The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 23rd June 2019

In my previous piece last week, I forecasted that the best trade would be short NZD/USD. Unfortunately, the price rose strongly over the past week, giving a loss of 1.49%.

Last week’s Forex market again saw the strongest rise in the relative value of the Swiss Franc, and the strongest fall in the relative value of the U.S. Dollar.

Last week’s market was dominated by a more dovish message from the FOMC on the pace of rate cuts. This has weakened the U.S. Dollar and while this has boosted the stock market and Crude Oil, it has also boosted safe havens such as Gold, the Swiss Franc, and the Japanese Yen.

The Forex market was more active last week, with the best performing currencies relatively being the safe havens of the Japanese Yen and the Swiss Franc.

This week has a slower news agenda than last week, with central bank input due for the New Zealand Dollar, plus GDP data for the U.S. and Canadian Dollars

Fundamental Analysis & Market Sentiment

Fundamental analysis has turned more bearish on the U.S. Dollar following the Federal Reserve’s more dovish approach to monetary policy and growth and weaker than expected inflation data. However, the economy is still growing quite strongly, and the stock market continues to make new all-time high prices.

Market sentiment is a little mixed, as although the safe-haven assets (such as the Swiss Franc, Japanese Yen and Gold) are bid, so are stocks and Crude Oil. The long-term bullish trend in the U.S. Dollar seems to be preparing to reverse.

Technical Analysis

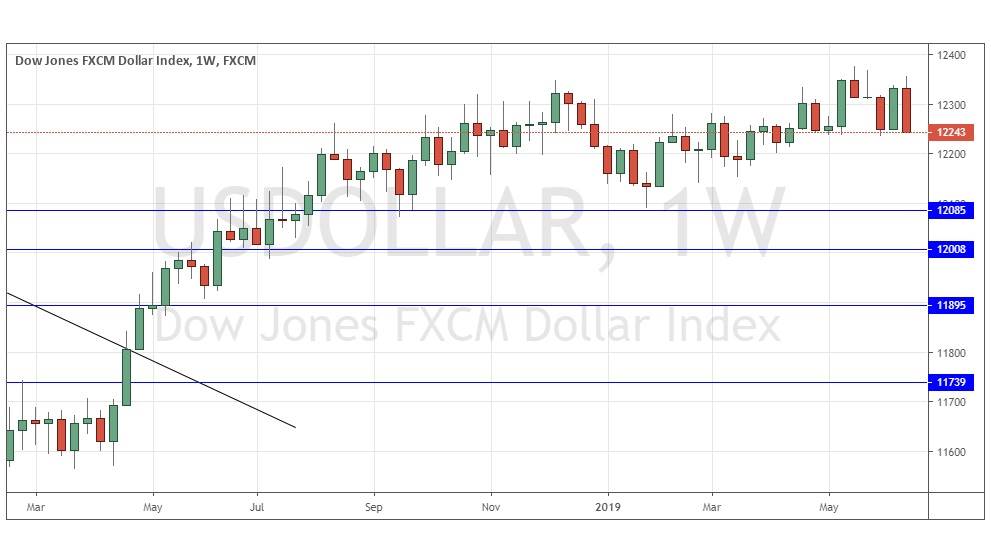

U.S. Dollar Index

The weekly price chart below shows that last week the USD Index fell quite strongly, printing a relatively large and strongly bearish candlestick which closed right on its low. The price is barely up over 3 months but down over 6 months, indicating the early stage of a new bearish trend may be underway, following a long period of consolidation by the Dollar.

XAU/USD (Gold)

The weekly chart below shows last week saw this pair print an extremely large and very strong bullish candlestick, closing quite near its high – these are bullish signs. Even more bullish is the fact that the price just made a new 5-year high, and the weekly move up was the strongest weekly movement in price that we have seen in Gold for a long time. All factors are extremely bullish, the only thing the bulls should be watching out for is the round number at $1,400 just ahead of the current price, despite the price moving upwards through “blue sky”.

USD/JPY

The weekly chart below shows last week saw this pair print a strong bearish candlestick, closing right on its low after falling quite solidly over the past month – these are bearish signs. Although the weekly close was the lowest for a long time, the price was in this area in December, suggesting that the bearish trend might be prone to deep retracements. The Yen is also not the fastest-rising currency, but the long-term trend does look relatively healthy. If the U.S. Dollar continues to be sold off, the Japanese Yen is likely to continue to benefit.

USD/CHF

The weekly chart below shows last week saw this pair print a very large and strongly bearish candlestick, closing right on its low after falling rapidly over the past month – these are bearish signs. Although the bearish momentum is very strong, and the Swiss Franc is the fastest-rising major currency, the long-term trend does look technically questionable. Bears should be wary of two facts: the USD/CHF currency pair rarely trends, and we have a strong, long-term inflection point below near the big round number at 0.9500 which might halt further decline, at least temporarily.

Conclusion

This week I forecast the best trades will be long Gold/USD and short USD/CHF and short USD/JPY.