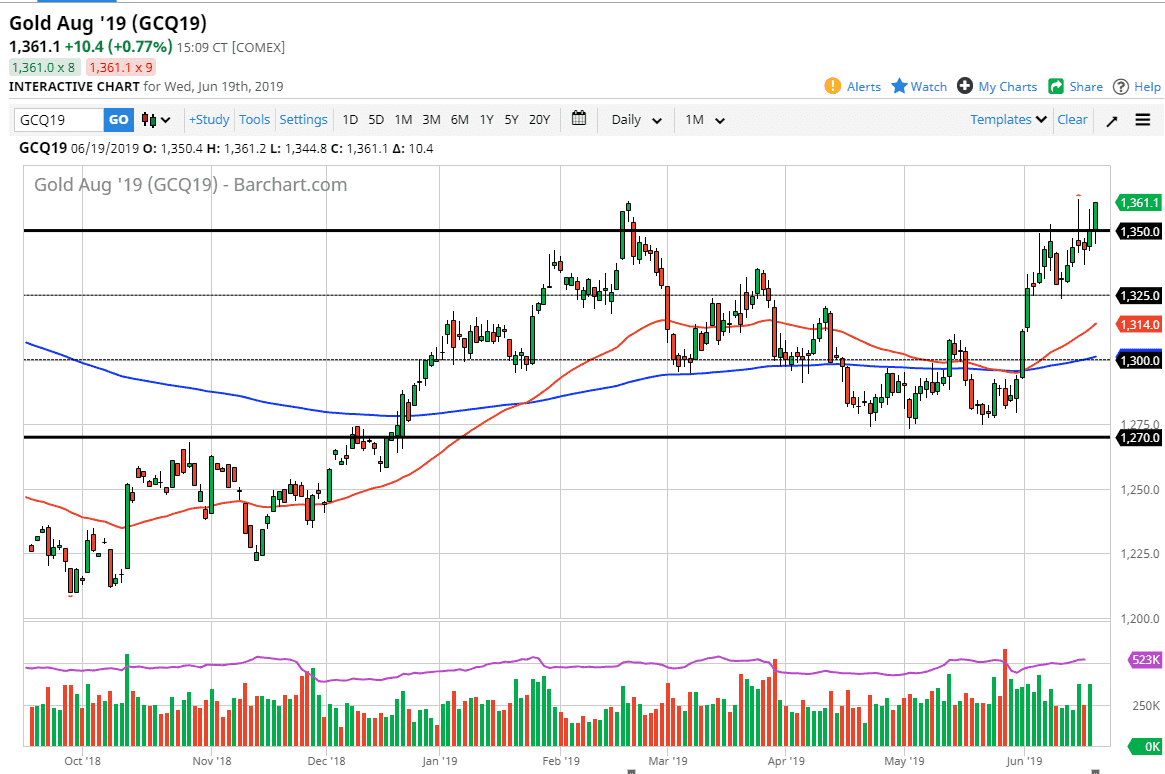

Gold markets rallied significantly after initially trying to pull back during the trading session on Wednesday. After the Federal Reserve Statement came out, market participants continued to start buying this market. Now that we are clearly above the $1350 level, and now breaking above the couple of shooting stars, this is an extraordinarily bullish sign. I think at this point it’s very likely that short-term pullbacks should continue to offer a nice buying opportunities. As long as we can stay above the candle stick for the trading session on Wednesday, I fully anticipate that gold markets will continue to go higher. If that’s going to be the case, then it’s likely that market participants will continue to flood toward this commodity every time there are the slightest signs of weakness.

Now that central banks around the world continue to look soft, it makes sense that precious metals in general will continue to rally. At this point, I have no interest in selling this market at all, as there is so much in the way of noise underneath that it’s very likely that there should be plenty of buyers. The last couple of days have been leading towards the upside, and now it looks likely that we have a larger move to be had over the longer-term. This doesn’t mean that there won’t be the occasional selloff, but clearly something has changed over the last couple of days as both the European Central Bank and the Federal Reserve have suggested that they are on a path to easing, it makes sense that precious metals in general should continue to go higher. There is no real reason to think that this market breaks down, and it’s likely that the $1400 level is the likely target.