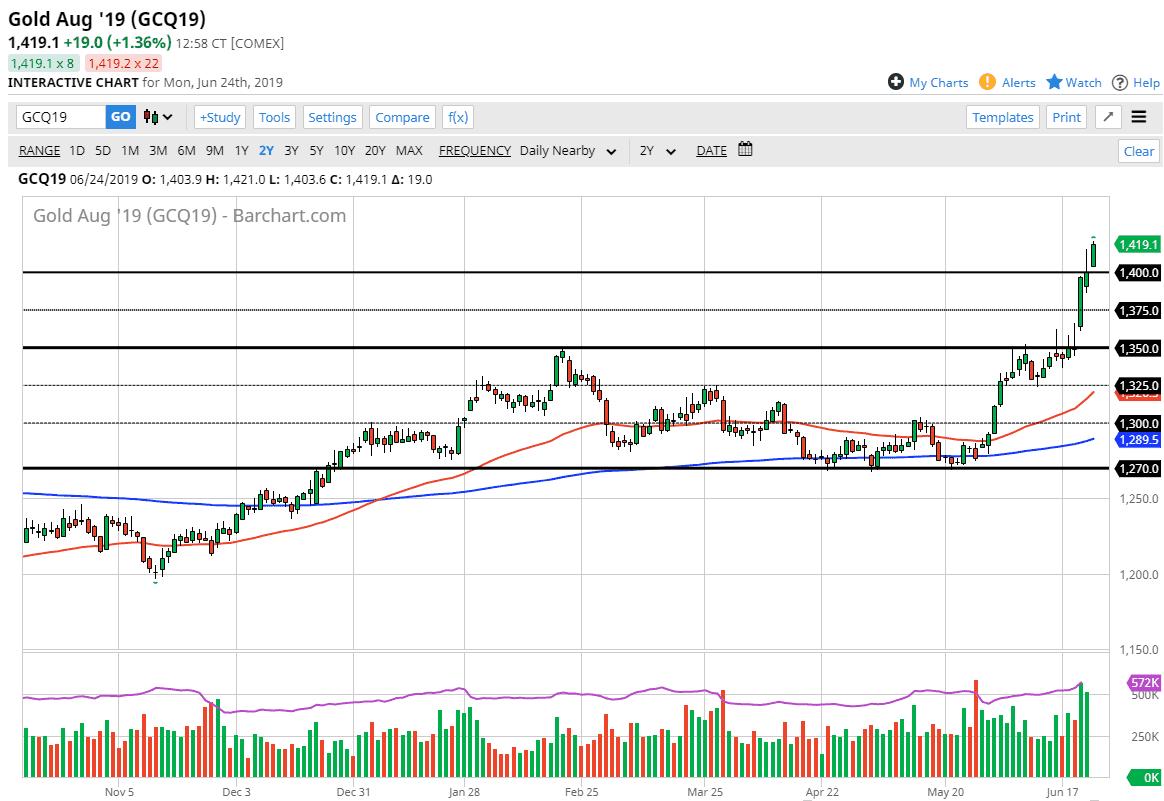

Gold markets rallied again during the day on Monday, breaking the highs from the Friday session. The shooting star from that day being broken to the upside is a very bullish sign, and it suggests that we are going to enter an even more erratic and extended phase of the rally. With that being the case, it makes sense that you can’t sell this market, because it’s like stepping in front of a runaway train.

Having said that, the market is a bit overextended, so it’s very unlikely that the metal should be bought at these highs. A short-term pullback seems like a nice opportunity, as we have gapped higher to kick off Monday, but we also have a gap underneath from the Thursday morning as well. In other words, the market is starting to get out of its usual attitude, and although that’s a bullish sign it can only run so high.

I like the idea of buying short-term pullbacks, at the $25 level increments that I have marked on the chart. I do believe that we can go higher from here, and the fact that we are closing towards the top of the range certainly leads credence to that idea. However, with the market being up $68 over the last three days, it’s difficult to get into the market at these lofty levels. Granted, the US dollar is getting hammered in general due to the Federal Reserve stepping away from monetary tightening, but ultimately this is a market that needs to cool off and collect more buyers until we get the opportunity to pick up a bit of value. Buying value is exactly how you should look at Gold markets right now, as we are most certainly in a very bullish trend after the last several days’ action.