The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 2nd June 2019

In my previous piece last week, I forecasted that the best trade would be short USD/JPY. This currency pair fell by 0.91% over the week, producing a profit of 0.91%

Last week’s Forex market again saw the strongest rise in the relative value of the Japanese Yen, and the strongest fall in the relative value of the British Pound.

Last week’s market stayed in “risk off” mode as the U.S. and China continue to fail to resolve their trade dispute. The situation has worsened with President Trump imposing new tariffs on Mexico and the U.S. stock market selling off to close below its 200-day moving average.

The Forex market has had another relatively quiet week, but markets are in a risk-off mode. Safe havens such as the Swiss Franc, Gold, and the Japanese Yen are strong, while the British Pound, stocks, and crude oil are all very weak.

This week has a busier news agenda than last week, with central bank input due for the Euro and for the Australian Dollar, as well as U.S. non-farm payrolls. However, the week in the Forex market will quite likely be dominated by news about the progress of the trade dispute between the U.S.A. and China, as well as between the U.S.A. and Mexico.

Fundamental Analysis & Market Sentiment

Fundamental analysis has turned more bearish on the U.S. Dollar following the Federal Reserve’s more dovish approach to monetary policy and growth and weaker than expected inflation data. However, the economy is still growing relatively strongly although the stock market has been hit by the trade war with China and now a new dispute with Mexico.

Market sentiment remains firmly risk-off and this seems likely to continue this week, with the safe-haven assets (such as the Japanese Yen and the Swiss Franc, as well as Gold) bid while the weaker currencies seem to the British Pound and other riskier assets. Prices are moving firmly against the U.S. Dollar also.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows that last week the USD Index fell after making a new 2-year high, a relatively small but certainly bearish candlestick which closed right by its low. The price is clearly up over 3 months and 6 months, indicating a bullish trend. However, the short-term momentum is negative on the greenback, so it still seems dangerous to be bullish on the USD right away, until there is a technical bullish turn.

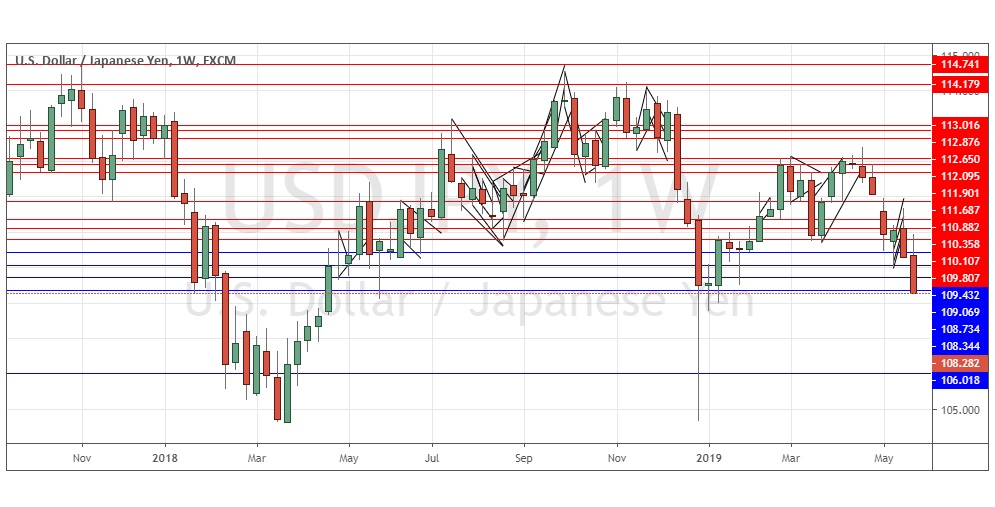

USD/JPY

The weekly chart below shows last week saw this pair print a strong bearish candlestick, closing right on its low and being of a relatively large size – these are bearish signs. The price is in a bouncy but valid long-term downwards trend, below its levels from both three months ago and six months ago and falling with momentum. This pair is always liable to find support or resistance to halt such a move, but the odds favor lower prices over the course of the coming week, especially early in the week, after such a strong fall on Friday. The fact that global stock markets and especially the U.S. stock market look vulnerable is another sign that the JPY is most likely to strengthen again over the coming week.

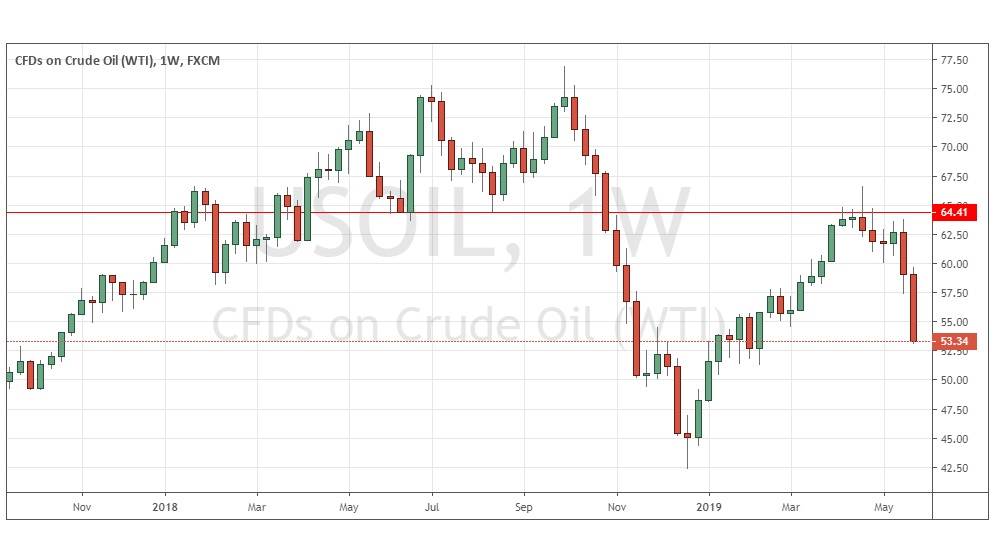

WTI Crude Oil

The weekly chart below shows last week saw this pair print a strong bearish candlestick, closing right on its low and being of a very large size – these are bearish signs. The price is in a bouncy but valid long-term downwards trend, below its levels from three months ago (but not six months ago) and falling with strong momentum. The odds favor lower prices over the course of the coming week, especially early in the week, after such a strong fall on Friday. The fact that global stock markets and especially the U.S. stock market look vulnerable is another sign that a risky asset such as WTI Crude Oil is most likely to weaken again over the coming week.

Conclusion

This week I forecast the best trades will be short USD/JPY and WTI Crude Oil.