During the trading session on Tuesday we have seen a lot of volatility in the precious metals markets, not only gold, but also silver. Part of this is due to the anticipation of a dovish Federal Reserve statement coming out on Wednesday, but let’s not forget that the European Central Bank has shown its willingness to be dovish as well during the trading session on Tuesday, and other words making fiat currency a bit difficult to own.

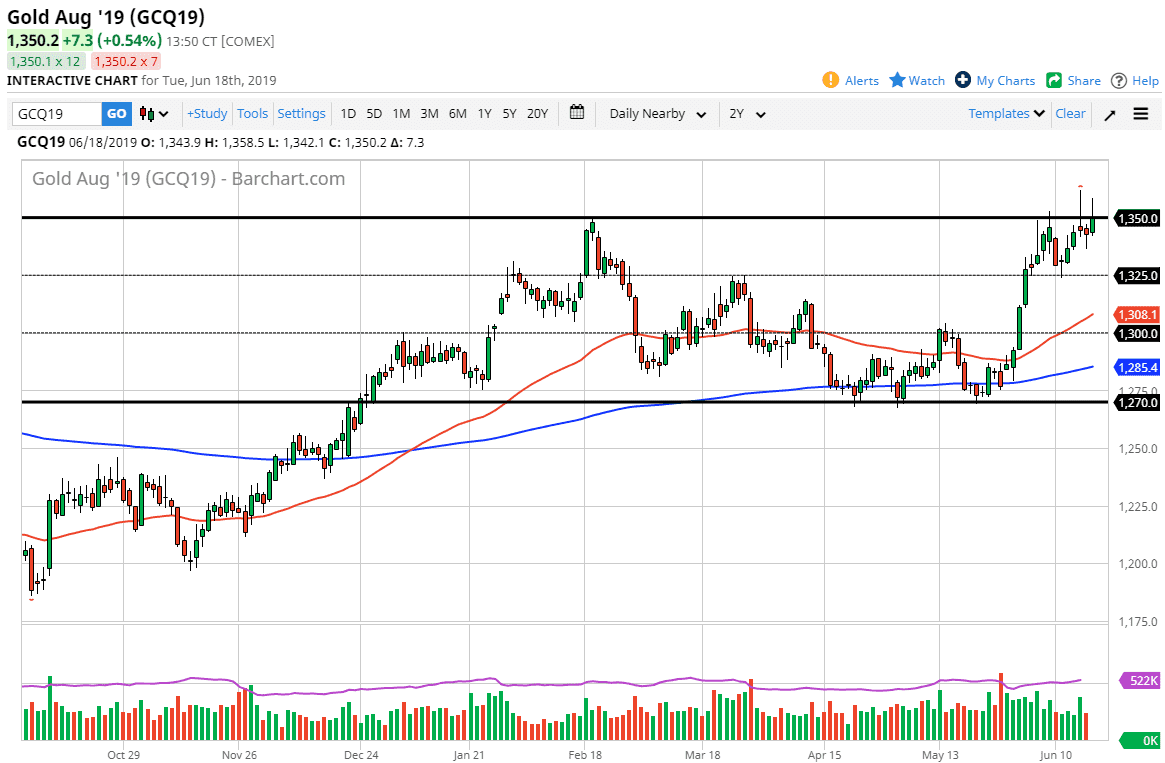

With that being said, it’s obvious that the $1350 level has offered significant resistance, and therefore I believe that the market is going to wait until the FOMC Statement at 2 PM Eastern Standard Time on Wednesday to make a significant move. If the Federal Reserve does in fact cut rates, old markets will probably take off. We would need to clear the $1360 level in order to go higher. Otherwise, if we break down below the lows of the trading session on Monday, we probably reach down towards the $1325 level. That is an area that should be significant support.

A break down below there opens up the door to the 50 day EMA which is pictured in red, followed by the $1300 level. If we were to break out to the upside though, that does give the market an opportunity to go looking towards the $1375 level, followed by the large, round, psychologically significant $1400 level. At this point, I believe that the gold market is solely focused on the Federal Reserve and other central banks as opposed to being in a safety trade. For the next 24 hours I would stay out of this market and allow it to tell you which direction it’s going to go. By the time we close business on Wednesday, we should have a clear signal as to which direction gold goes longer term.