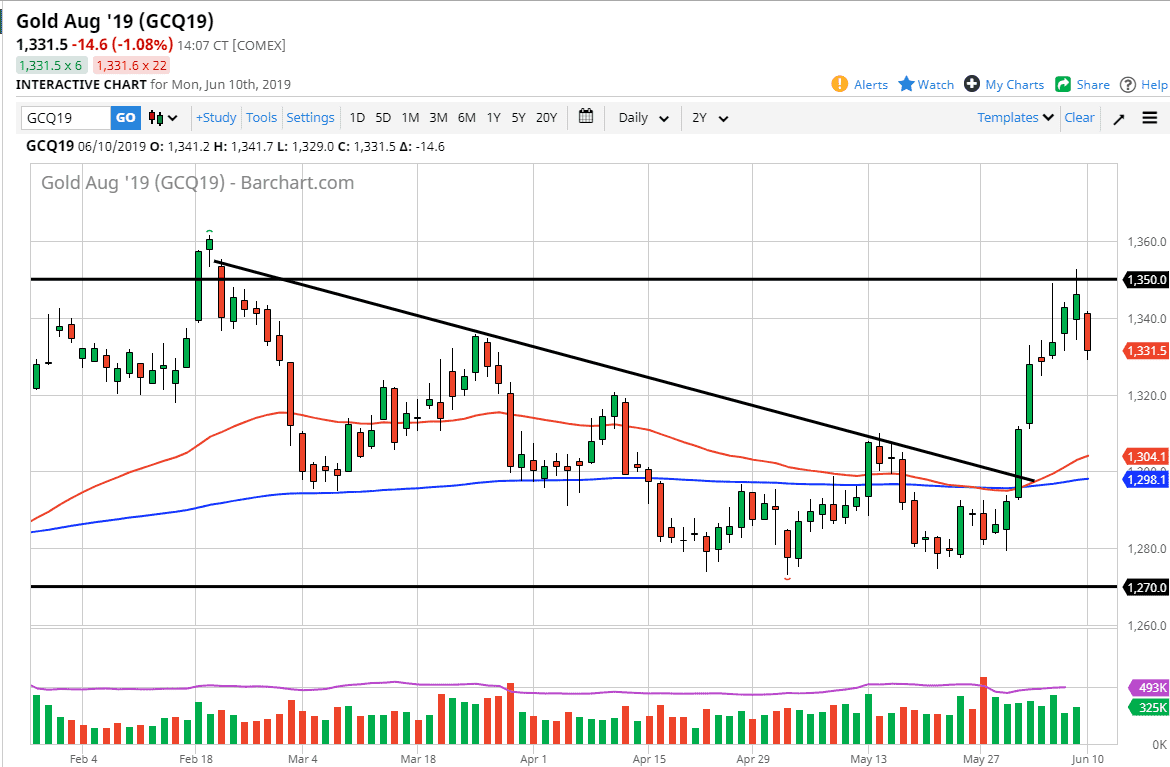

Gold markets broke down immediately at the open on Monday, gapping lower in a sign of perhaps markets calming down a bit after the United States and Mexico seem to be coming together as tariffs have been averted. The size of the candle is also a very negative sign and therefore it looks like we are ready to continue to go much lower.

The $1350 level above offers an extreme amount of resistance, which has recently been resistance not only in the last couple of days, but also a few months ago. The question now is whether or not we are going to break down from here significantly, or if we are hanging about in a larger range from that level down to the $1270 level.

The Federal Reserve easing its monetary policy of course gives a bit of a boost for gold, but the fact that gold has sold off is a bit interesting as the monetary policy has shifted. The question now is whether or not it is a bit of a sign that we are becoming more comfortable, perhaps as the stock markets rally. However, there is a lot of volatility to say the least and I think the easiest way to deal with this market is to understand that we are simply overbought. The next question is whether or not we break down below the candle stick for the session, because if we do then I think we drop down to the $1320 level. It is at that level that we will probably have to ask questions again. If we break down below $1320, then we almost certainly will go down to the 50 day EMA underneath. If we do rally from here without pulling back significantly, I will probably look to fade this market the closer we get to the $1350 level. Alternately, if we did manage to break above the highs on Friday, then perhaps we go even further but it is overbought to say the least.