Since the beginning of this week's trading, the EUR/USD pair is continuing making gains, reaching towards the 1.1411 resistance level at the time of writing, the highest level in three months. Taking advantage of mounting pressure on the US dollar, this pair is expecting important data today with comments by Federal Reserve Governor Jerome Powell, as markets are looking for more confirmation about the most appropriate date for US interest rate cuts. The improvement Eurozone Industrial and Services sectors PMIs at the end of last week's trading contributed to reducing pressure on the euro. Markets are watching for an important summit between US President Trump and the Chinese president this week to determine the course of their trade war. The continuation of that war means that the Eurozone economy is slowing down and the Euro may lose its recent gains and more.

Both the European Central Bank and the Federal Reserve have confirmed readiness to cut interest rates to cope with the economic slowdown. The recent US economic data confirm the US economic slowdown and therefore market expectations are that the US interest rate could be reduced as soon as possible.

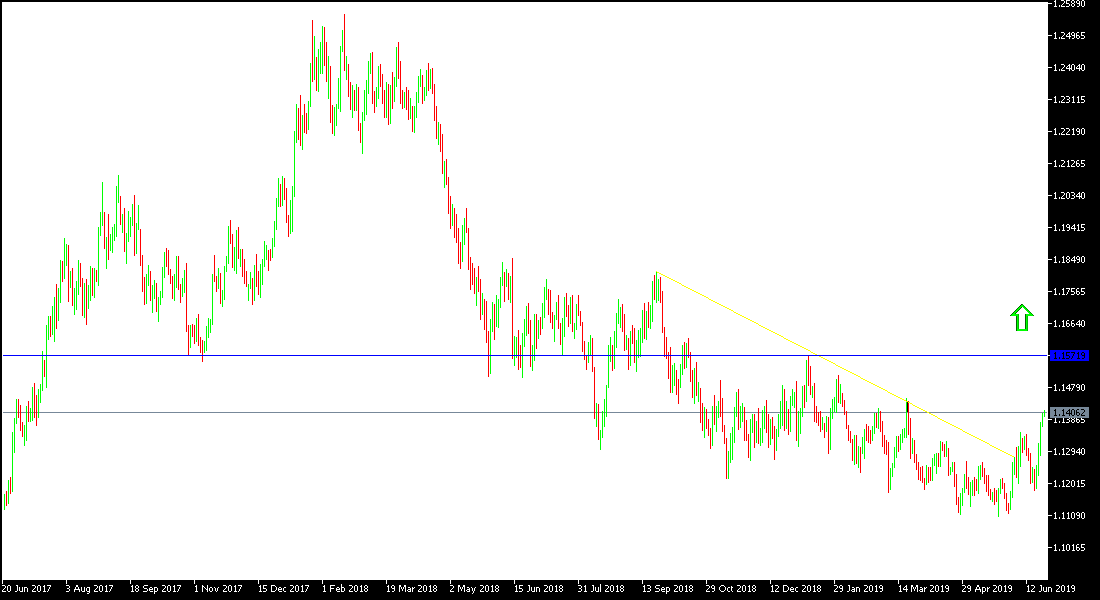

The Philadelphia manufacturing index pointed to the recession, and the German ZEW Economic Sentiment Index fell to its lowest level in seven months, underscoring pessimism over the performance of the Eurozone's biggest economy. On the daily chart below it is clear that the pair lacks the strength and sufficient momentum for the upward correction. The European Central Bank (ECB) is in a cautious position, keeping the interest rate unchanged as expected and ruling out a chance to raise interest rates later this year.

Continuing trade war between the United States and China will continue to be a significant pressure factor on the performance of the Eurozone economy. The growth of the US economy remains strong, boosting US consumer confidence to its highest level in 18 years. Pressure on the Euro rose after a pessimistic view of the outcome of the European Union (EU) elections, where anti-EU parties won more seats than expected.

The bearish stability supports investors' question of the most appropriate timing for buying: this will depend on the return of confidence in the Euro and optimism about the imminent resolution of the US-China trade dispute, which increases the pressure on the Eurozone economy, which depends on manufacturing and exports. Technical indicators are still confirming oversold areas and the pair is ready for an upward correction.

As we mentioned earlier, we now emphasize that the divergence of the economic situation and the monetary policy between the US and the Eurozone will remain a strong influence on any chances for an upward correction of this pair.

Technically: We had expected and recommended in the previous analysis for a long time to sell the pair from every ascending level. Turning to the EUR / USD bullish trend needs a move towards the resistance levels 1.1355, 1.1440 and 1.1515 to confirm the upward correction strength. On the bearish side, the nearest support levels are currently 1.1330, 1.1240 and 1.1180 respectively, which confirm the strength of the bearish trend again.

On the economic data front, the pair will be watching the release of US data, consumer confidence, new home sales, and comments by Federal Reserve Governor Jerome Powell.