I think that the market is still going to go down to the 1.25 level eventually, mainly because it is a large, round, psychologically significant figure that will attract a lot of attention. It has been structurally supportive in the past as well so that of course helps. With so many issues involving the Brexit, it makes quite a bit of sense that selling rallies works.